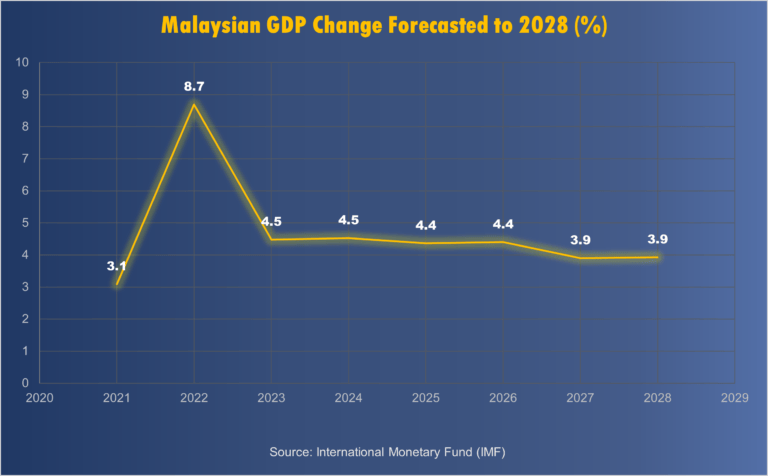

As the Malaysian economy continues to open up beyond the constrictions brought about by the recent pandemic, the need to ensure forward economic momentum is a major imperative. This is especially so considering that global economic outlook predictions show that recessionary forces are likely to be factor due to ongoing supply chain issues, the war in Ukraine and tensions between the United States and China.

The IMF predicts that global growth will fall from 3.4% in in 2022 to 2.8% in 2023 before settling at 3.0% in 2024. It also predicts an especially pronounced slowdown among advanced economies from 2.7% in 2022 to 1.3% in 2023.

In light of these factors, 27Group is of the view that it is increasingly important for the Malaysian economy to leverage on the most promising areas of growth within the economy to sustain economic expansion in the coming year and buffer against potential recessionary forces. A key area within the economy that holds potential for achieving this goal lies in the industrial property market of the Malaysian manufacturing sector.

The Industrial Sector in Malaysia has been a major driver of the countries economy over the last 30 years. In 2021, it constituted a 37.8% value added contribution to overall GDP. One of the biggest drivers of Malaysian Industry comes from the manufacturing sector, which is expected to grow by 3.9% this year, according to the Updates on Economic Outlook and Revenue Estimates 2023 Report.

The Electronics and Electrical (E&E) segment is the leading driver of growth within the manufacturing sector, which grew by 18% in 2021 and 30% in 2022. The E&E segment in Malaysia has expanded considerably over the last several decades, as efforts have been made by local players to create an active ecosystem for E&E manufacturing in the country.

In 2021, the E&E industry recorded investments of amounting to RM148 billion, and from January to September 2022, a total of 83 E&E projects with investments of RM22.5 billion were approved. During this period, E&E products contributed 39.8% or RM57.41 billion towards Malaysia’s total exports, which totalled at RM 144.31 billion. The E&E industry is targeted to contribute RM 120 billion to Malaysian GDP in 2025, as per the 12th Malaysia Plan (12MP).

A major component of the E&E sector is the semiconductor industry, which is projected to grow to $US 1 trillion in global revenue in 2023. The industry is a key enabler for a range of technological applications including IoT, medical, industrial, transportation, aerospace and energy. In recent years, MNC’s have begun upgrading their semiconductor operations into integrated manufacturing centres, which combine manufacturing processes with R&D, product Design and Development (D&D), marketing and distribution, 27Group found.

