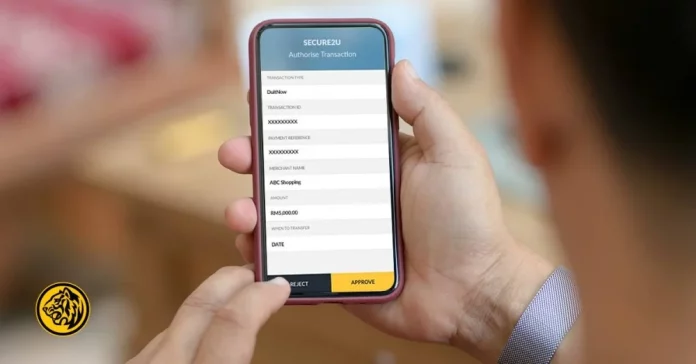

Maybank annouces an additional verification process for Secure2u to approve online banking transactions on the MAE app

and Maybank2u web. Customers registering Secure2u for the first time, or on a different or new device can securely and conveniently activate Secure2u via any Maybank automated teller machine nationwide, beginning 31 October 2023.

This additional measure it said was to curb unauthorised transactions and fraudulent activities, on top of the five key measures to combat financial scams implemented by the Bank in July 2023. Dato’ John Chong, Group CEO of Community Financial Services said, “By allowing customers to perform self-activation of Secure2u via ATM, they can better control their

online banking authorisation process by physically verifying their identity at the ATM, heightening supervision over their accounts and ultimately, safeguard their monies from scammers. Maybank says it has made the process easy and straightforward, keeping customer experience in mind.

To register for Secure2u, customers need to perform two simple steps – firstly, register for Secure2u on the MAE app and secondly, activate Secure2u with their debit, credit or charge card PIN number at any of the 3,000 Maybank ATMs nationwide, at their convenience.” Upon activation of Secure2u via ATM, customers can start approving transactions after

12 hours. To further protect customers, the cooling-off period may vary as the Bank continuously analyses scam trends and transaction patterns. This measure is imperative, and acts as an additional layer to thwart scammers as it ensures that customers are the sole approvers of their Secure2u registration.