The Real Estate Investment Trust (REIT) sector is seeing some relief with recovery in occupancy rates for both retail and office spaces, helped by the return of physical shopping and working arrangements.

Kenanga Investment Bank (Kenanga IB) is cautious on the medium-term traction as consumer sentiment may be dragged by inflation and the implementation of targeted fuel subsidies possibly undermining spending capacity, while the oversupply of office spaces remains.

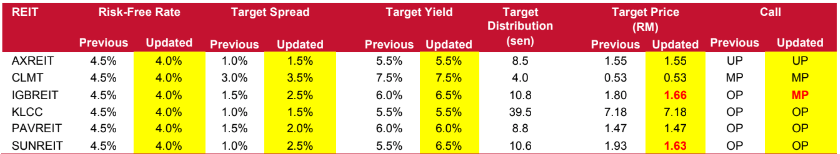

Kenanga IB has recalibrated their target yield valuations due to updated Malaysian Government Securities (MGS) projections. Amidst this, they have cherry picked names that they believe are better positioned to ride through the near-term headwinds and propose KLCC (OP; TP: RM7.18) and SUNREIT (OP; TP: RM1.63) as their sector top picks.

Earnings delivery mostly sustainable

Industry-wide, Kenaga IB observed in recent months that commercial assets have retained healthy footfall and rental yields whereas office spaces remain mired in an oversupply issue, prompting property owners to seek ways to improve their property offerings.

Some relief from office and retail segments recovery

According to the National Property Information Centre’s (NAPIC) 1HCY23 Property Market Report, occupancy rates are gradually rising with retail space in shopping complexes coming in at 76.6% (Dec 2022: 75.4%) from an occupied space of 13.2m sqm on a total retail space of 17.5m sqm.

Kenaga IB believes the industry could benefit from improving appetite for physical retail spending, primarily seen in the prime locations. Meanwhile, purpose-built office spaces stood at 79.0% (Dec 2022: 78.5%) from an occupied space of 19.1m sqm against a total office space of 24.3m sqm with the progressive reversion to working-in-office arrangements translating to some support in office demand.

Not out of the woods yet

On the flipside, Kenaga IB opines that the prospects for the sector may continue to face some headwinds.

In the near-term, the outlook for retail spending could be dampened by the implementation of targeted fuel subsidies which could reduce the disposable income of the middle to upper higher income brackets.

Not helping either are broad inflationary pressures which would unanimously affect overall retail appetite. On the other hand, although office spaces are becoming more relevant, overall occupancy levels may remain thin as the incremental supply of new office spaces could outweigh the modestly rising take up.

In 1HCY23, NAPIC quoted the completion of several new office buildings, injecting an additional 61k sqm into the market which are likely to further dampen the desirability of existing excess stock.

MGS yield due to normalise

The 10-year Malaysian Government Securities (MGS) yield – a risk-free benchmark used by us as a valuation reference to impute the corresponding yield spreads in deriving our individual target prices, has come off from its peak of 4.57% in Oct 2022.

Given that inflationary readings appear to be mostly well-contained, Kenaga IB subscribes to a flattish interest rate outlook at least in the near-term and for MGS to sustain closely at 4.00%, which would also be fairly in line with historical averages pre-pandemic.

A cause to recalibrate

Kenaga IB, in its Sector Update today (Sept 21) has reviewed their individual target yields for organisation the cober given that the abovementioned challenges may more significantly affect certain REITs as compared to others.

They have applied the lowest spread to asset owners with the lowest occupancy and footfall risk (i.e. targeted to the affluent segments) and vice versa to players that may be more sensitive to inflation-sensitive groups. With that, Kenanga IB has revised their valuations and target prices as per below:

While Kenaga IB noted that most their organisations covered are retail-centric and are cognizant that they control a variety of assets with varying locational advantages and target markets. KLCC and PAVREIT will likely continue to be more in tune with the affluent markets though the latter is raising its exposure to a wider consumer segment with the addition of newer, more neighbourhood-oriented assets to its portfolio (i.e., Pavilion Bukit Jalil).

Meanwhile, they reckon IGBREIT and SUNREIT will continue to cater to a good mix across segments while SUNREIT also has more diversified asset types including hospitality and office.

Kenanga IB maintains a Neutral sector view amid the still challenging industry dynamics. Within the sector, they favour REITs with the following attributes: (i) niche in the right business segments particularly in industrial and retail, and/or (ii) own property assets in prime and strategic locations, which will continue to provide resilient rental income streams.

On valuation grounds, KLCC and SUNREIT are their sector picks as they believe their risk-to-reward is favourable. They expect KLCC to remain resilient thanks to its highly prime location and assets which they believe are less susceptible to spending pressures.

On the other hand, SUNREIT may have a balanced buffer against sector risk exposures thanks to its diversified assets and strong brand equity.

Kenanga IB remains cautious on AXREIT, being their sole industrial REIT as their occupancy rates have witnessed a notable drop, declining from 95% at end-Dec 2022 to 89% at end-June 2023. This decline has had a significant adverse effect on their earnings and may translate to further near-term uncertainty.