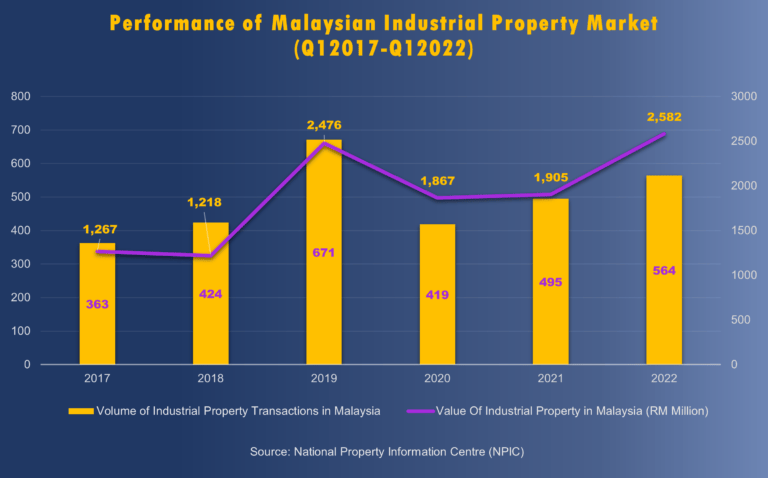

The industrial property market is a key element supporting the manufacturing sector in Malaysia. Industrial property sales in Malaysia achieved a total of RM 5,935.261 million in December of 2022, and the market continues to experience significant growth as demand for more advanced industrial facilities continues to rise. The recent expansion of the e-commerce sector has further increased demand for industrial facilities, more specifically those providing sufficient logistics and warehousing units. Additionally, increasing awareness across industries on the need to ensure compliance with ESG criteria also plays a central role governing the shifting demand for industrial property infrastructure.

In light of these trends, there is a prevailing need within Malaysia to upgrade and expand on the industrial infrastructure development model to cater for a fully integrated industrial park ecosystem. One which provides the physical integrity, technological infrastructure, and supplementary facilities which cater to the evolving needs of both international and local businesses.

The Malaysian Industrial Property Market

The Malaysian Industrial property sector has grown steadily over the last 30 years, as the nation has been increasingly positioned as a viable hub for industrial activities. The development of Industrial Parks during the 1990’s period was carried out to allow the sector to continue to meet growing demand for industrial facilities in line with the countries “Look East Policy” emphasising industrialisation.

Various industrial properties and facilities have since been sectioned and developed in the greater Klang Valley area, with locations such as Shah Alam being designated as industrial hubs and initially attracting Japanese, Korean and Taiwanese corporations. Increasing property prices due to high demand within the Shah Alam area led to industrial property development gravitating towards alternatively viable locations such as Bukit Raja, Banting, Rawang and Sungai Buloh.

Taken from a more recent perspective, the ensuing lockdowns from the 2019 pandemic caused major disruption in global supply chains, which had the impact of shifting consumer patterns towards greater demand for e-commerce products. This change in purchasing behaviour has compelled businesses to place greater emphasis on the development of warehousing and logistics facilities to support the housing and transportation of e-commerce products.

Furthermore, increasing expansion towards industry 4.0 practices and smart factories has also been a rising trend among business owners. These companies, who are increasingly looking towards optimising their operational workflows, reducing costs and mitigating the risks associated with lockdowns, are seeking out the implementation of novel technologies such as artificial intelligence, robotics and machine vision to support their industrial operations, and improve production efficiencies.

Malaysia has successfully attracted interest from various large MNC’s to utilise local industrial facilities for their operations. Among these include Intel Corp, which announced in January 2022 that it would be investing RM 30 billion in the expansion of its manufacturing facilities, focusing on the utilisation of advanced semiconductor packaging technology in the Bayan Lepas Free Trade Zone. China based Risen Energy Co Limited will be investing Rm 42.2 billion over 15 years to set up solar panels in the Kulim Hi Tech Industrial Park in Kedah while Microsoft will be setting up an RM 1 billion regional data centre. Malaysia’s own homegrown glove manufacturing company Hartalega will be investing RM 7 billion to build 16 rubber glove factories in Kedah.

