Malaysia’s trade surplus in March 2023 widened to RM26.69 billion as compared to the corresponding month the previous year. This was the 35th consecutive month of trade surplus since May 2020 and the highest trade surplus ever recorded for the month of March.

The Ministry of Investment, Trade And Industry (MITI) said while the trade surplus expanded, trade for the month declined by 1.6% to RM232.72 billion. Exports totalled RM129.71 billion, contracted by 1.4% and imports declined by 1.8% to RM103.01 billion.

Compared to February 2023, trade, exports, imports and trade surplus recorded double-digit growth of 13.5%, 15.5%, 11.1% and 36.4%, respectively.

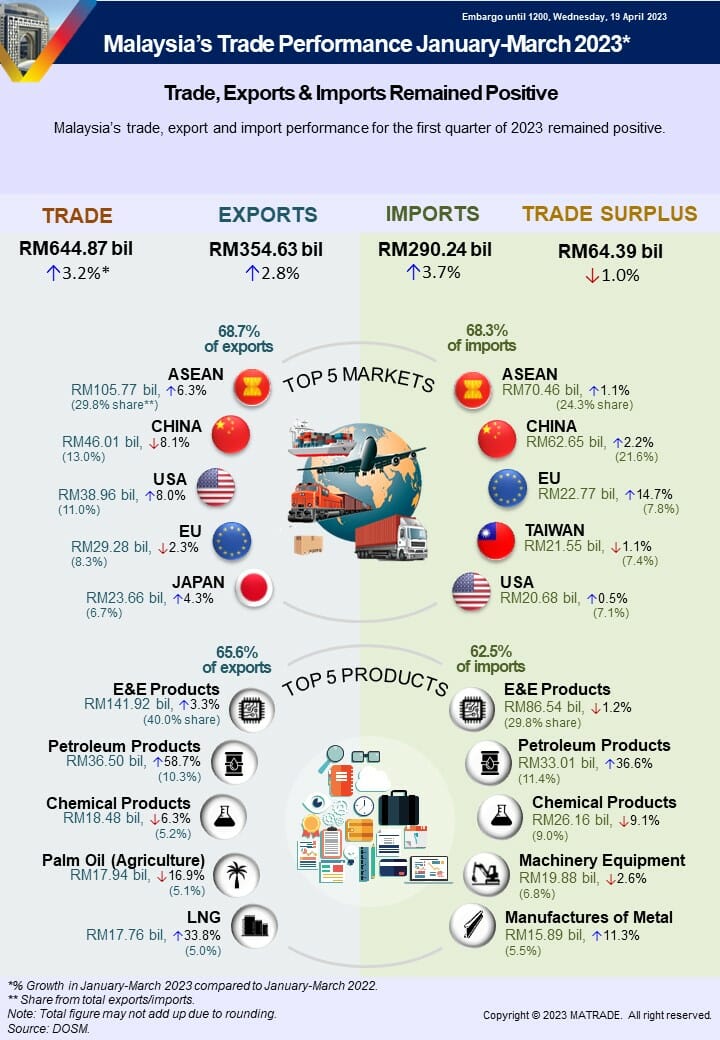

Trade for the first quarter (Q1) of 2023 grew by 3.2% to RM644.87 billion compared to Q1 2022. Exports increased by 2.8% to RM354.63 billion and imports expanded by 3.7% to RM290.24 billion. Trade surplus edged down by 1% to RM64.39 billion. Trade, exports and imports registered the highest value for the period.

Compared to the fourth quarter (Q4) of 2022, trade, exports, imports and trade surplus were down by 10.2%, 9.8%, 10.7% and 5.2%, respectively.

Export Performance of Major Sectors

In March 2023, exports of manufactured goods which constituted 84% or RM108.96 billion of total exports decreased marginally by 0.4% year-on-year (y-o-y), attributed to lower exports of electrical and electronic (E&E) products, rubber products and wood products. Higher exports of petroleum products, optical and scientific equipment as well as machinery, equipment and parts offset the impact of the decline.

Exports of mining goods (8% share) totalled RM10.4 billion, a decrease of 3.5% y-o-y on account of lower exports of petroleum condensate and other petroleum oil.

Meanwhile, increase in exports was registered for liquefied natural gas (LNG).

Exports of agriculture goods (7.3% share) stood at RM9.43 billion, fell by 10.8% compared to March 2022 due to lower exports of palm oil and palm oil-based agriculture products.

