The FBM KLCI index opened at 1,495.31 vis-a-vis yesterday’s close of 1,499.38.

At press time, the main index was traded in the range of 1,494.44 – 1,495.87.

At 9:12 am, the KLCI inched lower by 3.94 points or 0.26% at 1,495.44.

The DJIA (Dow Jones Industrial Average) slid 1.14% at 33,959 after Goldman Sachs reported its worst earnings miss in a decade. Meanwhile the S&P 500 SPX shrank 0.20% and ended at 3,998, while the Nasdaq rose 0.14% at 11,095.11. Goldman Sachs’s fourth-quarter profit plunged 66% from a year earlier to $1.33 billion, or $3.32 per share, about 39% below the consensus estimate.

RHB Retail Research has continued to maintain long positions on FKLI.

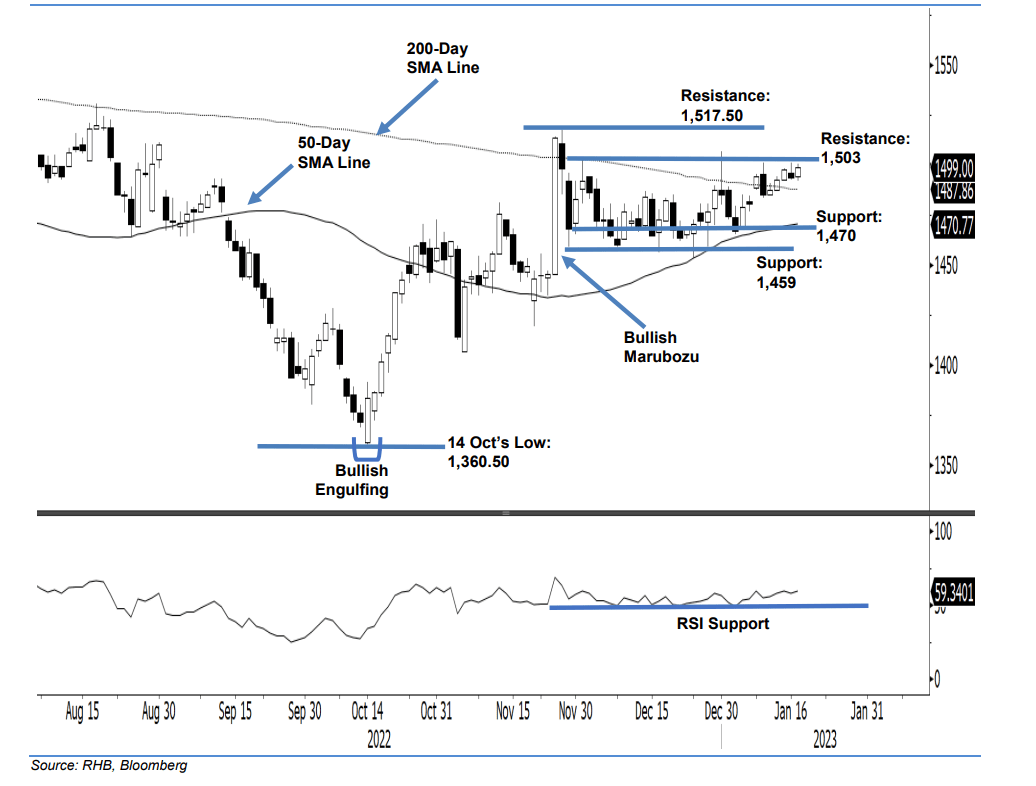

The FKLI inched higher yesterday, closing 5 points higher at 1,499 points – firming up to trade

above the long-term average line as it heads towards the 1,503-point immediate resistance. The index began the session at 1,494.50 points and briefly touched 1,492 points before rebounding positively towards the end of the session, hitting the 1,500.50-point high before the close.

Yesterday’s positive price action reaffirmed the bullish bias above the long-term average line in the medium- to long-term period. As a “higher low” bullish pattern has also formed above that level, the FKLI may trade higher, breaching the 1,503-pt immediate resistance in the coming sessions. The positive momentum is also supported by the momentum indicator of the RSI, which is pointing towards the 60% level. As long as the index manages to sustain above the long-term average line, the medium- to long-term bullish bias will remain intact. Tracking the latest positive price action, the research house is holding on to our bullish trading bias.

Traders should stick with the long positions initiated at 1,475.50 pts, ie the closing level of 11 Nov 2022. To manage the downside risks, the stop-loss threshold is fixed at 1,459 pts.

The immediate support is set at 1,470 points and followed by 1,459 points or 29 Nov 2022’s low. The immediate resistance is at 1,503 points – 1 Dec 2022’s high – with the higher resistance pegged at 1,517.50 points, ie 25 Nov 2022’s high.