Alliance Bank’s MSME Business Outlook 2023 – Malaysia reported that 71.6% of Malaysian MSMEs saw that their revenues increase year-on-year in 2022, and almost half of the businesses (46%) said revenues have returned to pre-pandemic levels or exceeded expectations.

This indicates an encouraging recovery momentum by the MSMEs in 2023, which is backed by Malaysia’s strong GDP growth of 9.3% in the first three quarters of 2022.

Despite the projected weaker global economy and a possible impending recession in 2023, one in three (32.9%) MSMEs are optimistic in making business decisions and willing to take bolder strides for better future gains.

“MSMEs play a significant role in growing the Malaysian economy as the sector contributes 11.7% to the country’s total exports and provide employment to 47.8% of the population. By supporting MSMEs grow, we are also helping them maximise their impact and contribution to the economy,” said Raymond Chui, Group Chief SME & Commercial Banking Officer of Alliance Bank.

Depreciation of the Malaysian ringgit (RM) was cited as the biggest concern among MSMEs this year, especially for import-driven businesses. Other key concerns include, Higher cost of doing business (38%); Lower sales (31%); and reduced domestic demand (26%).

Insufficient cash flow and working capital are also the common barriers to MSMEs’ growth aspirations, where 42.9% expect cash flow to be an issue for them to capture business opportunities in 2023.

“It is important that MSMEs have convenient access to financing to grow their businesses. We understand that MSMEs face their own unique challenges such as limited access to financing and difficulty navigating complex financial regulations. As such, banks must consider new ways to facilitate the growth of MSMEs by providing them with solutions tailored to their business needs. These include offering specialised financial solutions, empowering them with financial education and resources, and deepening engagement with business owners to better understand their needs and challenges,” Chui continued.

The MSME Business Outlook 2023 – Malaysia report captures the responses from over 300 MSMEs surveyed by Alliance Bank Malaysia Berhad – Digital SME (Alliance DSME) in November and December 2022. The report provides an overview of MSMEs’ key concerns, investment plans, digital initiatives, and Environment, Social and Governance (ESG) considerations for 2023.

This survey is one of the Bank’s many initiatives aimed to help bridge the gap between MSMEs and banks.

Alliance Bank has introduced specialised solutions, including two fully-digital collateral-free financing solutions via Digital SME to help MSMEs get access to funding easily. Alliance Digital SME Express Financing offers financing of RM20,000 up to RM300,000 for MSMEs as young as one year in operations, while Alliance Digital SME Cash Flow Financing offers financing of RM300,000 up to RM1 million for MSMEs that have been in operations for at least three years.

Requiring only a single document submission via a simple online process, the digital financing solutions make it easy and convenient for MSMEs to develop their business faster.

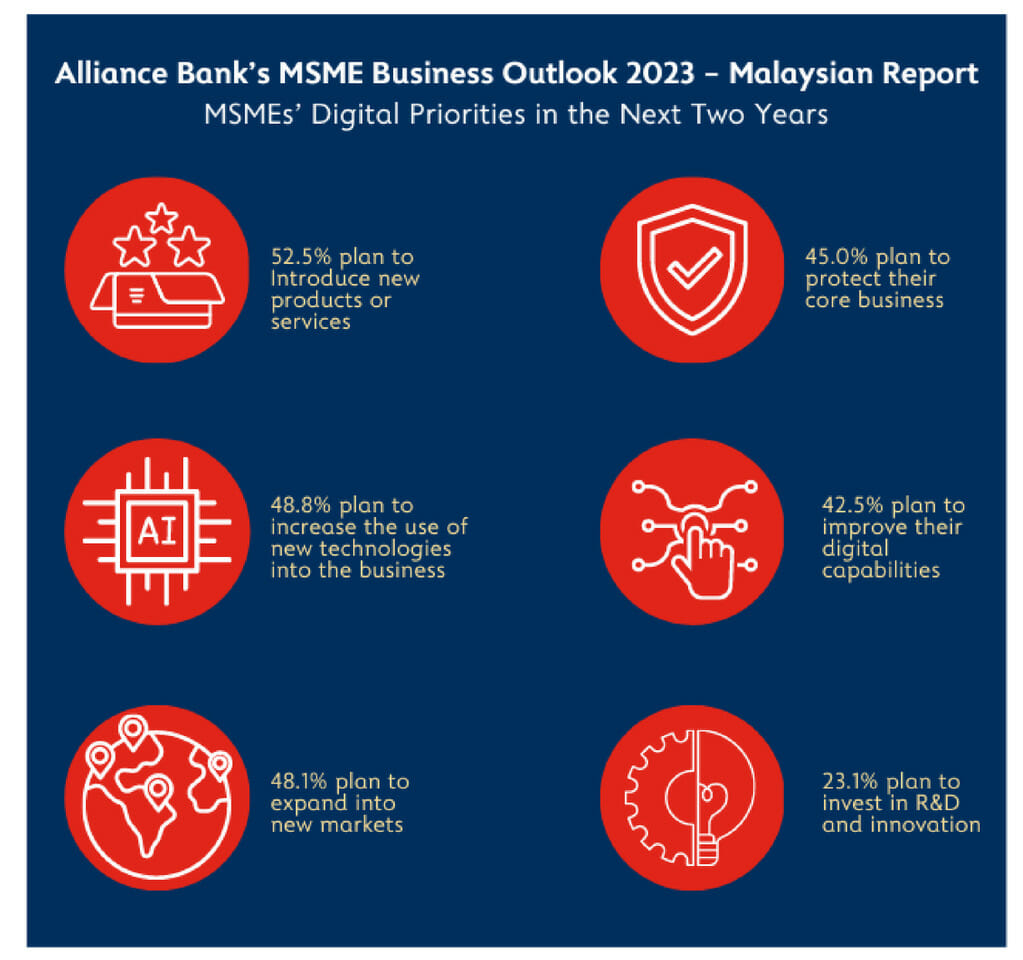

The survey also found that Malaysian MSMEs are adopting digital initiatives to stay competitive and have expansionary view that takes into account ESG concerns.

Over 52.5% of MSMEs plan to introduce new products and services as part of their digital offerings,

48.8% look to increase the use of new technologies,

48.1% plan to leverage digital initiatives to expand into new markets, and

51.3% of Malaysian MSMEs plan to rethink their business models, either by trying a different approach to ensure more sustainable operations, or by ensuring products are responsibly made.

“The Bank’s role does not simply end once an MSME opens a business banking account or applies for a loan. To support MSMEs at every stage of their business lifecycle, we must embrace the digital ecosystem that the business owners inhabit. We proactively innovate our products and services to serve our business customers better, and to grow alongside them to help succeed,”Chui added.

One of such example is the Alliance Bank’s BizSmart ® Solution, a one-stop online business community portal for business customers to access a broad suite of solutions and services at preferential rates.