RHB’s Regional Thematic Research cited today (Dec 5) that ASEAN’s EV industry – both production and adoption – is at an early growth stage, but growth is going to be rapid.

The region’s EV market was valued at USD10bn in 2021 and is projected to expand at a CAGR of >10% over the next five years, reaching USD18bn by 2027.

Among MIST (Malaysia Indonesia-Singapore-Thailand), Indonesia and Thailand are the key beneficiaries, not only in Asia but globally. Malaysia, though, could play catch-up with its two neighbours with more supportive government policies.

Growth creates opportunities – The Global EV Outlook 2023 report sees global EV sales possibly increasing c.4x from 2022 to 2030.

RHB said while China, Europe, and the US are set to be the three largest consuming markets, the regions supplying the key components today are still highly concentrated, eg China dominates the entire downstream EV battery supply chain, and trades in battery and EV parts.

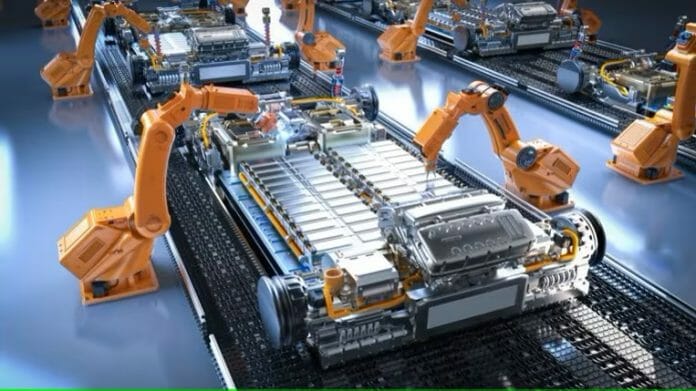

RHB sees Asia offering a large opportunity for growth in EV adoption and, given its prominence in battery-related minerals and automotive component manufacturing, we think ASEAN is an attractive proposition in terms of being a major key EV component supply hub.

ASEAN is already playing a growing role in the EV supply chain – Its countries provide incentives and actively support foreign direct investments (FDIs) in EV production while urging customers to adopt EVs.

RHB has seen a rapid influx of EV-related investments regionally since 2019. As of now, the top 10 EV producers are in ASEAN, which is also home to nine of the top 10 global EV battery manufacturers. Indonesia and the Philippines, with their vast nickel reserves, are set to become battery production hubs.

Indonesia and Thailand, which already have large manufacturing or assembly bases for the automotive industry, are rapidly evolving into bases for EV component supplies.

Malaysia is also set to make its presence felt as an EV battery manufacturer, and supplier of E&E products. While Singapore is an insignificant automobile producer, Hyundai has committed to manufacturing EVs at its Jurong plant there starting in 2025.

Singapore is also rapidly building an EV battery recycling capacity.

Key risks, according to RHB, include escalation of a US and China conflict, ii) technological discoveries leading to lower EV manufacturing costs globally, iii) discovery of alternative competing technologies, iv) frequent and unfavourable policy changes, and v) possibility of weak regional demand for EVs within ASEAN.

Key picks: Within RHB’s coverage, they see Astra International, Astra Otoparts, ComfortDelGro, Malaysian Pacific Industries, PTT, and Vale Indonesia as the key beneficiaries of the rapidly growing EV production and adoption.

Beyond their coverage, they see Banpu (BANPU TB, NR), ECA Integrated Solution (ECA MK, NR), Genetec Technology (GENE MK, NR), Greatech Technology (GREATEC MK, NR), Hana Microelectronics (HANA TB, NR), KCE Electronics (KCE TB, NR), Nex Point Parts (NEX TB, NR), Somboon Advance Technology (SAT TB, NR), Trimegah Bangun Persada (NCKL IJ, NR), and YBS International (YBS MK, NR) as some of the beneficiaries of this theme.