Opportunities for Growth in the Malaysian Industrial Property Market

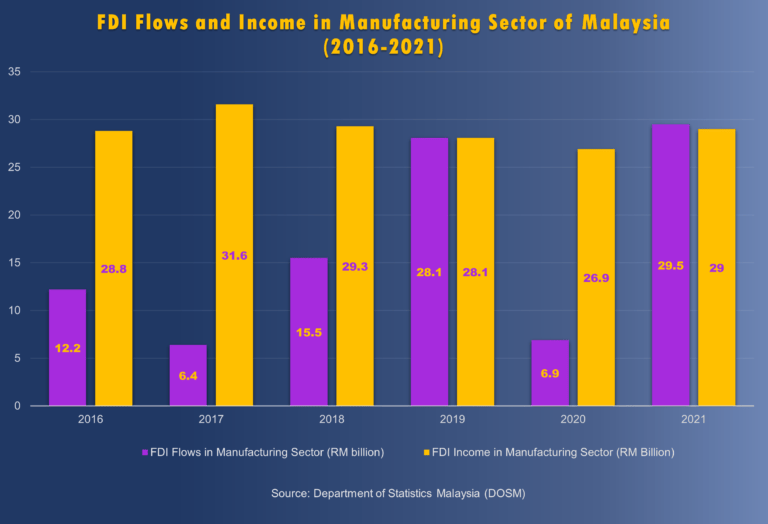

Foreign Direct Investment (FDI) in the Malaysian manufacturing industry had been on a downward trend between 2017 and 2020. The combination of headwinds from the pandemic, the China Lockdown, U.S-China Trade Tensions, labour shortages, and the War in Ukraine have impacted confidence in the industry, notwithstanding the associated supply chain disruptions. As per Malaysia’s Industrial Master Plan 4, initiatives are being planned to attract more high-technology and value-added industries.

Trade tensions with the United States have caused China to seek manufacturing infrastructure overseas in countries within the South-East Asian region, including Malaysia. Attractive investment policies and good infrastructure make it a viable location for international MNCs. A number of logistics and distribution centres have been set up as per 2021, such as the IKEA Distribution Hub in Port Klang (1 mil sq ft), the Hap Seng Industrial Hub in Shah Alam(1.3 mil sq ft) and the Lam Soon Distribution Hub in Selangor (277,000 sq ft).

More recently, industrial development projects have been adopting the Built-to-Suit (BTS) approach, in which the properties and facilities are customised according the specific needs of the tenants or buyers. For instance, the Bandar Raja Industrial Gateway has allocated 839 acres for BTS factories, while the Cipta Serenia project in Sepang involves 196 acres set aside for BTS model developments.

As mentioned above, there is an increasing trend towards the adoption of integrated industrial park facilities among both MNCs and local businesses. Such parks would incorporate not only the most advanced 4IR technology infrastructure such as 5G connectivity, but also come ready with adequate warehousing and logistics facilities to manage the storage and distribution of manufactured products.

Recent technological advancements offer various enhancements to such facilities that improve overall performance. These include connected IoT and automation systems which enable more efficient monitoring and tracking of goods and workers. Such smart systems, for instance, enable inventory management through the use of IoT devices, barcodes and RFID scanning systems integrated into specially designed warehouse management software. These systems can be expanded to include shipment tracking, in which the particulars of shipments, associated bills, packing lists and invoices are generated and sent out automatically.

In addition to the warehouse management systems mentioned above, robotics is another area that offers significant potential with regards to advanced warehousing facilities. Robotic systems that enable picking, sorting, packing and shuttling have been implemented in certain facilities, mainly in China and U.S. to support productivity and logistics errors. Another area that businesses are looking to improve in these facilities is in terms of the environmental factor. Energy efficient systems that incorporate solar panels, LED lighting and green building materials can be opted for to reduce the carbon footprint of the facilities in question.

Many corporations, particularly MNCs, have been increasingly demanding for ESG compliant and certified green facilities from industrial property developers in order to keep their operations sustainable and minimise the risks associated with exposure to ESG related factors. This has compelled developers to incorporate a range of eco-friendly and socially conducive elements into their industrial park projects, as well as to adopt circular economy principles which minimise the amount of waste discharged from industrial operations.

With respect to the environmental factor in particular, a present available measurement for environmental sustainability in Malaysia comes in the form of the GreenRE industrial assessment indicator. The Green RE rating measures an industrial operations environmental footprint according to six key sustainability elements, which include Energy Efficiency, Water Efficiency, Indoor Environmental Quality, Environmental Protection, Carbon Emissions/Resource Management, and Green Innovation.

Within the last 10 to 15 years, there have been a number of projects in Malaysia that have adopted a more progressive model for the development of industrial infrastructure. One example is the i-Park@Senai Airport City by AME, an industrial township project that has been developed with sustainability as a central defining principle. The industrial township located in Johor is a fully integrated development that features a resort style layout, complete clubhouse, swimming pool, gym, badminton courts and multifunction hall.

