RHB Investment Bank provides insight into the price movement of Commodity Exchange Inc (COMEX) Gold, which managed to stage a rebound on Friday (Oct 6), following a series of declining sessions.

The price surged by US$13.40 (RM63.41) to close at US$1,845.20 after commencing the session at US$1,834.30.

During the trading day, the commodity established its intraday low at US$1,823.50 but then experienced a notable uptick, reaching a high of US$1,849 before closing at US$1,845.20.

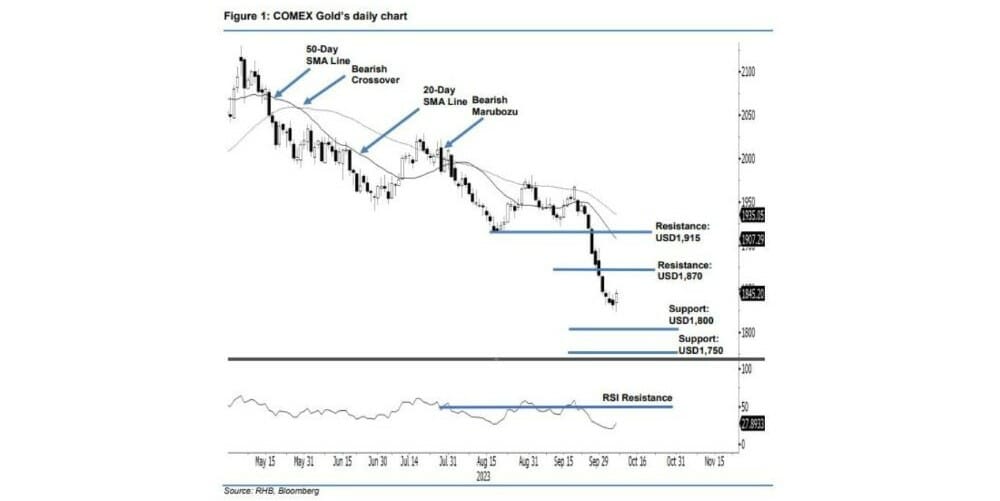

This recent bullish candlestick, combined with the Relative Strength Index (RSI) below the 30% level, indicates COMEX Gold’s attempt to stage a technical rebound from an oversold region.

Should the commodity’s price surpass the resistance level at US$1,870, it has the potential to enhance market sentiment and attract additional buying pressure, thereby driving the precious metal toward the 20- and 50-day Simple Moving Average (SMA) lines.

However, RHB Investment maintains a bearish trading bias for now, pending a bullish breakout at the US$1,870 level.

Traders are advised to retain their short positions, initiated at US$1,944.20 or the closing price on Sep 6. To mitigate trading risks effectively, the trailing-stop threshold is adjusted lower to US$1,870 from the previous US$1,915.

The immediate support level remains unchanged at US$1,800, followed by the US$1,750 level.

On the contrary, the immediate resistance level remains at the previously mentioned US$1,870, with US$1,915 serving as the subsequent resistance marker.