Bursa Malaysia edged up at 9:00 am this morning with the FBM KLCI opened at 1,471.89 as compared to yesterday’s close of 1,470.12.

At press time, the main index was traded in the range of 1,471.64 – 1,473.26.

KLCI is expected to inch up today following the US soft inflation print as the probability of a Dovish monetary policy is higher. Dow Jones closed 0.3% higher at 34, 108.64 whilst Nasdaq climbed 1.01% at 11,256.81.

Technical Analysis on KLCI Futures (FKLI)

RHB Retail Research has continued its long positions on FKLI.

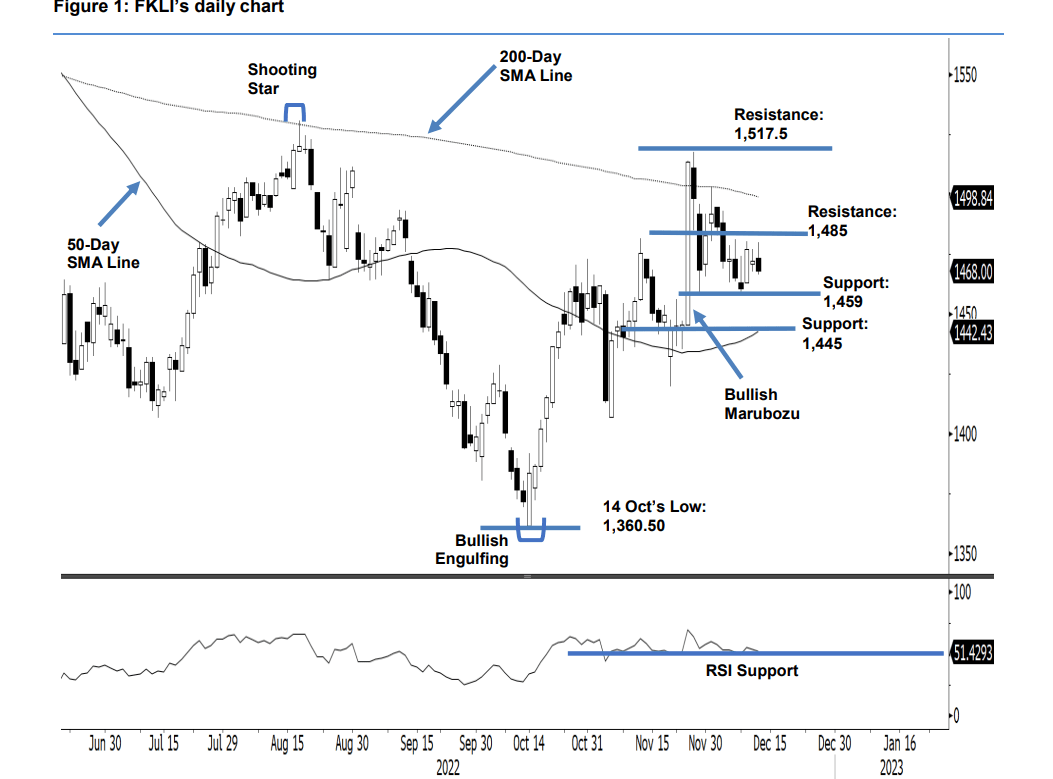

The FKLI wrote off its intraday gains yesterday to close in negative territory, settling 4 points

lower at 1,468 points – still within the consolidation phase of 1,485 points and 1,459 points. It opened at 1,473.50 points, and after hitting the high of 1,480 points, strong selling pressure kicked in to drag the index lower towards the 1,466.50-point low before the close. Despite the weak price action yesterday, the index is still trading within the consolidation phase – indicating it would oscillate between the 1,459-point support and 1,485-point resistance in the later sessions.

We do not see the weaker price action yesterday as a turning point in terms of direction, as the RSI indicator is still printing above the 50% level. Hence, we think the bullish bias remains intact, with the index expected to rebound above 1,485 points in the later sessions unless it falls below the 1,459-point support. As such, the research house is sticking to a bullish bias for now.

Traders should remain in the long positions initiated at 1,475.50 points (11 Nov’s close). To manage the trading risks, the stop-loss is set at 1,459 points.

The immediate support is still at 1,459 points – 29 Nov’s low – followed by 1,445 points. Towards the upside, the immediate resistance is pegged at 1,485 points – 25 Nov’s low – followed by 1,517.5 points, which was the high of 25 Nov.