The Global Economic Prospects report from the World Bank released in January 2023 projects global growth to be 1.7 per cent in 2023, lower than the projection of 3.0 per cent six months prior, due to factors such as elevated inflation, higher interest rates, reduced investments, and disruptions caused by Russia’s invasion of Ukraine.

The World Bank predicts that growth in the Philippines and Vietnam, after a strong recovery in 2022, is likely to slow down as export growth in major markets may decelerate.

The projected growth rate for the Philippines is estimated at 5.4 per cent, while Vietnam is expected to grow at 6.3 per cent. Meanwhile, the Ministry of Finance’s revised Economic Outlook 2023, released in October 2022, estimates Malaysia’s economy to grow between 6.5 per cent and 7.0 per cent in 2022 and to moderate in 2023, with a growing range of 4.0 per cent to 5.0 per cent.

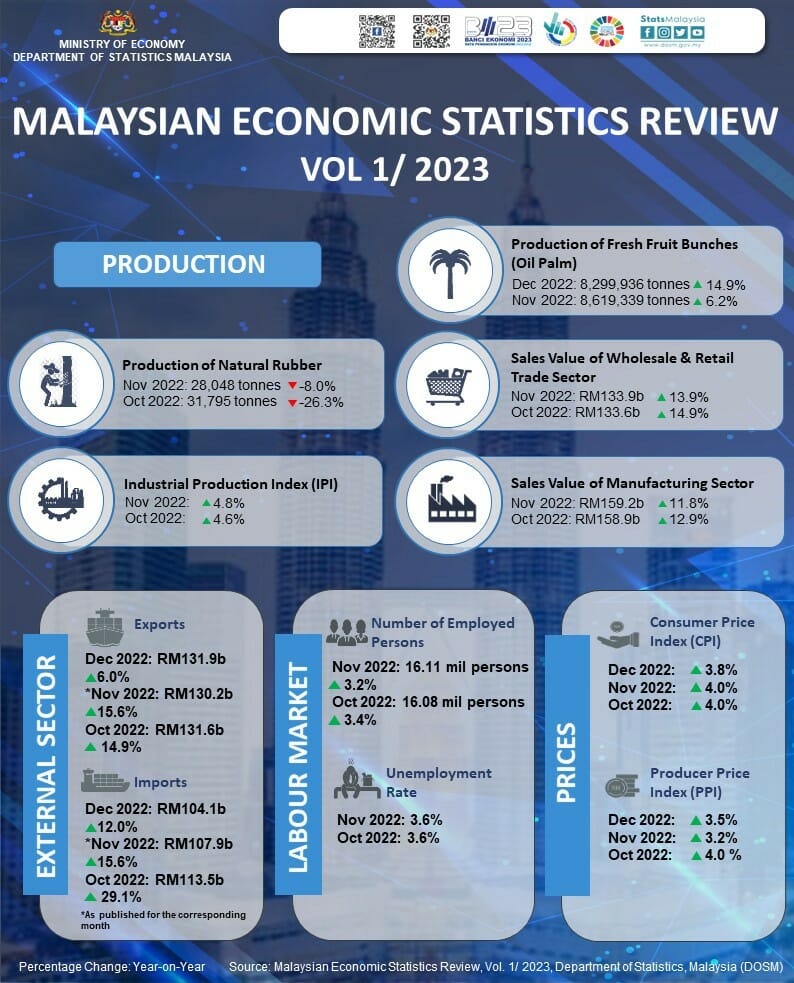

The Department of Statistics Malaysia (DOSM) in its release titled ‘Malaysian Economic Statistics Review (MESR), Volume 1/2023’ today (Jan 31) cited natural rubber production fell by 8.0 per cent in November 2022 to 28,048 tonnes from 30,493 tonnes in the same month in 2021. On a monthly basis, natural rubber production decreased by 11.8 per cent as against 31,795 tonnes in October 2022.

While for oil palm fresh fruit bunches (FFB) production, Malaysia produced 8,299,936 tonnes of FFB in December 2022, an increase of 14.9 per cent as compared to December 2021 (7,225,956 tonnes).

