RHB Retail Research has maintained long positions on HSI futures.

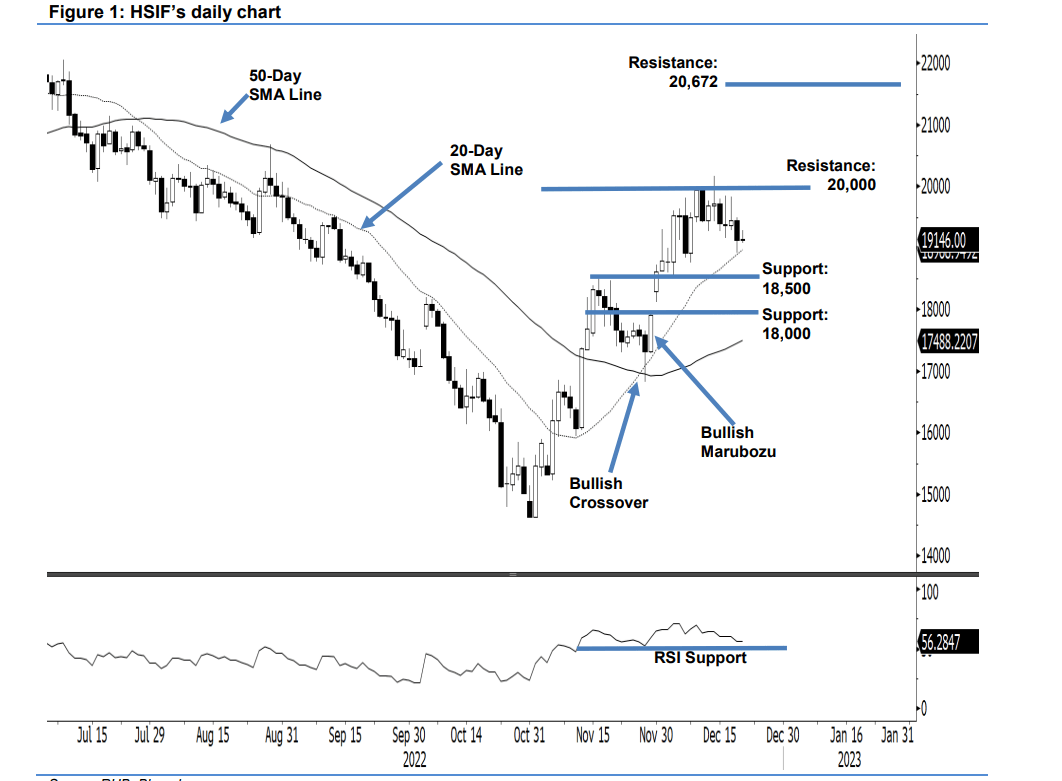

Following its recent volatile movement, the HSIF fell 316 points to settle at 19,124 points yesterday – hitting the 20-day average line before bouncing off moderately at the close. It opened on a neutral tone at 19,446 points and briefly touched the 19,496-point high before moving south towards the end of the session. It fell to the day’s low of 18,917 points before rebounding moderately towards the close. In the evening, it inched up a mere 22 points and was last traded at 19,146 points.

Yesterday’s black body candlestick with lower shadow reaffirms its recent expectation that selling interest would increase in the coming sessions for further profit-taking towards the 20-day SMA line. With the RSI yet to signal any reversal of strength in the coming sessions, we expect the index to hover near the 20-day average line before firming up its direction – either rebounding above (bullish) or falling below (bearish) the 20-day SMA line. Until the trailing-stop is triggered, the research house is keeping its bullish bias.

Traders should remain in the long positions initiated at 18,617 points (30 Nov’s close). To minimise trading risks, the trailing-stop is introduced at 19,000 points.

The immediate support is marked at 18,500 points, followed by 18,000 points. The first resistance stays at 20,000 points, followed by 20,672 points, which was the high of 29 Aug.