RHB Retail Research has reiterated short positions on HSI futures.

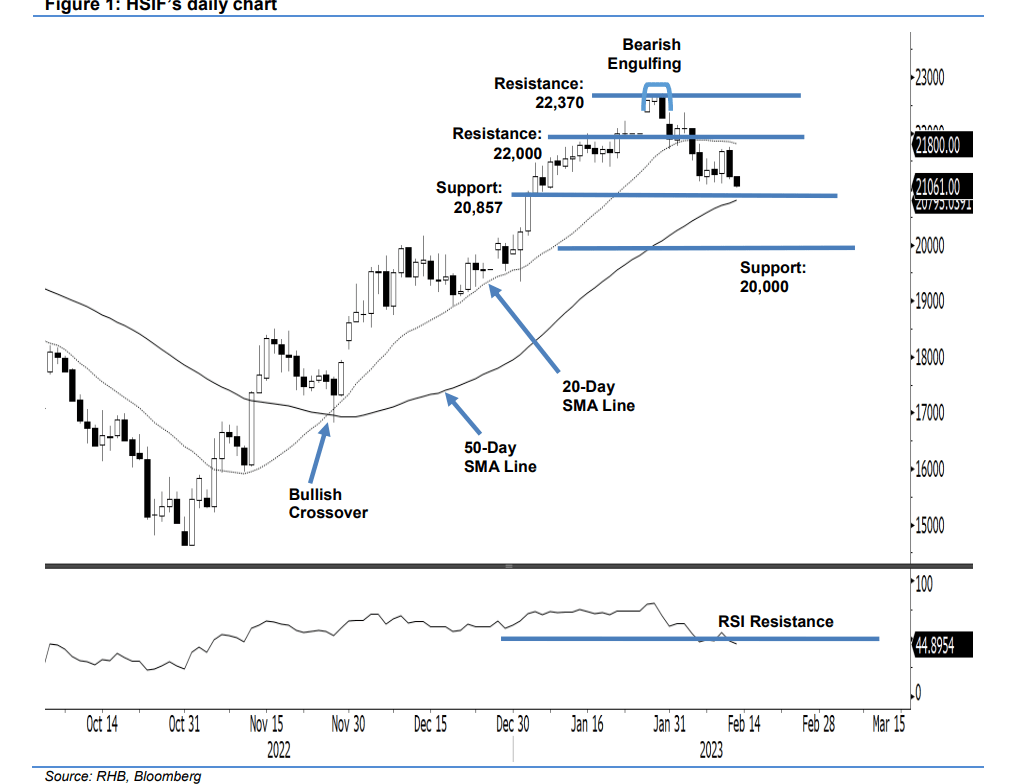

The HSIF’s positive momentum was short-lived, with the index retreating to close at 21,232 points on Friday – the negative price action has engulfed Thursday’s bullish candlestick. The index opened Friday’s session at 21,687 points and rose to the 21,747-point intraday high. It then reversed to the low of 21,172 points before the close.

In the evening, it retreated 171 points and was last traded at 21,061 points. The bearish price action suggests that strong resistance has formed at 22,000 points, while the bearish candlestick indicates there will be a follow-through session to test the 20,857-point support level. A fall below the immediate support level would improve the bearish setup.

The 20-day SMA line will remain as resistance in the coming sessions. If the short-term moving average line continues rounding down, the index will see strong selling pressure. As the bears still have the lead, the research house is keeping the negative trading bias.

Traders are advised to retain the short positions initiated at 21,643 points (3 Feb’s close). To manage the trading risks, the stop-loss is set at 22,000 points.

The immediate support is marked at 20,857 points (5 Jan’s low), followed by 20,000 points. The immediate resistance is pegged at 22,000 points, followed by the higher resistance of 22,370 points, or 2 Feb’s high