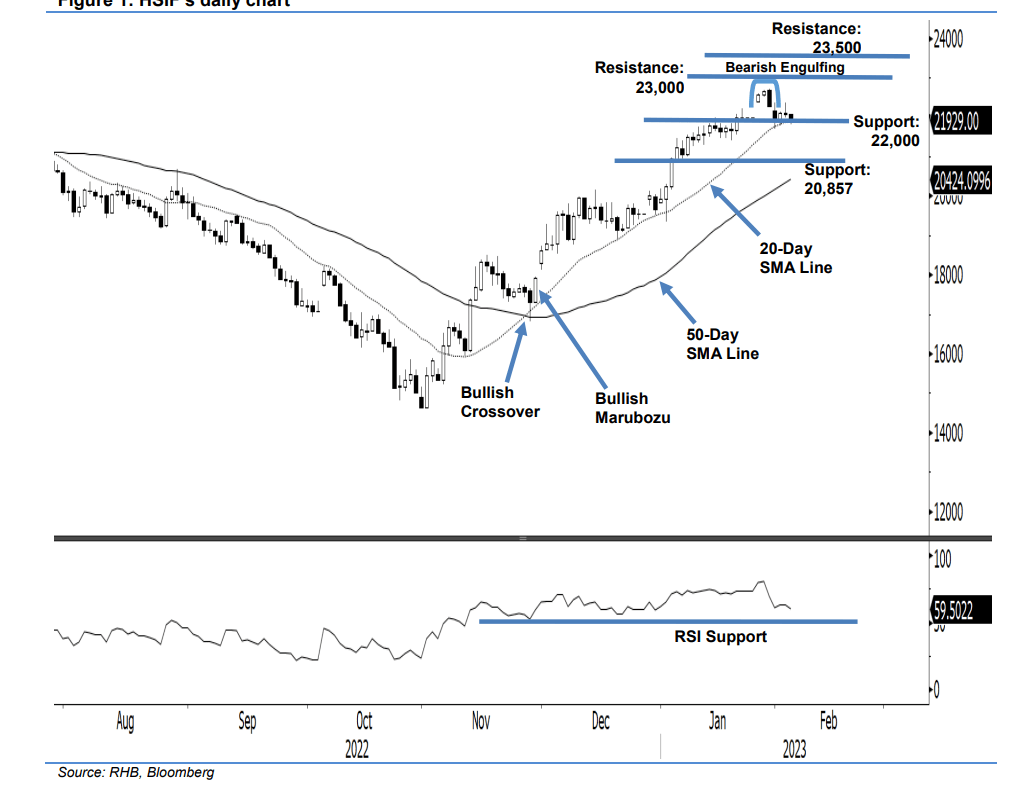

The HSIF attempted to rebound higher yesterday, but sharp intraday profit-taking wrote-off most of its profits – it settled 1 pt higher at 22,090 points. The index opened the session mildly lower at 22,078 points, and whipsawed between 21,983 points and 22,370 points, which saw it close just above the opening level.

During the evening session, the HSIF fell lower by 161 points and last traded at 21,929 points. Yesterday’s neutral candlestick with upper-shadow signals for further corrections in the coming sessions. As mentioned in RHB Retail Research’s previous note, the 22,000-point level will be critical for the bullish structure. If the 3 Feb closing prints below this threshold level, it will attract strong bearish momentum. The latest leading RSI indicator is weakening at 59% from 62% previously, hence, indicating short-term weakness. Until the immediate support is broken, the research house is sticking to its positive trading bias.

Traders should retain the long positions initiated at 18,617 points, ie 30 Nov 2022’s close. To minimise the trading risks, the trailing-stop threshold is set at 22,000 points.

The immediate support is at 22,000 points and followed by 20,857 points or the low of 5 Jan. Towards the upside, the immediate resistance is at 23,000 points and followed by 23,500 points.