Asia’s role as a hub for electric vehicle (EV) manufacturing activity will be supported by regional demand growth for low-emissions transportation, says Sustainable Fitch in a new report.

Diverse EV options at a wide range of price points should continue to attract consumers, despite issues with electricity availability and vehicle affordability.

In a report dubbed ‘Asia’s Electric Vehicle Ecosystem: An Engine for Sustainable Growth’, Sustainable Fitch found that public support for transport-sector electrification is essential for governments to meet national net-zero targets, which range from the years 2050 to 2070 among Asia’s largest economies.

China, which generates one-third of global emissions, has provided financial incentives via tax breaks and subsidies to the EV sector for more than a decade. These policies prioritise domestic manufacturers, contributing to the country’s dominance in global EV production and sales.

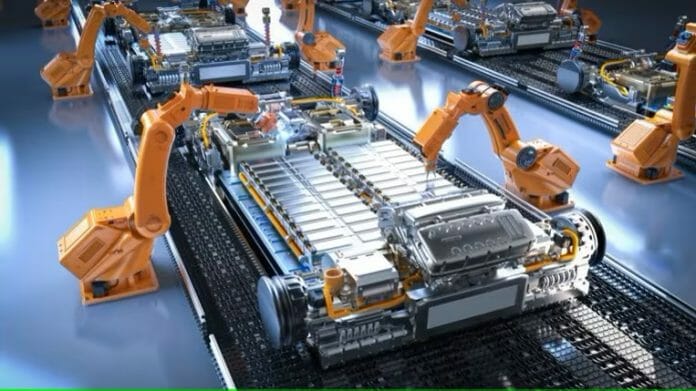

In southeast Asia, which has traditionally been a centre for vehicle-component manufacturing, governments are aiming to attract foreign direct investment for the EV sector. There have been a number of announced investments from international automotive, electronics, and metals and mining companies seeking to boost manufacturing capacity for both the Asian and global export markets.

Japan and South Korea are home to most of Asia’s legacy automakers. Both counties face pressure in the EV market, including competition from newer – mostly Chinese – manufacturers, investor demands to reduce Scope 3 emissions, and changing consumer preferences towards zero-emission vehicles in key North American and European markets.

Japanese automakers have been slower than Asian peers to shift towards electrification, while Korean corporates are targeting vertical integration, with increased investment in mining, battery production, and charging infrastructure.

Under Sustainable Fitch’s ESG Ratings methodology, EV-related activities within ESG-labelled bonds have an average score of ‘1’. This indicates excellent sustainability performance.

In addition, the findings revealed EV demand has strong growth potential in Asia.

A range of companies from the automotive, metals & mining, technology and energy sectors are investing in EV-related products and services to which Sustainable Fitch considers EV-related activities to be environmentally positive, but certain factors could affect their sustainability impact.