Behind the success of integrated ecommerce platform Borong, formerly known as Dropee, it was a slow climb for three young co-founders Lennise Ng (pic), Aizat Rahim and Haslind Rasip.

Now, they take on the challenge and expand their business and rebrand their once small dropshipping company called Dropee, to Borong to help micro, small, and medium enterprises (mSMEs) thrive.

Headquartered in Kuala Lumpur, and operating in multiple cities across Malaysia and Indonesia, Borong currently offers a wide range of online and offline solutions to both suppliers and retail solutions, with over 150,000 businesses listed on their website.

Since its launch in 2017, the platform is one of the fastest growing B2B wholesale SaaS-enabled marketplace in Southeast Asia – but it has loftier aspirations – to grow further and expand its market presence in the region, beyond Malaysia and Indonesia.

In an exclusive interview with BusinessToday, its chief executive officer Lennise Ng, who was one of the co-founder, shares Borong’s seven year journey to get to where they are today and their plans ahead.

Simple Beginning As Dropshipping Company Dropee

With the rise of B2C e-commerce, social commerce and marketplaces, Lennise, Aizat Rahim and Haslind Rasip wanted to capitalise on the exponential growth of the industry.

“We started the company as a dropshipping platform where businesses are able to find products to list and sell on their respective online stores.

“As majority of online sellers are looking for white label products to resell, instead of branded goods, we pivoted the company,” she said.

Ng said with the pivot, the company was later focused on solving offline retail stores problems including lack of insights on the best-seller items for their stores and lack of access to business financing and cashflow due to poor credibility.

