The FBM KLCI opened at 1,499.97 as compared to yesterday’s close of 1,498.39.

At the press time, the main index was traded in the range of 1,498.76 – 1,500.91.

At 9:15am, the index gained 1.24 points or 0.08% at 1,499.63

The KLCI might inch higher today as a catch-up with the regional peers and the positive cue of Wall Street overnight performance. Wall Street rallied overnight after strong GDP report with the Dow Jones Average Index gained 0.67% to 33,949.41, while the Nasdaq Index jumped 1.76% to 11,512.41.

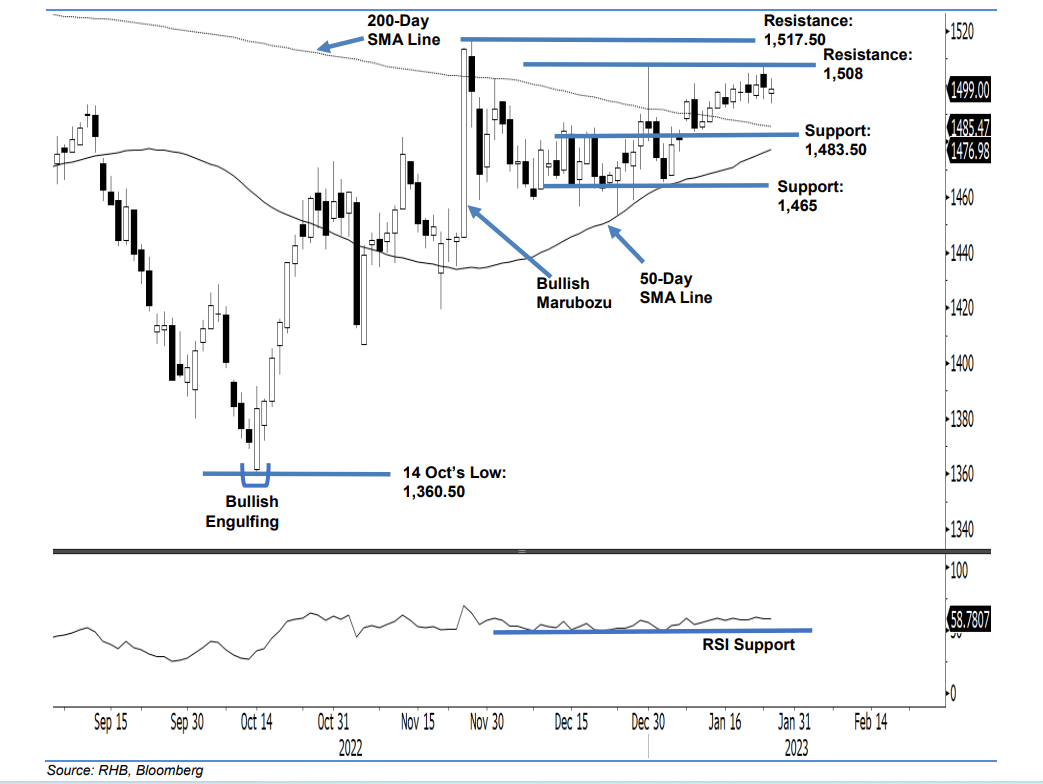

Technical Analysis on FKLI (KLCI Futures)

RHB Retail Research has continued to hold long positions on FKLI.

The FKLI continued to take profit yesterday as it lost 1 point to close at 1,499 points. The index

started the session lower at 1,497.50 points, whipsawing between the 1,503-point high and 1,494-point low throughout the session, which saw it close slightly above the opening level. The neutral candlestick that printed lower vs the previous close is firming up its profit-taking activities, which started on Wednesday.

Hence, this augurs well with our earlier expectation for the FKLI to retrace lower towards the 1,483.50-point support or near the 200-day average line. In the medium term, the index may whipsaw between the 1,483.50-point support and 1,503 points, with the upside bias of breaching above the immediate resistance. As it is still trading above the 200-day long-term average line, the research house is holding on to its positive trading bias.

Traders are advised to keep the long positions initiated at 1,475.50 points, which was the closing level of 11 Nov 2022. To manage the downside risks, the stop-loss threshold is fixed at 1,483.50 points.

The immediate support is at 1,483.50 points – 10 Jan’s low – and followed by 1,465 points or 15 Dec 2022’s low. The immediate resistance is revised higher at 1,508 points – 25 Jan’s high – and followed by 1,517.50 points, ie 25 Nov 2022’s high.