Tune Protect Group Berhad (Tune Protect) turned around from a loss in the third quarter of the financial year 2023 (3Q23) with a profitable bottom line driven by improvements in underwriting performance and investments.

In a statement, the group said its profit after tax (PAT) increased by more than 100% in 3Q23 to RM4.8 million and recorded a double digit growth of 22% year-on-year (YoY) in Net Written Premiums (NWP) for the quarter.

The topline growth’s main drivers are its Travel, Motor and Health pillar, with overall retention ratio in 3Q23 and 9M23 exceeded the group’s target of 70% by 4% and 6% respectively.

Quarterly earnings per share came in at 0.5 sen, from losses per share of 1.35 sen in 3QFY2022.

Its chief executive officer Rohit Nambiar said the group’s NWP across all the main pillars increased 22% YoY in 3Q23, which has compensated for the absence of the Perlindungan Tenang (Tenang) scheme which was discontinued this year.

However, he said, for the first ninth month of the year (9M23), NWP recorded a decline by 17.6% if Tenang was included.

“The NWP growth excluding Tenang was encouraging with a healthy 38.8% growth, signalling the trailing off of the dependency on Tenang.”

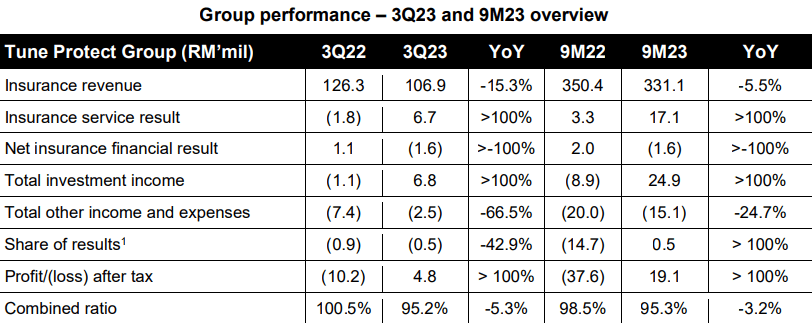

Rohit explained that despite the 15.3% drop of quarterly revenue YoY to RM106.9 million from RM126.3 million for general insurance, the group’s profitability was underpinned by the growth of the insurance service result, coupled with improved investment performance.

“Insurance service result grew more than 100% YoY to RM6.7 million in 3Q23. Furthermore, lower allocation of reinsurance premium turned insurance service result from negative to positive translating to a lower combined ratio of 95.2% during the period.

“In 3Q23 and 9M23, combined ratio were lower than 100%. These healthy indicators, coupled with rising investment performance with total investment income of RM6.8 million have led to the Group’s profitability in the quarter,” Rohit said.

He added the number of digital partners increased from 65 in 3Q22 to 79 in 3Q23 while the group’s digital partnership and ecommerce posted NWP growth of 7.5% YoY.

The group said it will emphasize on its digital partnerships both locally and abroad, and remains as the first insurer to collaborate with Credit Guarantee Corporation (CGC) to introduce digital solutions for micro, small, and medium enterprises (MSMEs).

It also expanding its presence in Southeast Asia, and to focus on the new group’s core system Hydro and Tune Integrated Producer System (TiPs) implementation.

Moving forward, Rohit is confident that the Group will deliver favourable investment returns, as it has affirmed its investment strategy for its portfolio totalling RM714.5 million as of 30 September 2023.

“Close to 80% of our portfolio is invested in money market funds and term deposits. Bank Negara has again maintained the current Overnight Policy Rate (OPR) at 3.0% for the third time (indicating supportive policy for the economy).

“Our conservative asset allocation continues to shield us from recent market volatility. We will remain vigilant on developments in both global and local capital markets,” Rohit added.