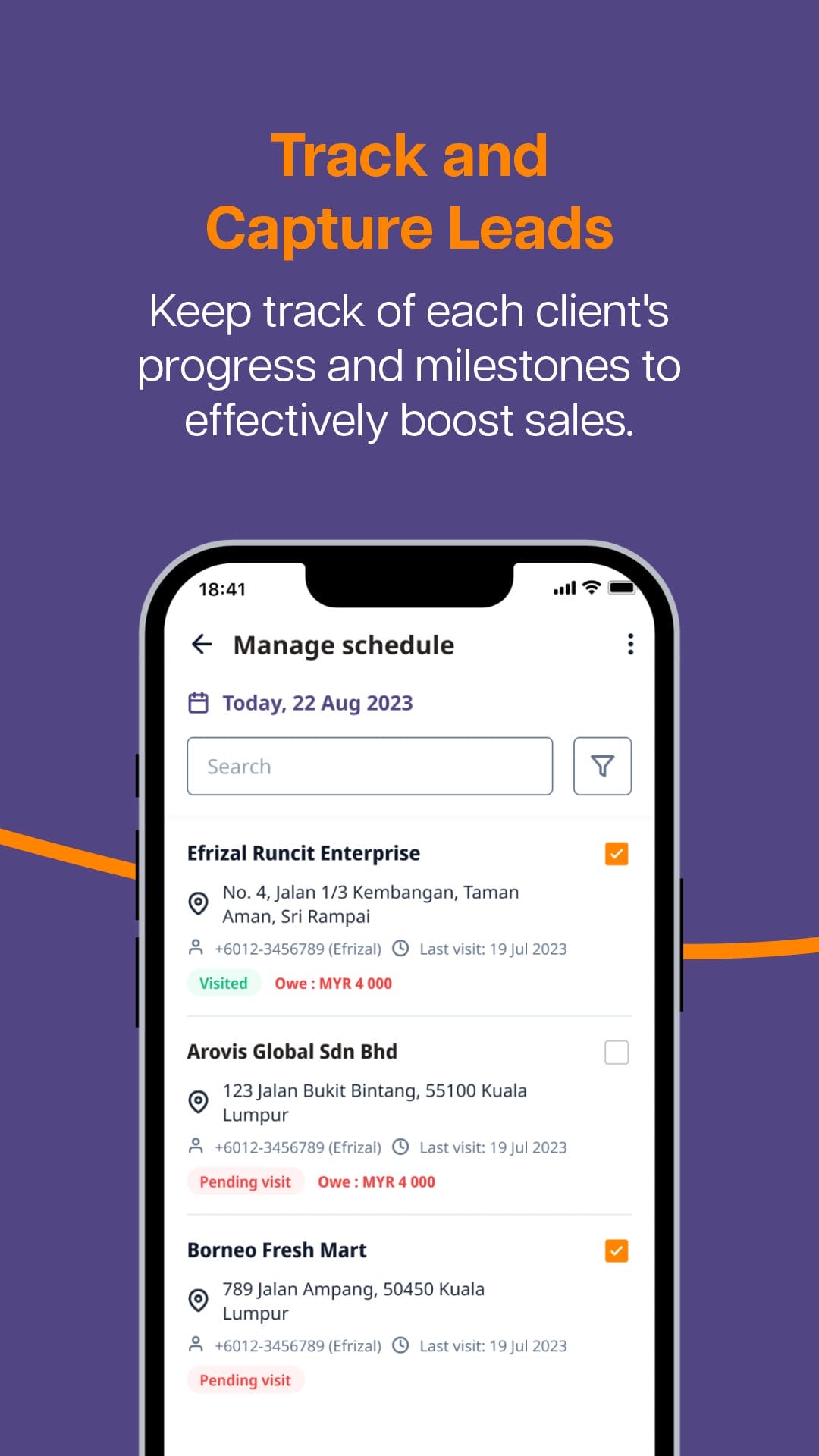

“In 2019, we launched our integrated e-commerce and order management tools for sellers to serve their retail customers in a better, faster, and smarter way. B2B sellers can now sell in bulk via online channels (through Dropee marketplace and their own ecommerce store), and offline channels (through on-ground sales agent app),” she said.

From early 2020, Dropee identify cashflow problems among mSMEs and started to partner with commercial banks to help entrepreneurs, so that they can get access to SME financing products digitally.

Expanding to Indonesia and Securing Funds To Spread Its Wings

In 2022, the e-commerce platform had a big win, securing USD7 million (RM32.71 million) from a Series A funding round led by Vyn Capital, and included notable investors such as LKF Capital, Resolution Ventures and HCL Capital.

“These VC funds specialise in fintech that supports Dropee, now Borong, to enhance the fintech development of our business,” said Ng.

Dropee was the second Malaysian startup to enter one of the most prestigious Silicon Valley programme, the Y Combinator.

It has gained unanimous votes and passing Endeavor’s local Selection Panel (LSP) hosted by Endeavor Malaysia and Endeavor Philippines and became an alumni of Endeavor’s Scale Up Program Cohort 1. In the same year, Borong rolled out its operations in Indonesia.

Rebranding to Borong

When the company started in 2017, the name “Dropee” made a lot of sense as dropshipping platform (it sounded a lot like e-commerce platform Shoppe).

However, Ng said, since they changed their approach and started serving offline mSME retail outlets and expanded its technologies and solutions, they needed a name change.

Furthermore, earlier this year, Borong created Digital Niaga as a programme to increase the quality of mSMEs funnelled to its banking partners.

Ng said this is done by working with industry partners and training mSMEs to provide these businesses relevant insights on how to improve their business credibility.

“The goal is to increase the bankability of mSMEs so they can have the right financing support to purchase more inventories to grow their business.

“With and growing wholesale transactions on the platform, the decision to change our name to Borong was timely. Borong allows businesses to understand what is the value we can deliver to them: we make wholesale,” she explained.

On why ‘Borong’ was chosen, Ng said the company decided the to rebrand ‘Dropee’ to ‘Borong’, as it means wholesale in Bahasa Melayu, representing the exchange of goods between local wholesalers.

“It resonates with us a platform for wholesale and B2B trading. Also, as a company whose mission is to uplift grassroot economies, it is important for us that our name reminds us of where we started – in Malaysia.

“What better way to embody that other than incorporating the Malay language into our name?,” added Ng.

What is Borong Now and What’s Next?

Currently, Borong is operating in Malaysia and Indonesia with over 150,000 businesses on its platform that facilitate over USD$300 million (RM1.4 billion) wholesale transactions annually.

Borong works with multiple partners, including suppliers and financial institutions, such as DiethelmKellerSiberHegner (DKSH), LH Marketing, Mydin, and more to supply products on our platform to mSMEs.

“We also work with strategic partners that can create more value for mSME business growth such as BSN, UOB and Agrobank,” Ng said.

Ng said unlike other platforms, Borong is beyond just a marketplace, adding that it is the biggest B2B e-commerce platform in Malaysia.

“We understand that in order to serve mSMEs better, we need to include the entire supply chain ecosystem and work with the right partners.

“That way, businesses can serve mSMEs in a better, smarter, and cheaper way. Borong is designed to create a win-win situation between suppliers and retailers, making it a one-stop solution for all things wholesale.

Ng highlighted that the mSMEs face three issues, getting access to the right best-sellers to their stores, stocking up products at the right price, and having access to financing support to grow their business.

The platform is using tech moat and data growth flywheel recommend best-seller products for mSMEs to stock up for their stores, connect them to the right supplier to provide fair pricing, and help their business build credibility amongst suppliers and banks to get more cashflow support such as extended credit terms, invoice financing, among others

“Overall, the aim is to ensure mSME entrepreneurs are able to identify the right products, right prices, and right partners to scale and grow their businesses.”

Ng said there are about 70 million micro and small businesses that are underserved by suppliers and banks across the Southeast Asian region.

“With out tech, we aim to help at least 1 million mSMEs grow their businesses by ensuring they are able to stock up the right products, at the right price, and from the right suppliers,” she said.

With a lot of room for growth, Borong is also looking to expand its presence in Malaysia and Indonesia, with hopes for further expansion into regions like Thailand and Vietnam in the coming years.

Supercharge your business with a banking app that’s simpler, smarter & more secure at your fingertips with Maybank2u Biz App. Download it on App Store & Play Store today. Learn More.