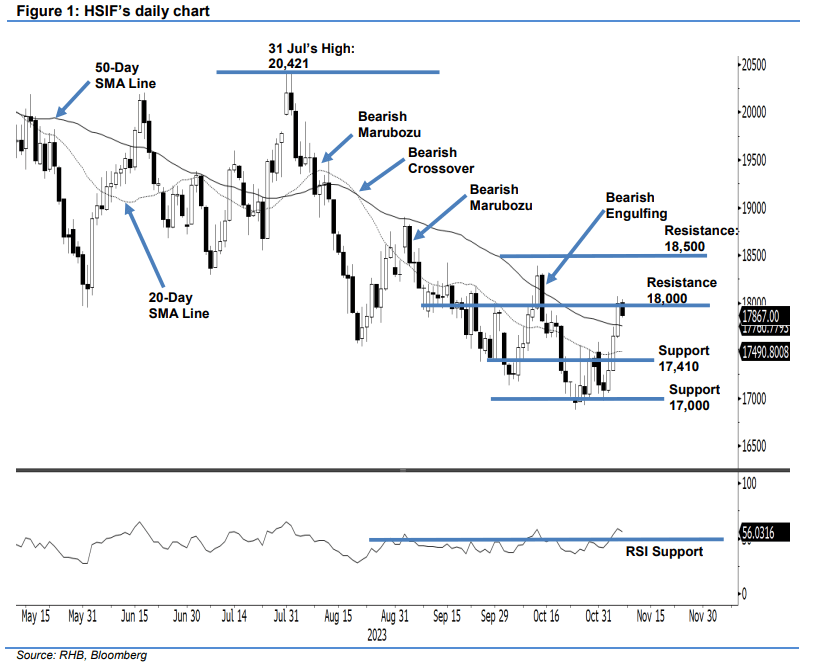

The HSIF climbed above the 50-day SMA line and closed at 17,994 pts – breaking past the 17,762 pts resistance.

RHB Retail Research Market Dateline today (Nov 7) said yesterday, the index began trading at 17,652 pts. It rose to the 18,072 pts day’s high before closing at 17,994 pts. In the evening, the index retraced 127 pts and last traded at 17,867 pts.

The latest bullish breakout on Monday’s session confirmed the bulls are having the technical advantage. For the immediate session, it will likely test the 18,000 pts immediate resistance.

Under the bullish environment, the resistance wall is thin while the support is strong. On the downside, both the 20-day and 50-day SMA lines are acting as supports. RHB observed the RSI is trending higher – showing strong bullish momentum is in play now. As the bulls are in control now, RHB shifts to a positive trading bias.

RHB closed out the short positions (initiated at 19,140 pts or the close of 8 Aug) after the trailing-stop at 17,762 pts was breached. Conversely, they initiated long positions at the close of 6 Nov, ie 17,994 pts.

To manage the trading risks, the initial stop-loss threshold is placed at 17,000 pts. The immediate support is revised to 17,410 pts – 27 Oct’s close – and followed by 17,000 pts. On the upside, the immediate resistance is pegged at 18,000 pts, and followed by 18,500 pts.