The FBM KLCI opened lower at 1,490.40 as compared to yesterday close of 1,493.42.

At press time, the index was traded in the range of 1,488.14 – 1,491.22.

At 9:11am, the index slid further down by 5.68 points or -0.38% at 1,487.74.

Technical Analysis on FKLI (KLCI Futures)

RHB Retail Research again reiterated its long positions on FKLI.

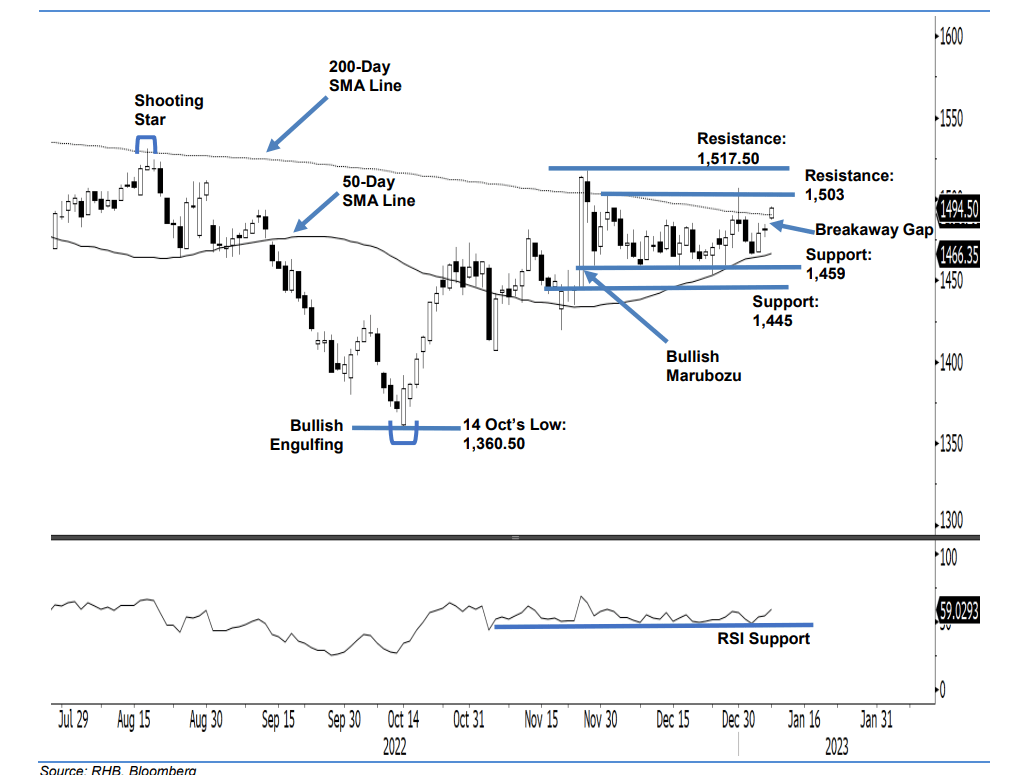

The FKLI crossed above the 200-day long-term average line yesterday, settling 13.5 points stronger at 1,494.5 points. The index started off higher, forming a bullish “Breakaway Gap” at 1,488.5 points. After touching the 1,487.5-point low, it then climbed until the end of the session to hit the 1,495.5-point high before the close. The strong bullish momentum above the long-term average line – amid the “Breakaway Gap” formation – signals that the index is set for an uptrend continuation pattern, which strengthens the bullish setup.

It is expected the FKLI to climb towards the 1,503-point immediate resistance before reclaiming the next resistance level at 1,517.5 points. Towards the downside, the 1,459-point level is still acting as a support. If it sustains above the 200-day average line, the long-term uptrend movement will remain intact. Supported by the RSI strengthening at 59%, the research house is keeping its positive trading bias.

Traders are advised to hold on to the long positions initiated at 1,475.50 points, which was the closing level of 11 Nov 2022.

To minimise the downside risks, the stop-loss is set at 1,459 points. The immediate support stays at 1,459 points – 29 Nov 2022’s low – followed by 1,445 points. The immediate resistance is pegged at 1,503 points – 1 Dec 2022’s high – followed by the higher resistance at 1,517.50 points (25 Nov 2022’s high).