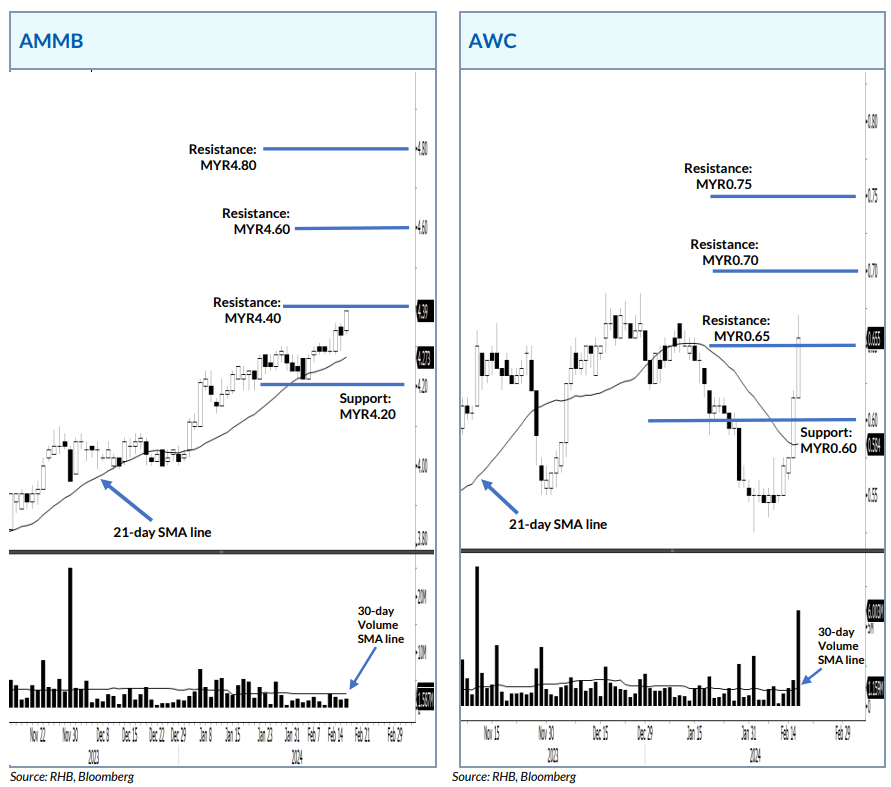

AMMB’s price is in the midst of extending the upside movement and testing the immediate resistance.

RHB Retail Research in a note today (Feb 19) said they have observed the stock’s price charting a series of “higher highs” and “higher lows”,

showing that a strong bullish momentum is underway.

In the event its price breaks past the MYR4.40 resistance, they should see the counter’s price climb towards MYR4.60, followed by the

MYR4.80 level.

Conversely, falling below the MYR4.20 support kicks off the correction phase.

AWC’s price is poised to scale higher after it broke past the key resistance on high volume.

The stock’s price managed to climb above the 21-day SMA line and close above the MYR0.65 resistance.

The latest price action confirmed a bullish setup.

The renewed momentum should propel the counter’s price towards the next resistance pegged at MYR0.70 and followed by the MYR0.75 level.

On the downside, breaching the MYR0.60 support negates the bullish setup.

CPE Technology’s price is eyeing to extend its bullish trajectory after breaking past the key resistance.

The counter’s price has climbed above the MYR1.03 resistance on strong volume and printed a Bullish Marubozu candlestick.

Riding on the momentum, the stock’s price will test the next resistance levels at MYR1.08 and MYR1.12.

However, a fall below the MYR0.975 support invalidates the bullish setup.

HE Group’s price is set to have a fresh leg on the upside.

The house has observed the counter charting a series of bullish candlesticks, showing momentum is picking up pace.

In the event its price breaks out from the MYR0.45 resistance, the technical setup will improve.

In this case, the momentum will propel the stock’s price towards MYR0.48, followed by the MYR0.52 mark.

On the other hand, falling below the MYR0.40 support leads to a bearish phase.