Its facilities are also powered by renewable energy implementations in the form of end-to-end solar PV technology. Another example of a company adopting the integrated industrial approach in Malaysia is PKT logistics Group, who have incorporated a trucker’s lounge, R&R centre, food court and inland port into their industrial hub. The company’s Penang based industrial operation in Batu Kawan also features a maritime campus and student residence as part of its facilities.

The NCT Smart Industrial Park (NSIP), which is being developed in the Integrated Development Region in South Selangor (IDRISS) is another example of an advanced industrial estate project in Malaysia. The project will feature an integration of technologies such as IoT, artificial intelligence, data analytics and automation, supported by 5G connectivity in what the developers call the first “Managed Industrial Park” in Malaysia. Its facilities will include semi-detached urban housing, Built-to-Suit industrial infrastructure, as well as a global logistics hub. It has also been designed according to Green RE criteria, utilising solar technology among other environmentally friendly approaches.

While there are indeed projects such as those above which are being developed to meet the standards for modern industrial development projects, the rate of adoption for ESG infrastructure in Malaysia is still minimal overall. According to data released by Bursa Malaysia supported by FTSE Russel ESG scoring mechanism, the performance of Malaysian companies within the industrial sector with respect to ESG indicators is still at very low uptake levels.

Of the 55 listed companies in Malaysia, only 25.5% were of the band 3 ranking or higher. This may be due to a lack of awareness surrounding the importance of adopting ESG principles, operational challenges involved in implementing the necessary transitionary mechanisms, or simply a reluctance to adopt ESG strategies due to a failure to appreciate the long-term benefits they may bring to the company.

Industry Challenges

There remain several key challenges that the Malaysian Industrial Property sector must address in order to improve growth and attract the necessary inflow of investment from international and local companies. The first of these is the prevalent shortage of skilled and labour presently available in the market, as well as the difficulty in safely securing foreign labour resources.

A further challenge lies in the fact that there is currently insufficient industrial land to meet the needs of both local and foreign businesses. This is particularly apparent for large international organisations that require a few hundred acres of land to develop their operations.

There is a present need to engage in the relocation of warehouses and logistics facilities to locations around the outskirts of the city and setting up operations at more affordable locations. The older and more outdated warehouses would need to reassess the viability and value of their facilities and engage in upgrading and modifications wherever appropriate. Certain locations may need to be turned over towards residential and commercial development projects as is deemed necessary.

Most essentially, the planning and development of high-quality infrastructure projects will be vital for ensuring that businesses are attracted towards moving their operational practices to Malaysian industrial zones. Industrial property developments that meet the highest standards of construction integrity and safety, while providing the necessary advanced manufacturing facilities featuring all the necessary 4IR ready technological implements will be equally necessary. The availability of in-demand facilities such as the aforementioned logistics and warehousing complexes as well as ESG ready infrastructure that allows sustainable operations to take place will further compel business investments.

Malaysia has a robust and well-developed manufacturing sector, and has over the past few decades developed the necessary industrial infrastructure to support the growth of the sector and attract both local and international business owners to set up their operations in its various industrial facilities and parks.

As the industrial sector continues to evolve in the face of a shifting global economic landscape, developers will need to augment their services to deliver industrial parks and facilities that accommodate the needs of modern-day manufacturing companies. Fully integrated industrial parks that incorporate 4IR technologies to improve production efficiencies will become a staple component of industrial operations in the coming years. Additionally, the availability of facilities which support sustainability principles and enable clean, healthy and productive social and environmental ecosystems will also become the norm as the sector continues to evolve.

The industrial infrastructure of the future will therefore dynamically transition into a new model. One which balances the need for efficient and productive output with ecologically and socially conducive elements. Such a transition will support global initiatives to meet the increasing demand for consumer goods without sacrificing the wellbeing and integrity of our social systems and natural resources in the process.

27 Group is a business consultancy and advisory organisation geared towards project development and socioeconomic transformation strengths. The group provides project management and master planning services for clients within multiple industries and are also keenly involved in the development of socioeconomic initiatives within the public sector. Its guiding ethos of ‘Rebuilding Humanity’ drives us to deliver transformative projects with the right amount of care and attention, meeting both stakeholder expectations and the essential needs of the wider communities that we serve.