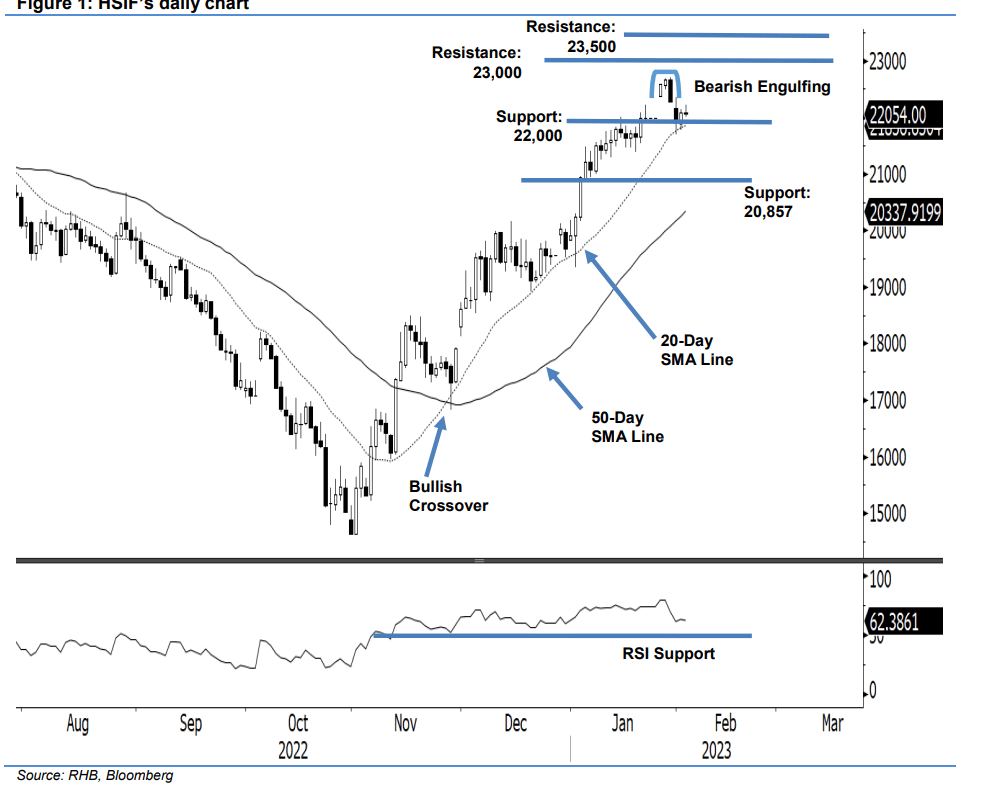

The HSIF underwent a rebound from the 22,000-point level and closed at 22,089 points on 1 Feb. It opened February’s session at 21,886 points. After setting its foothold at the day’s low of 21,770 points, the index climbed towards the day’s high of 22,136 points before the close, thereby charting a bullish candlestick.

The positive price action shows that the bulls are still in control. That said, towards the end of January, the index printed a Bearish Engulfing pattern and bounced off the immediate support of 22,000 points – which indicates that it has yet to form a “lower low” bearish pattern.

The 22,000-pt level would be critical for the bullish structure. Breaching this threshold would attract strong selling pressure. For now, since the immediate support is still intact, no change to positive trading bias. Hence, RHB Retail Research has reiterated its long position on HSI futures.

Traders should retain the long positions initiated at 18,617 points (30 Nov 2022’s close). To minimise the trading risks, the trailing stop is set at 22,000 points.

The immediate support is at 22,000 points, followed by 20,857 points or the low of 5 Jan. Towards the upside, the immediate resistance is at 23,000 points, followed by 23,500 points.