RHB Retail Research has retained its long positions HSI futures.

The HSIF paused its pullback on Friday, moving in a volatile fashion during the intraday session before settling near the opening level. It closed 8 points lower at 19,385 points. It began Friday’s session at 19,360 points and touched the intraday high of 19,844 points. Strong selling pressure then kicked-in to reverse the index’s direction – it hit the 19,161-point low before rebounding to close above the opening level. In the evening, it fell 25 points, and was last traded at 19,360 points. Friday’s neutral candlestick with a long upper shadow suggests that bullish momentum is easing, following the recent pullback.

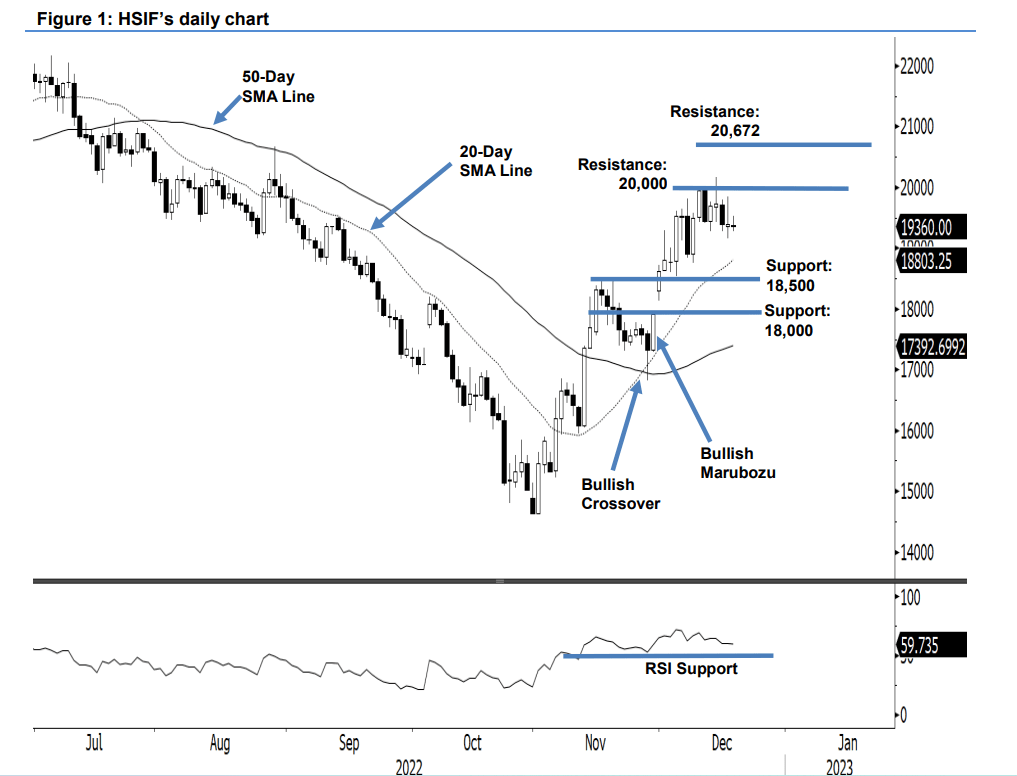

The index is expected to see further profit-taking in the coming sessions, and fall towards the 20-day SMA line or near the 18,500-point immediate support level – supported by the declining RSI, which is at below 60%. Conversely, the medium-term bullish bias remains intact as it is trading above the 18,500-point support level. Based on this, the research house is holding on to its bullish bias – unless the stop-loss is triggered.

Traders should remain in the long positions initiated at 18,617 points (30 Nov’s close). To minimise trading risks, the stop-loss is pegged at 18,500 points.

The immediate support is marked at 18,500 points, followed by 18,000 points. The first resistance stays at 20,000 points, followed by 20,672 points, which was the high of 29 Aug.