RHB Research has maintained long positions on HSI futures.

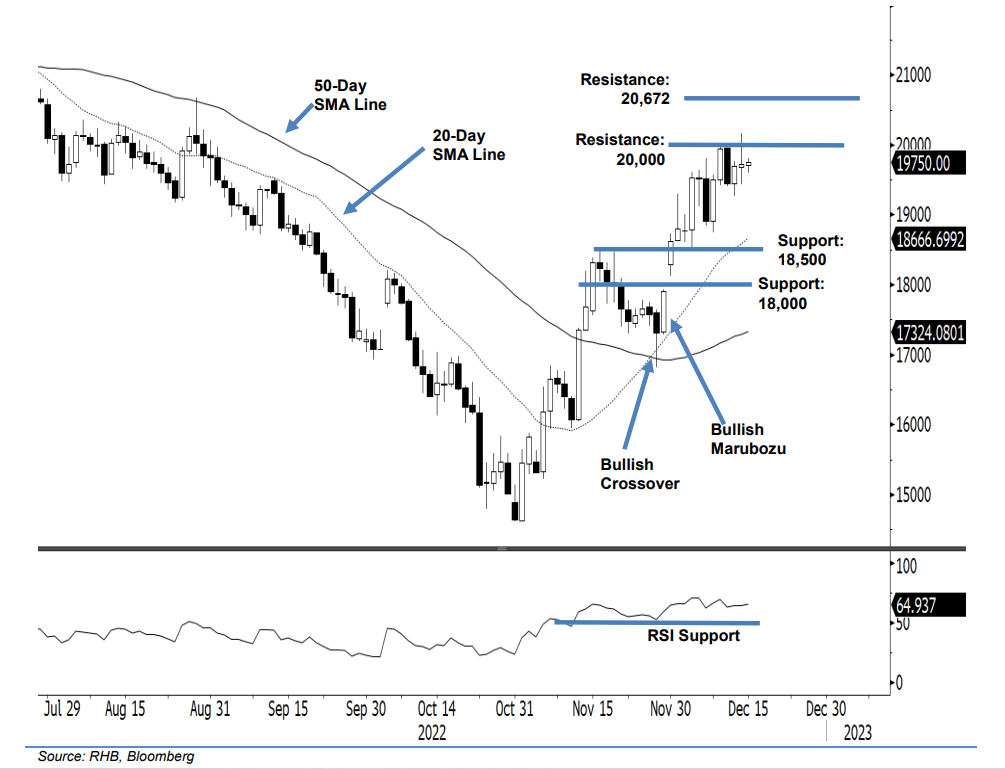

The HSIF closed in a neutral position beneath the 20,000-point mark yesterday, up 36 points at

19,725 points. The index began at 19,680 points and whipsawed between the intraday high at 20,168 points and day’s low at 19,602 points. In the evening, the index inched 24 points higher and last traded at 19,750 points. Yesterday’s neutral candlestick with a long upper shadow suggests that the strong intraday bulls were blocked by the selling pressure at the 20,000-point threshold. With the RSI strength easing, we think that the HSIF would move in a sideways direction beneath the 20,000 points before staging a breakout in the medium term. Nevertheless, there could be a pullback towards the 18,500-point level in the coming sessions before the buying re-emerges. As the bullish setup remains intact, The research house is holding on to a bullish trading bias.

Traders should remain in the long positions initiated at 18,617 points (30 Nov’s close). To minimise the trading risks, the stop-loss is pegged at 18,500 points.

The immediate support is marked at 18,500 points, followed by 18,000 points. Conversely, the first resistance stays at 20,000 points, followed by 20,672 points ie the high of 29 Aug.