In support of the MADANI Government’s ongoing efforts to bring the country’s economy back on track, the Ministry of Finance (MOF) announced details of tax reforms aimed to strengthen the national fiscal foundation.

In a statement released by MOF today (Feb 28), the ministry said the increase in Service Tax from 6% to 8%, which takes effect on 1 March 2024, has been designed to focus on discretionary activities and business-to-business services, while protecting the rakyat from shouldering higher consumption tax for key essential services such as food and beverage, telecommunications, parking and logistics.

Minister of Finance II Datuk Seri Amir Hamzah Azizan said: “To truly transform our economy, the Government has taken a measured approach to reform our tax system. While it is important for the Government to raise its revenue, there is a balancing act that we have to consider between improving the tax base and cushioning the rakyat from any undue burden.”

“It is necessary for us to broaden the tax base to realign and strengthen our national fiscal foundation as we set the stage for a new era of economic growth under the Ekonomi MADANI framework.

“At the same time, we will continue to take on a ‘Whole of Government’ approach to right our economic trajectory, including being more prudent in our spending, reduce leakages and attract FDI,” he added.

The expanded tax system is expected to generate an estimated additional RM3 billion in revenue to the country, which will help the MADANI Government increase its support for the rakyat through better social assistance schemes and improved critical public infrastructure like healthcare, schools and roads.

Under the Service Tax (Amendment) Regulations 2024, which was gazetted on 23 February 2024, all taxable services categorised in the First Schedule of the Service Tax Regulations 2018 will be subject to 8% service tax. This also includes imported taxable services and digital services.

In addition, the coverage of Service Tax will be expanded to harmonise the tax treatment for selected services within the same industry.

For example, karaoke centres will be subject to 8% Service Tax, similar to other entertainment as night clubs, dance halls, cabarets, and wellness centres.

Meanwhile, brokerage and underwriting services, which currently only apply to financial services, will be expanded to cover other brokerage industries such as ship/aircraft brokerage, commodities and real estate.

The change in Service Tax rate does not involve services that form a basic need and intrinsic part of the rakyat’s lifestyle.

For example, the Service Tax rate for services that are widely used by the rakyat such as food and beverage, telecommunications and parking remain unchanged at 6%.

This also applies to logistics services which will be subject to 6% service tax. For food and beverage delivery services, no Service Tax will be imposed.

For electricity services, the service tax is only applicable for usage above 600kWh. Almost 85% electricity users fall below this threshold, and therefore will not be affected by the service tax.

The service tax also does not apply to treated water supply services.

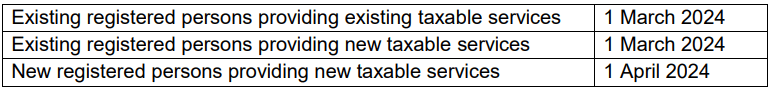

To enable the companies to effect the changes in the service tax, the Government has agreed to the following implementation dates:

The Government does not anticipate the changes to engender sharp price increases that would lead to an economic shock as the small two-percentage increase affects selected taxable services.

The complete list of taxable services and Frequently Asked Questions (FAQ) can be found at https://www.mof.gov.my/portal/ms/berita/soalan-lazim/soalan-lazim-peluasan skop-perkhidmatan-bercukai-dan-perubahan-kadar-cukai-perkhidmatan.