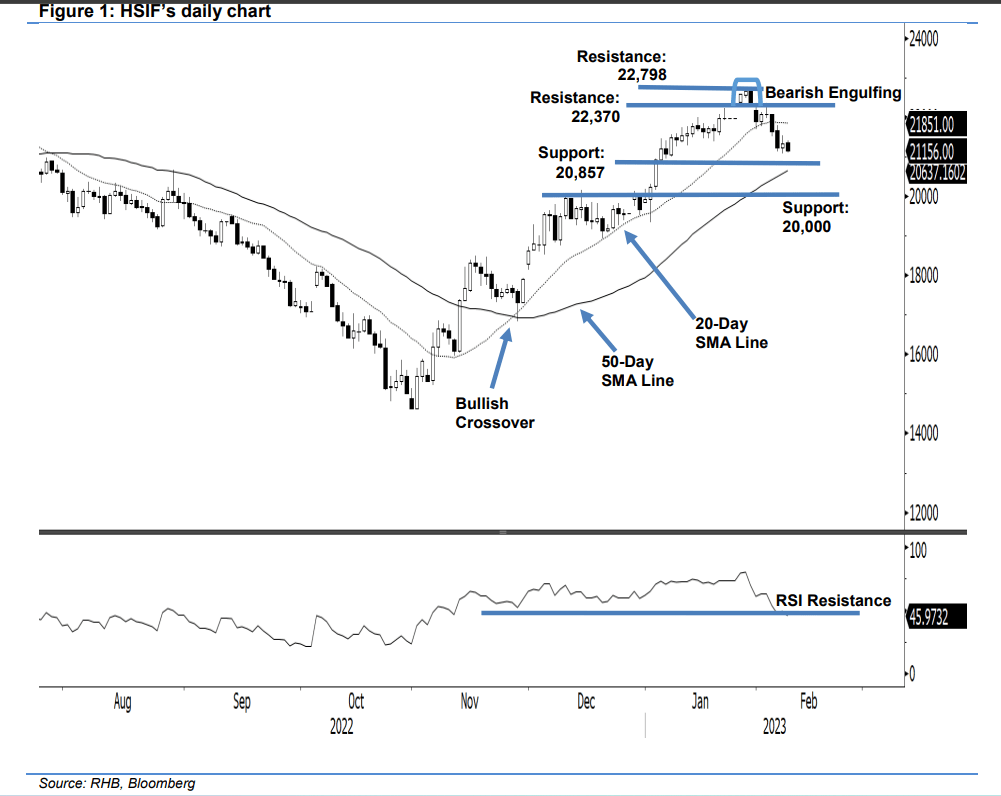

The HSIF underwent a mild rebound yesterday and closed at 21,339 points. However, the technical reading suggests that the bears are still in control. It opened at 21,225 points, traded between 21,551 points and 21,068 points.

In the evening, the index dropped by 183 points and last traded at 21,156 points. Although the HSIF charted a bullish candlestick during Tuesday’s session, it has yet to form a meaningful “higher high”. Furthermore, it is trading below the 20-day SMA line, which means the bears remain resolute.

In the event the 20-day SMA line turns south further, this would exert strong selling pressure on the index. On the flip side, it will need to break past 22,370 points to resume its uptrend. Until the index breaches the immediate resistance, RHB Retail Research will maintain a negative trading bias.

Traders should maintain short positions initiated at 21,643 points, ie the closing level of 3 Feb. To mitigate the trading risks, the initial stop-loss is set at 22,370 points.

The immediate support is at 20,857 points ie 5 Jan’s low, followed by 20,000 points. Conversely, the immediate resistance is pegged at 22,370 points – 2 Feb’s high – followed by 22,798 points or the high of 30 Jan.