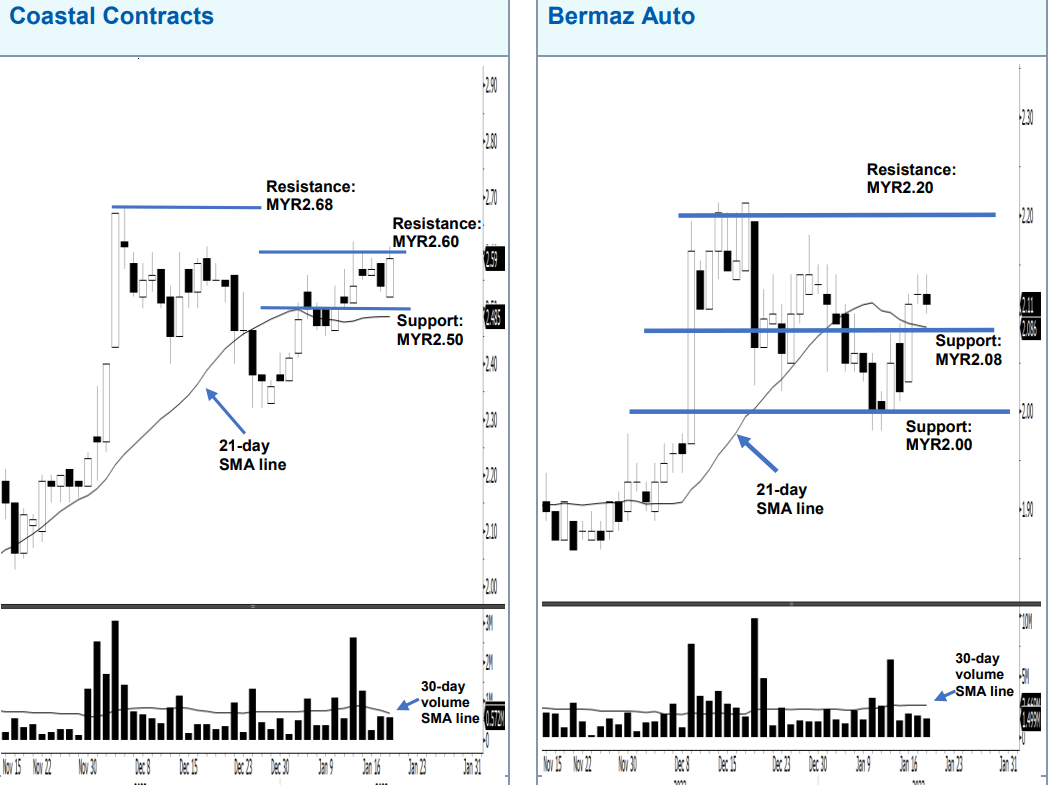

Coastal Contracts

This counter, as cited by RHB Retail Research’s technical analysis report (Jan 19), is eyeing to resume its uptrend rebound as it bounced off the 21-day average line to hit the MYR2.60

immediate resistance yesterday. If a breakout above that level occurs, the bullish bias should propel the stock towards MYR2.68 – its YTD high – followed by the MYR3.00 mark. Conversely, the counter may reverse its direction if it falls below the MYR2.50 support, forming a “lower low” bearish structure below the average line.

Bermaz Auto

Bermaz Auto is expected to rebound higher following the recent

pullback as it managed to sustain above the recent breakout

level of MYR2.08 and also the 21-day average line, amid lower

trading volume indicating weak selling pressure. We expect the

buying interest to re-emerge in the later sessions which would

see the stock rebound towards the MYR2.20 resistance,

followed by MYR2.40, ie near its historical high. However, the

counter may move downwards if it drops below the MYR2.00

support, as it heads to trade below the short-term average line

besides forming a “lower low” bearish pattern.