The Malaysia stock market has moved higher in two of three trading days since the end of the four-day losing streak in which it had dropped more than a dozen points or 0.9 percent. The Kuala Lumpur Composite Index now rests just beneath the 1,420-point plateau and it’s expected to extend its gains on Friday.

At 9.16am, the FBM KLCI Benchmark Index rose 0.15pts to open at 1,418.20.

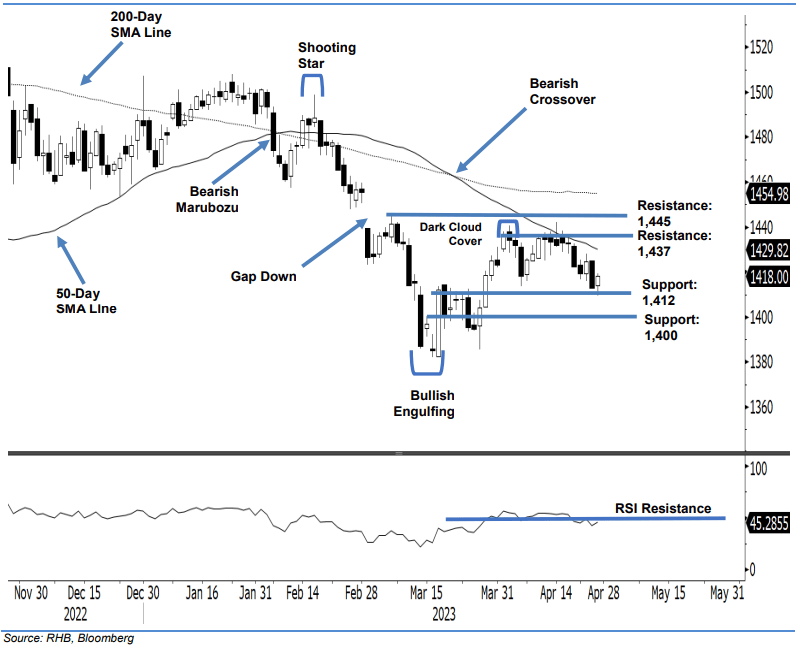

RHB Retail Research, in a note today (April 28), said the FKLI underwent a sharp retracement in recent sessions, and found support at yesterday’s level, creeping up by 5 pts to close at 1,418 pts.

The index opened at 1,414 pts and fell to the day’s low of 1,409.50 pts before bouncing back into positive territory, hitting the day’s high of 1,419.50 pts before closing.

The mild bullish candlestick pattern following the previous session’s strong bearish candlestick points to a temporary positive rebound, which is expected to be short-lived – with the overall weak momentum supported by the RSI printing below the 50% level at 45% yesterday.

Therefore, we expect the bearish momentum to be resume later, with the FKLI likely to fall below the immediate support level of 1,412 pts, followed by the threshold of 1,400 pts.

Premised on this, we maintain a bearish trading bias. Traders should remain in the short positions initiated at 1,414 pts or 10 Mar’s close. To minimise the trading risks, the stop-loss threshold is set at 1,437 pts.

The immediate support is pegged at 1,412 pts – 17 Mar’s close – followed by 1,400 pts. The immediate resistance is at 1,437 pts, ie 3 Apr’s close, and followed by 1,445 pts or the high of 7 Mar.