Major exports in March 2023 include:

- E&E products, valued at RM50.54 billion and accounted for 39% of total exports, decreased by 4.4% from March 2022;

- Petroleum products, RM12.32 billion, 9.5% of total exports, increased by 32.1%;

- Palm oil and palm oil-based agriculture products, RM7.28 billion, 5.6% of total exports, decreased by 14.2%;

- Chemicals and chemical products, RM6.54 billion, 5% of total exports, decreased by 5.2%; and

- Machinery, equipment and parts, RM5.71 billion, 4.4% of total exports, increased by 11.1%.

In a statement on Malaysia External Trade Statistics released today, MITI cited that on a month-on-month (m-o-m) basis, exports of manufactured, mining and agriculture goods registered double-digit growth of 14.2%, 13% and 31.8%, respectively.

For Q1 of 2023, exports of manufactured goods rose by 2.6% to RM299.17 billion compared to the corresponding period last year. This was bolstered by higher exports of petroleum products, E&E products as well as optical and scientific equipment.

Exports of mining goods grew by 22.2% to RM29.82 billion boosted by higher exports of LNG and crude petroleum.

Exports of agriculture goods was valued at RM23.59 billion, decreased by 13.2% following lower exports of palm oil and palm oil-based agriculture products.

Trade Performance with Major Markets

In March 2023, trade with ASEAN represented 27.9% or RM64.84 billion of Malaysia’s total trade, declined by 1.4% y-o-y. Exports amounted to RM37.98 billion, dropped by 3.4% on lower exports of E&E products.

However, increases in exports were recorded for petroleum products, machinery, equipment and parts as well as transport equipment.

Imports from ASEAN expanded by 1.6% to RM26.86 billion.

Breakdown of exports to ASEAN countries:

• Singapore RM20.74 billion, increased by 3.1%;

• Thailand RM5.58 billion, ↓3.7%;

• Indonesia RM4.88 billion, ↑17.9%;

• Viet Nam RM3.63 billion, ↓29.4%;

• Philippines RM2.20 billion, ↓18.3%;

• Myanmar RM477.1 million, ↑0.4%;

• Brunei RM242.1 million, ↓64.8%;

• Cambodia RM233.3 million, ↑19.1%; and

• Lao PDR RM6.4 million, ↓92.2%.

Exports to ASEAN major markets that recorded increases were Singapore which grew by RM615.3 million and Indonesia, expanded by RM738.9 million on account of robust exports of petroleum products.

MITI said compared to February 2023, trade, exports and imports expanded by 15.5%, 12.7% and 19.6%, respectively.

For the period of January to March 2023, trade with ASEAN rose by 4.2% to RM176.23 billion compared to the same period of 2022. Exports edged up by 6.3% to RM105.77 billion boosted by robust exports of petroleum products, E&E products and crude petroleum. Imports from ASEAN rose by 1.1% to RM70.46 billion.

China – Trade Moderated in March 2023

In March 2023, trade with China which made up 16.3% or RM37.84 billion of Malaysia’s total trade contracted by 3% y-o-y. Exports to China was valued at RM16.68 billion, shrank by 6.2% as a result of lower exports of E&E products. Increase in exports however, was recorded for metalliferous ores and metal scrap, chemicals and chemical products as well as LNG. Imports from China slipped by 0.3% to RM21.16 billion.

Compared to February 2023, trade, exports and imports rose by 11.9%, 16.2% and 8.7%, respectively. Trade with China during the period of January to March 2023 edged down by 2.4% to RM108.66 billion compared to the corresponding period of 2022. Exports fell by 8.1% to RM46.01 billion due to lower exports of iron and steel products as well as E&E products.

Nevertheless, export expansion was registered for metalliferous ores and metal scrap, LNG as well as paper and pulp products. Imports from China was up by 2.2% to RM62.65 billion.

The U.S. – E&E Products Supported Export Expansion

Trade with the United States (US) in March 2023 which accounted for 9.5% of Malaysia’s total trade increased by 5.2% y-o-y to RM22.05 billion. Exports expanded by 7.5% to RM14.59 billion, driven by solid exports of E&E products. Imports from the US edged up by 1% to RM7.46 billion.

On a m-o-m basis, trade, exports and imports grew by 16.8%, 18.3% and 14%, respectively.

For the period of January to March 2023, trade with the US was up by 5.3% to RM59.64 billion compared to the same period of 2022. Exports expanded by 8% to RM38.96 billion led by robust exports of E&E products. Imports from the US rose by 0.5% to RM20.68 billion.

The EU – Trade Growth Remained Robust

In March 2023, trade with the European Union (EU) took up 8.3% of Malaysia’s total trade, expanding by 6.1% y-o-y to RM19.41 billion. Exports amounted to RM10.98 billion, declined by 5.3% on account of lower exports of E&E products, palm oil and palm oil-based agriculture products as well as rubber products.

