RHB Retail Research has continued to maintain long positions on HSI futures.

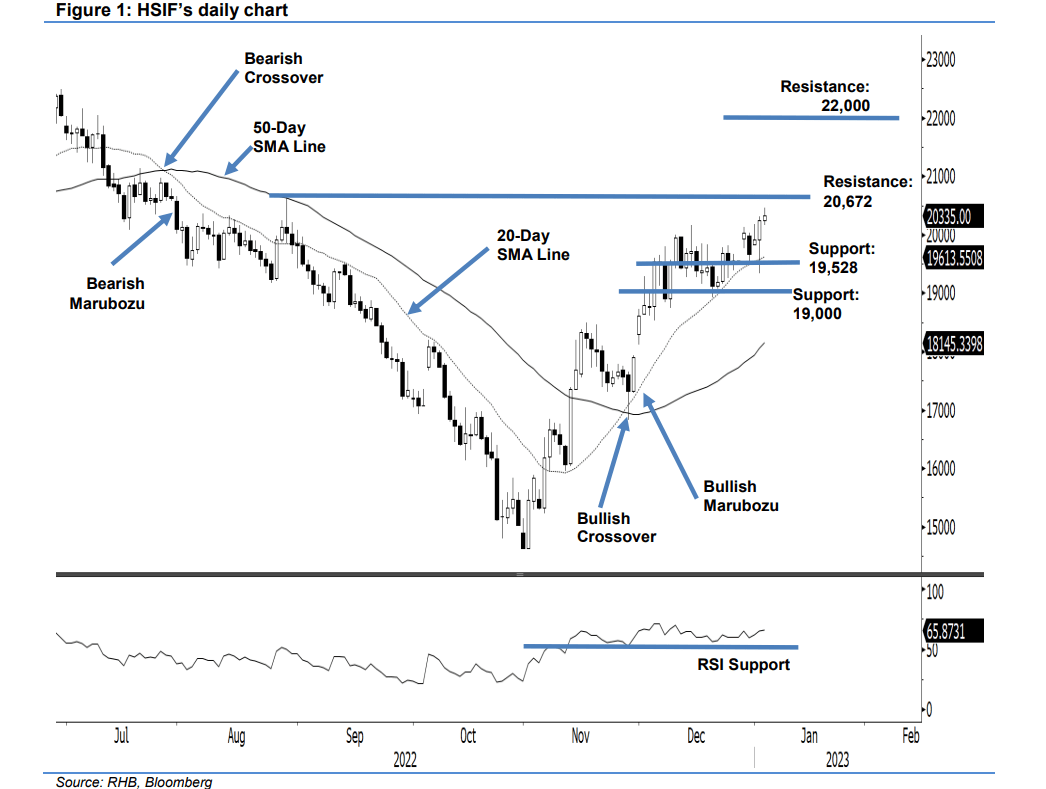

The HSIF crossed above the 20,000-point psychological level in the first trading session of the

year and closed at 20,238 points. Initially, strong profit-taking activities sent the index lower towards the 19,338-point session low. Then, during midday, it staged a rebound towards the 20,306-point session high before closing at 20,238 points. In the evening, the HSIF climbed 97 points and last traded at 20,335 points. The momentum has gotten stronger – evidenced by the RSI indicator trending higher. If this continues, the index may scale higher in the sessions ahead.

Meanwhile, strong support is established at 19,000 points. As long as the HSIF remains above the 19,000-point threshold, the bullish structure is deemed valid. The index may then attempt to test the immediate resistance pegged at 20,672 points. Since the bullish momentum is gaining speed, no change to positive trading bias.

Traders should hold on to long positions initiated at 18,617 points or 30 Nov 2022’s close. To mitigate the trading risks, the stop-loss threshold is at 19,000 points.

The immediate support is at 19,528 points – 29 Dec 2022’s low – and followed by 19,000 points. Conversely, the immediate resistance is pegged at 20,672 points – 29 Aug 2022’s high – and followed by 22,000 points.