RHB Retail Research has reiterated its long positions on HSI futures.

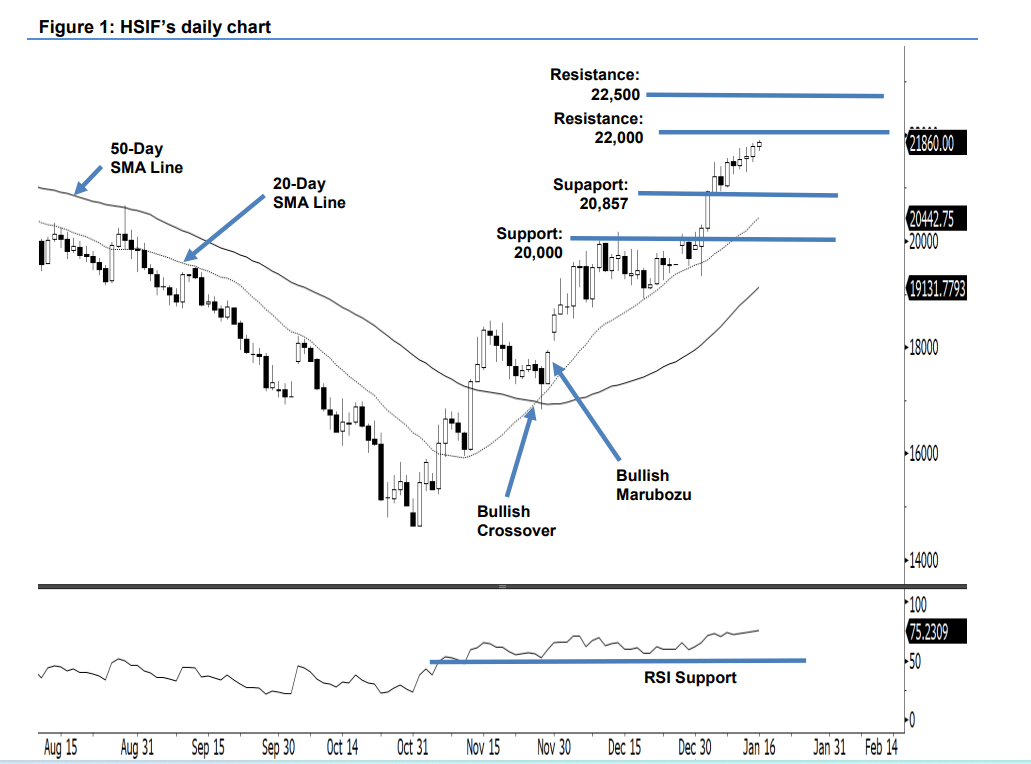

The HSIF rose 193 pts last Friday to close at 21,782 points, firmly on track to cross above the

22,000-point level. On Friday, the index began the session at 21,598 points. After establishing its intraday low at 21,478 pts, the index rose towards 21,837 points before the close. In the evening, it climbed another 78 points and last traded at 21,860 points.

The latest “higher high” bullish candlestick has negated the Spinning Top formed on 11 Jan, showing that the bullish momentum is getting stronger now. As the RSI continues to point upwards, expect the positive momentum to follow through in the immediate session and break past the 22,000-point resistance. Crossing above the threshold would attract strong bullish pressure. Observe that the index is trading above the 20-day SMA line – should it resort to profit taking, it may pull back to test the 20,857-point immediate support. For now, research house is still holding on to its bullish bias.

Traders should retain the long positions initiated at 18,617 points (30 Nov’s close). To control the downside risks, the stop-loss is placed at 20,857 points.

The immediate support remains unchanged at 20,857 points (5 Jan’s low), followed by 20,000 points. Meanwhile, the immediate resistance is pegged at 22,000 points, followed by 22,500 points.