The Department of Statistics, Malaysia (DOSM) released the Malaysian Economic Statistics Review (MESR) Vol. 11/2023 which focuses on the recent statistics released in September 2023, some forthcoming statistics for October 2023 and highlights on Malaysia’s economic situation in the third quarter of the year.

Viewing the situation at the global frontier, the world economy is anticipated to grow moderately at 3.0 per cent in 2023 and 2.9 per cent in 2024 as projected by the International Monetary Fund (IMF) in its World Economic Outlook (WEO) report released in October 2023. Additionally, Asian countries’ economy is projected to grow by 4.6 percent in 2023, moderating to 4.2 percent in 2024.

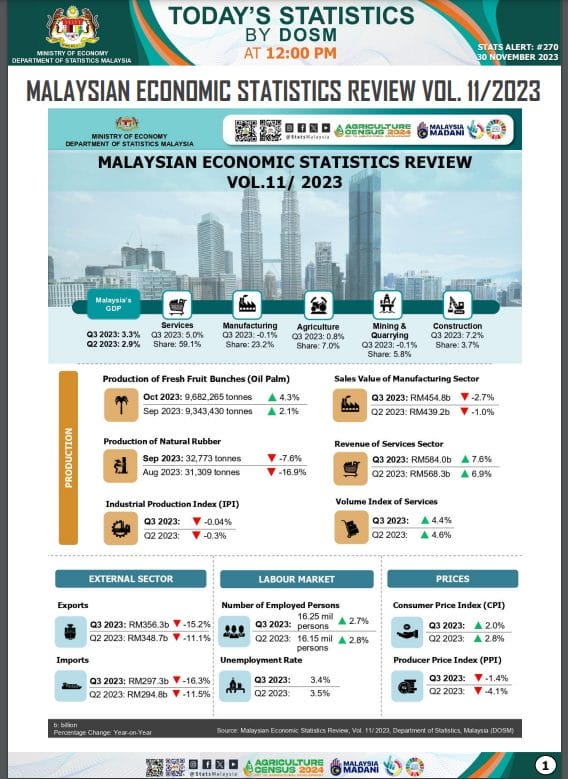

Chief Statistician Malaysia, Dato’ Sri Dr. Mohd Uzir Mahidin said, “The country’s economy expanded by 3.3 per cent year-on-year in the third quarter (Q3) of 2023, higher than the 2.9 per cent recorded in the previous quarter. The expansion of economy in this quarter was driven by domestic demand, especially in the Services and Construction sectors. In terms of quarter-on-quarter seasonally adjusted Gross Domestic Product (GDP), it increased by 2.6 per cent (Q2 2023: 1.5%) in this quarter.

On the nation’s recent economic indicators, Malaysia’s Current Account Balance (CAB) continued to maintain a surplus in the third quarter of 2023, recording RM9.14 billion as compared to RM19.0 billion in the same period last year. The surplus was supported by net exports of goods. Foreign Direct Investment (FDI) also recorded a lower net inflow of RM7.2 billion as against RM9.6 billion for the same quarter last year. Adding to this, Direct Investment Abroad (DIA) recorded a net outflow of RM13.4 billion in the third quarter of 2023 (Q2 2023 : RM8.0 billion).

Meanwhile, Malaysia’s total trade decreased by 15.7 per cent in the third quarter of 2023. Exports decreased by 15.2 per cent, while imports declined by 16.3 per cent resulting in the trade surplus registered a decrease of 9.1 per cent.

Looking into the performance of merchandise trade in September 2023, with the drop in exports and imports by 13.7 per cent and 11.1 per cent, respectively, total trade shrank 12.6 per cent year-on-year. At the same time, trade surplus decreased by 23.0 per cent.

In October, Malaysia’s trade performance continued to show a smaller decrease. Total trade, exports and imports noted the first single-digit decline since May 2023 with 2.4 per cent, 4.4 per cent and 0.2 per cent, respectively. Meanwhile, the trade surplus declined by 30.3 per cent.

The sales value of the Manufacturing sector, continued to decelerate for two consecutive quarters, dropping by 2.7 per cent year-on-year in the third quarter of 2023 as compared to the 1.0 per cent decline registered in the previous quarter. The decrease was attributed to the Petroleum, chemical, rubber & plastic (-13.3%), Food, beverages & tobacco (-5.3%); as well as the Wood, furniture, paper products & printing (-0.5%) sub-sectors.

On the annual performance, the sales value of the Manufacturing sector decreased at a slower pace of 1.9 percent in September 2023, compared to the 3.3 percent deterioration in the preceding month.

Malaysia’s Industrial Production Index (IPI) in the third quarter of 2023, registered a marginal decline of 0.04 per cent, after recording negative 0.3 per cent recorded in the second quarter of 2023. Meanwhile, the Services Volume Index rose 4.4 per cent to 146.7 points in this quarter. Concurrently, the revenue for Services sector grew by 7.6 per cent year-on-year in the third quarter of 2023 to record RM584.0 billion.

On the current labour force situation, number of employed persons increased by 0.6 per cent to 16.25 million persons (Q2 2023: 16.15 million persons) in the third quarter of 2023. Subsequently, the employment-to-population ratio, which indicates the ability of an economy to create employment further increased by 0.2 percentage points to 67.7 per cent. (Q2 2023: 67.5%). During this quarter, the unemployment rate improved to 3.4 per cent as compared to 3.7 per cent posted in the third quarter of 2022, decreased by 38.8 thousand of unemployed persons (Q3 2022: 611.8 thousand persons).

From the price’s perspective, the inflation for the third quarter of 2023 eased to 2.0 per cent to 130.7 as compared to 128.1 in the same quarter of the preceding year. Meanwhile, Malaysia’s inflation in September 2023, came down to 1.9 per cent 2023 as compared to August 2023 (2.0%) attributed to the lower prices for the group of Restaurants & Hotels, 4.4 per cent; Food & Non-Alcoholic Beverages, 3.9 per cent and Furnishings, Household Equipment & Routine Household Maintenance, 1.5 per cent. Malaysia’s inflation in October 2023 recorded 1.8 per cent, the lowest since April 2021.

In September 2023, Malaysia’s Producer Price Index (PPI) experienced a recovery, increasing by 0.2 per cent. However, PPI declined marginally by negative 0.3 per cent in October 2023.

Based on these economic indicators developments, Malaysia’s economy is expected to expand at a slower pace in the near future, as indicated by the Leading Index (LI) , which showed better movement for three consecutive months to negative 0.3 per cent by recording 109.3 points in September 2023 as compared to negative 0.5 per cent in the previous month.

Despite remaining below the 100.0 points trend in the smoothed long-term analysis for September 2023, the Leading Index suggests that Malaysia’s economy is poised for moderate growth in the near future, supported by an increase in investment spending, favourable labour market conditions and encouraging local demand.