However, the production on a monthly basis dropped by 3.7 per cent as against 8,619,339 tonnes in November 2022. In 2022, a total of 94,814,427 tonnes of FFB were produced, a 3.7 per cent increase from the previous year’s 91,393,666 tonnes.

On an annual basis, the Industrial Production Index (IPI) recorded an increase of 4.8 per cent in November 2022 (October 2022: 4.6%) as compared to the same period in 2021.

The increment was propelled by the growth in Manufacturing index which grew 4.8 per cent (October 2022: 4.2%), Mining index, 6.1 per cent (October 2022: 8.6%) and Electricity index, 1.2 per cent (October 2022: -1.0%).

Similarly, the Manufacturing sector’s sales soared by 11.8 per cent to RM159.2 billion in November 2022 from RM142.4 billion in the same period of 2021. The positive growth was driven by the increase in subsector of Electrical & Electronics Products, 19.0 per cent year-on-year (October 2022: 16.6%) and Petroleum, Chemical, Rubber & Plastic Products, 15.0 per cent (October 2022: 23.8%).

In addition, the sales value of Wholesale & Retail Trade recorded double-digit growth of 13.9 per cent year-on-year to reach RM133.9 billion in November 2022 (October 2022: 14.9%).

The increase was largely contributed by the Retail Trade sub-sector which rose 22.8 per cent to RM58.7 billion. This was followed by Wholesale Trade and Motor Vehicles sub-sectors which also grew 5.6 per cent (+RM3.1 billion) to RM59.5 billion and 17.2 per cent (+RM2.3 billion) to RM15.7 billion, respectively.

Malaysia’s inflation in November 2022 increased by 4.0 per cent as compared to the same month of the previous year. The rise in inflation for this month was mainly led by Food prices which increased by 7.3 per cent, followed by Restaurants & Hotels (7.0%) and Transport (5.0%). Meanwhile, the inflation rate for December 2022 eased to 3.8 per cent as compared to the same month in the previous year.

Over the course of the entire year, inflation rose to 3.3 per cent, as compared to a rate of 2.5 per cent in the preceding year.

In November 2022, the PPI local production eased further to record 3.2 per cent year-on-year (October 2022: 4.0%). The Agriculture, forestry & fishing sectors saw a decline of 18.5 per cent, while other sectors increased, led by the Manufacturing index, at 6.2 per cent, followed by indices of Mining (2.4%), Water supply (4.2%) and Electricity & gas supply (1.4%). However, PPI for December 2022 inched up to 3.5 per cent and overall PPI for 2022 increased by 7.8 per cent (2021: 9.5%).

Looking at the external trade performances, Malaysia’s merchandise trade rose 15.6 per cent year-on-year to RM238.2 billion in November 2022. The exports were valued at RM130.2 billion, surpassing imports valued at RM107.9 billion, yielding a trade surplus of RM22.3 billion. In December 2022, the trade surplus increased to RM27.8 billion with exports of RM131.9 billion and imports at RM104.1 billion.

Summarising the year 2022, Malaysia’s trade surpassed the RM2 trillion mark for the second year in a row, and surged 27.8 per cent year-on-year to RM2.8 trillion.

Pertaining to the labour market, the labour force increased by 2.5 per cent year-on-year in November 2022, registering 16.71 million persons. Subsequently, the labour force participation rate (LFPR) increased by 0.9 percentage points to mark 69.8 per cent over the same quarter of 2021 (68.9%).

The number of employed persons increased by 498.3 thousand persons, or 3.2 per cent year-on-year, to 16.11 million persons, while the unemployment rate remained at 3.6 per cent for three consecutive months.

In November 2022, Malaysia’s Leading Index (LI) fell 0.4 per cent to 110.5 points in November 2022 as compared to 110.9 points in November 2021. Based on the smoothed long-term trend in November 2022, LI remains trending below the trend line of 100.0 points.

Accordingly, the Malaysian economy is expected to moderate in the months ahead in 2023, despite the risk of a global economic slowdown.