Strong research culture is important in advancing financial literacy, said Bank Negara Malaysia (BNM) deputy governor Adnan Zaylani Mohamad Zahid.

“Our collective goal is to harness the power of research to shape the design, implementation and monitoring of financial education initiatives,” he said in his keynote speech at the National Financial Literacy Symposium 2023 (NFLS 2023).

He added that the Symposium serves as a platform for robust discussions on current financial literacy issues, involving senior policymakers, market practitioners and academicians.

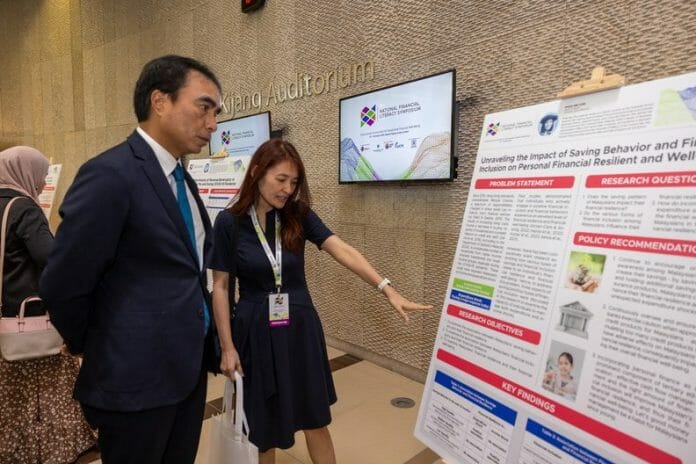

The symposium, which took place from Oct 10 to 11 at Sasana Kijang, Kuala Lumpur, and organised by the Financial

Education Network (FEN), in collaboration with the Malaysian Economic Association (MEA).

Among the participants were policymakers, researchers, practitioners and non-government organisations to discuss and translate research findings into practical tools and strategies to elevate financial literacy.

It was held in collaboration with MEA to provide synergy in promoting the involvement of economic community in scientific research on the financial well-being of Malaysians.

Meanwhile, Employees Provident Fund (EPF) chief financial officer Mohamad Hafiz Kassim said advancing financial literacy agenda remains one of our foremost priorities.

“Through this symposium, we hope to foster a collaborative learning environment, forge meaningful connections, and spark transformative ideas that will have a lasting impact”.

In addition to the importance of financial literacy, Agensi Kaunseling dan Pengurusan Kredit (AKPK) chief executive officer Azaddin Ngah

Tasir added: “Climate impact could severely affect our financial well-being in the near future and should be taken seriously.”

NFLS 2023 was co-hosted by BNM, the EPF and AKPK, in conjunction with FEN’s Financial Literacy Month 2023.

The two-day Symposium lined up a mix of panel discussions and research paper presentations by domestic, regional and international experts.

Among the topics discussed were the fast-evolving digital finance realm – the risks it poses and the opportunities it presents for meaningful financial inclusion among consumers.

Out of a total of 42 research papers were submitted earlier covering various aspects of financial literacy, ten submissions were shortlisted and presented at the symposium.

Three papers bagged the awards involving academicians from Monash University Malaysia, Sunway University, Universiti Sains Malaysia as well as researchers from The Institute for Capital Market Research Malaysia.