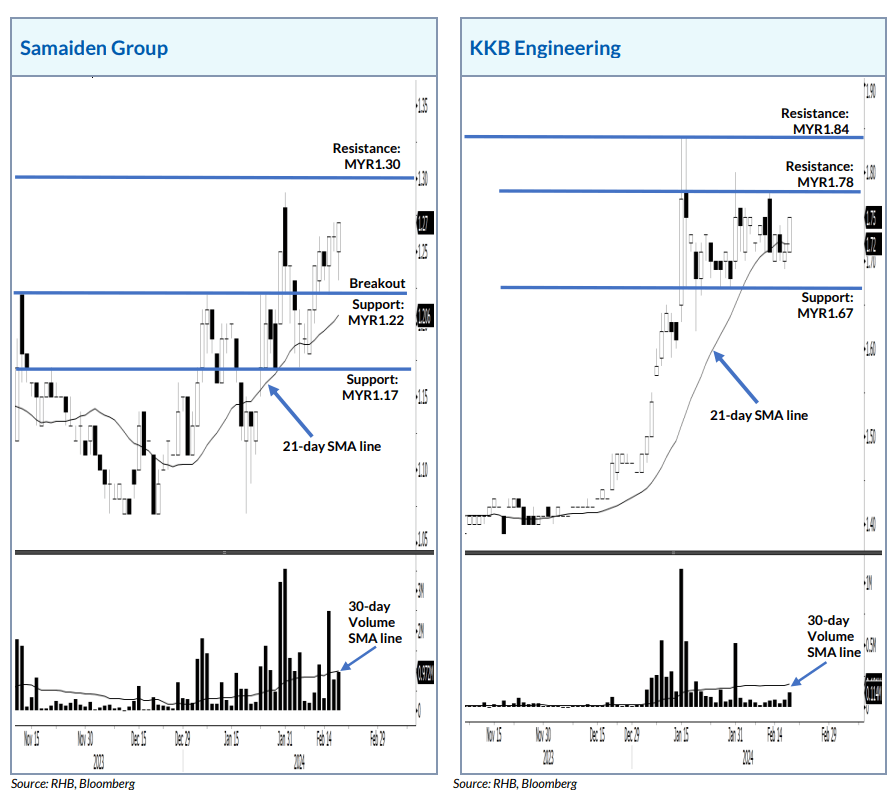

Samaiden Group’s price is set for an uptrend after recently experiencing a technical breakout above the MYR1.22 level with strong trading volume.

RHB Retail Research in a note today (Feb 20) said the bullish bias above that threshold may see the stock’s price climb higher towards the MYR1.30 immediate resistance, followed by the MYR1.35 next resistance.

However, a fall below the MYR1.17 support potentially signals a downtrend.

KKB Engineering’s price is in the midst of a sideways consolidation between the MYR1.67 and MYR1.78 levels, with buying pressure observed yesterday above the support level.

If it manages to move past the MYR1.78 immediate resistance, the stock’s price may climb higher towards the MYR1.84 recent high,

followed by the MYR1.91 next resistance.

However, if the price falls below the MYR1.67 support, this signals the reversal of the trend.

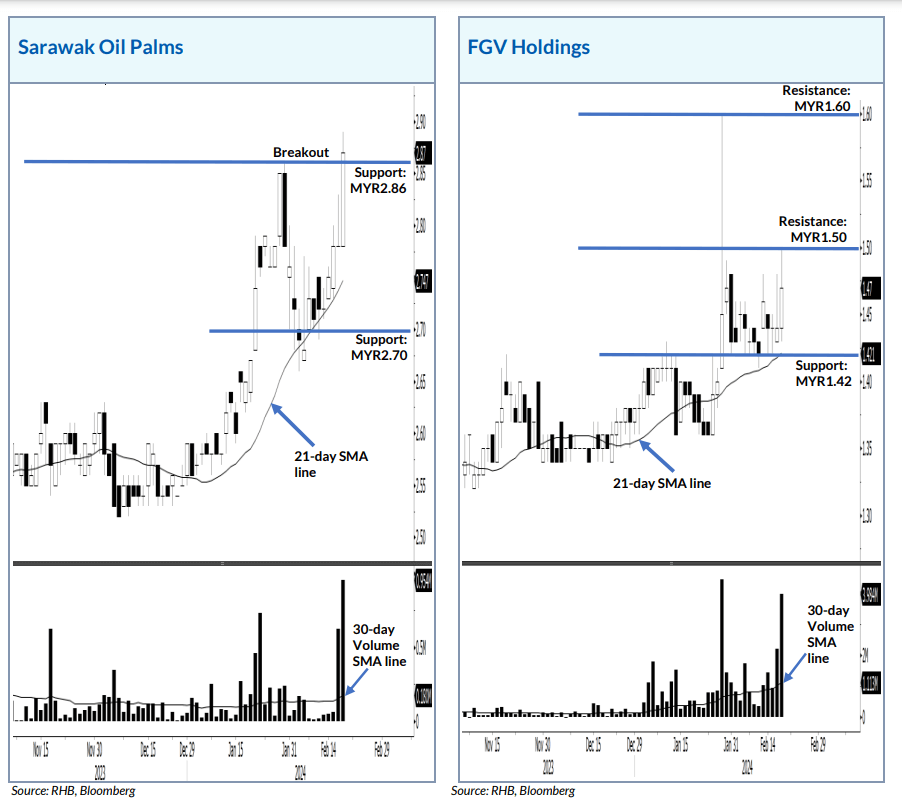

Sarawak Oil Palms’ price is set for an uptrend after bouncing off the 21-day SMA line and surpassing the MYR2.86 immediate resistance level yesterday – backed by strong trading volume.

If it manages to sustain above that level, the bulls may drive the stock’s price towards the MYR3 mark, followed by the next resistance at MYR3.50.

Conversely, a decline below the MYR2.70 support negates the bullish setup.

FGV Holdings’ price is set for an uptrend rebound after bouncing off the 21-day SMA line, testing the MYR1.50 mark during intraday session yesterday – backed by surging trading volume.

If it manages to surpass that mark, the bullish momentum is likely to persist – heading towards the MYR1.60 recent high, followed by the MYR1.75 next resistance level.

However, a decline below the MYR1.42 support triggers a downwards movement