However, export expansion was recorded for manufactures of metal, petroleum products as well as optical and scientific equipment. Imports from the EU increased by 25.9% to RM8.43 billion.

Breakdown of exports to the top 10 EU markets which accounted for 92.7% of Malaysia’s total exports to the EU were:

• Netherlands RM3.20 billion, decreased by 13.6%;

• Germany RM2.94 billion, ↑2.8%;

• Belgium RM1.19 billion, ↑22.6%;

• Spain RM709.5 million, ↑77.6%;

• France RM681.4 million, ↑37.3%;

• Italy RM584.9 million, ↓48.2%;

• Poland RM280.3 million, ↓9.7%;

• Czech Republic RM233.4 million, ↓32.5%;

• Hungary RM201.9 million, ↓3.3%; and

• Sweden RM156.7 million, ↓25.1%.

Exports to the EU major markets that recorded growth were Germany, which increased by RM80.8 million due to higher exports of E&E products, Belgium (↑RM219.5 million, petroleum products) and Spain (↑RM309.9 million, palm oil-based manufactured products).

Compared to February 2023, trade, exports and imports edged up by 23.7%, 22.7% and 25.2%, respectively. For the first three months of 2023, trade with the EU climbed by 4.5% to RM52.05 billion compared to the corresponding period of 2022. Exports stood at RM29.28 billion, a decline of 2.3% compared to the same period last year due to lower exports of E&E products.

The contraction however was cushioned by increase in exports of petroleum products. Imports from the EU rose by 14.7% to RM22.77 billion.

Japan – Export Expanded in Q1 2023

In March 2023, trade with Japan which contributed 6.4% or RM15.01 billion to Malaysia’s total trade slipped by 6.8% y-o-y. Exports was valued at RM8.28 billion, fell by 6% owing to lower exports of manufactures of metal, wood products and palm oil-based manufactured products.

Nevertheless, higher exports were recorded for LNG as well as palm oil and palm oil-based agriculture products. Imports from Japan dropped by 7.7% to RM6.73 billion.

On a m-o-m basis, trade, exports and imports climbed by 13.7%, 15% and 12.1%,respectively.

For the period of January to March 2023, trade with Japan was up by 1.3% to RM42.3 billion compared to the same period of 2022. Exports grew by 4.3% to RM23.66 billion buoyed by strong exports of LNG. Imports from Japan shrank by 2.2% to RM18.63 billion.

Trade with FTA Partners

In March 2023, trade with Free Trade Agreement (FTA) partners which contributed 67.5% or RM157.18 billion to Malaysia’s total trade edged down marginally by 0.9% y-o-y. Exports to FTA partners declined by 1.5% to RM89.48 billion and imports shrank by 0.1% to RM67.7 billion.

Increases in exports were recorded to Australia, which grew by 37.2% to RM4.82 billion and New Zealand (↑61.8% to RM655.6 million) boosted by robust exports of petroleum products. Exports to Mexico rose by 42.2% to RM2.02 billion and India (↑0.9% to RM4.54 billion) backed by strong exports of E&E products. Meanwhile, exports to Hong Kong SAR expanded by 9.5% to RM7.83 billion following higher exports of iron and steel products and exports to Peru increased by 27.7% to RM67 million on higher exports of palm oil-based manufactured products.

Compared to February 2023, trade, exports and imports expanded by 13.6%, 14.8% and 11.9%, respectively.

Trade with FTA partners during the first three months of 2023 edged up by 2.7% to RM437.02 billion compared to the corresponding period of 2022. Exports increased by 3.7% to RM247.41 billion and imports climbed by 1.5% to RM189.61 billion.

Import Performance

Total imports in March 2023 contracted by 1.8% y-o-y to RM103.01 billion. The three main categories of imports by end use, which accounted for 70.7% of total imports were:

• Intermediate goods, valued at RM53.81 billion or 52.2% of total imports, decreased by 8.7% y-o-y, following lower imports of primary fuel and lubricants;

• Capital goods, valued at RM9.77 billion or 9.5% of total imports, increased by 3.5%, due to higher imports of industrial transport equipment; and

• Consumption goods, valued at RM9.26 billion or 9% of total imports, grew by 6.2%, as a result of higher imports of semi-durables.

During the period of January to March 2023, imports grew by 3.7% to RM290.24 billion from the same period of 2022. Imports of intermediate goods contracted by 3.7% to RM151.04 billion compared to the same period last year, capital goods (↑0.3% to RM27.3 billion) and consumption goods (↑0.8% to RM24.55 billion).