As a significant player in Southeast Asia’s economic landscape, Malaysia continues to assert its global presence through Direct Investment Abroad (DIA). In the era of globalisation, Malaysia’s DIA initiatives have emerged as pivotal drivers of the nation’s economic development.

This trend underscores not only Malaysian companies’ readiness to expand across borders and engage with international markets but also signifies a strategic move towards achieving economic diversification and stability.

In the context of assessing economic growth, DIA serves as a crucial metric, aligning with perspectives observed in countries as mentioned by Agnihotri & Arora, 2019. Theoretically, DIA also involves investment abroad with the goal of finding efficiency, resources, markets, and strategic assets (Dunning, 1993). This article explores the intricacies of Malaysia’s DIA dynamics, unravelling its historical evolution, current landscape, while also addressing challenges, opportunities, and profound impacts on the nation’s economy.

Historical Context Of DIA

Malaysia’s journey into international economic engagement begins with a strategic policy shift and progressive economic reforms. Transitioning from an export-focused economy, Malaysia now actively encouraging overseas investment.

In the early 1990s, Malaysia entered an era of significant changes in its economic approach. Prior to that, the main focus of the country lay in the development of the domestic economy with a special emphasis on the industrial sector, notably in manufacturing and exports. However, Malaysia has since shifted its investment paradigm by engaging in DIA, aligning with the government’s drive to diversify its strategy and pursue new international economic opportunities.

The rapid growth in DIA is an important part of Malaysia’s economic transformation. The need to find better sources of raw materials, new markets, and investment opportunities encourages Malaysian companies to actively cross borders, engaging in various sectors such as services, real estate, manufacturing, and banking.

Concurrently, data indicates that Malaysia ascended from the 11th to the 10th position among the top 15 developing economies in terms of DIA stocks between 1980 and 2013 (UNCTADSTAT 2014). However, Malaysian capital outflows surpassed inflows after 2007, rendering Malaysia a net capital exporter (Goh and Wong, 2011). This phenomenon signifies a dynamic evolution in Malaysia’s foreign investment landscape, significantly influencing the nation’s global economic stature.

DIA’s Current Landscape

In the current landscape of the DIA, notable dynamic shifts are occurring alongside the rapid expansion of economic globalisation. This landscape reflects a strategic transformation in the economic approach, where companies are no longer bound by geographical boundaries, but instead engage in international investment as an important element of their growth strategies.

The Malaysian government plays a pivotal role in shaping this landscape, implementing various policies and initiatives aimed at facilitating, supporting, and bolstering companies’ access to global markets.

The Cross-Border Investment (CBI) Division under Ministry of Trade, Investment and Industry (MITI) serves as the function of investment spanning across borders between countries, representing a natural evolution for economically developed nations. Its significance lies in expanding business horizons and fostering market growth.

Malaysian companies are urged to explore beyond borders to enhance market share, seize new investment prospects, and elevate global presence. The Malaysian Government consistently advocates for Malaysian companies to venture abroad, facilitating market expansion, technological acquisitions, and integration into the global production network through CBI. (MIDA, 2023)

The DIA represented about 3.3 per cent of Malaysia’s GDP, while Foreign Direct Investment (FDI) comprised 4.2 per cent in 2022. In contrast, back in 2010, FDI only made up 3.6 per cent of Malaysia’s GDP, whereas DIA stood as high as 5.3 per cent.

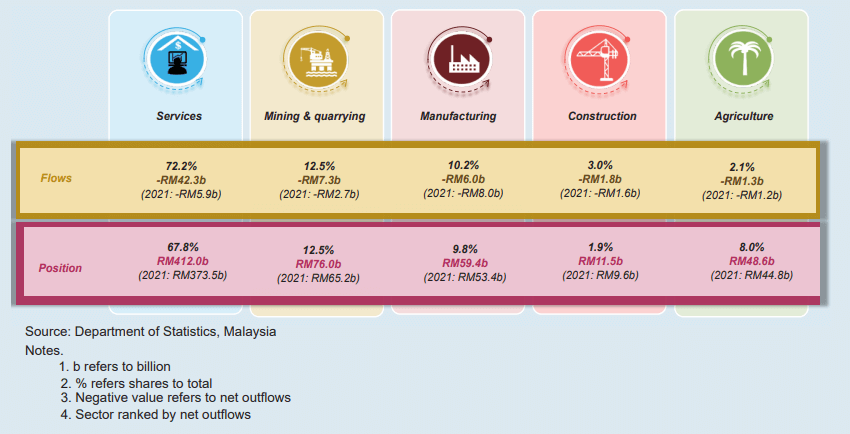

According to the data released by the Department of Statistics Malaysia (DOSM) in Statistics of Malaysia’s Direct Investment Abroad 2022 indicates that the trend of DIA flows in Malaysia are concentrated in the Services sector from 2013 to 2022, followed by Mining & quarrying and Manufacturing sectors.

The Services sector particularly in Financial activities emerges as the primary contributor to Malaysia’s DIA flows and stock in 2022 with RM42.3 billion (contribution share: 72.2%) and RM412.0 billion (contribution share: 67.8%), respectively. The country’s rapid economic growth and successful development of the domestic economy have facilitated opportunities for overseas investment.

Malaysia’s DIA of Flows and Stock by Sector, 2021 – 2022

As of 2022, DIA in Malaysia has demonstrated a steady growth, diversifying its investments across various regions and industries. The DIA registered a notable increase in net outflows, totalling RM58.6 billion compared to RM19.4 billion the previous year, marking the highest since 2014.

This surge was primarily driven by increased investments in the Services, Mining & Quarrying, and Manufacturing sectors. Services overtook Manufacturing as a vital sector to DIA, contributing 72.2 per cent of the total investment, primarily in Financial & insurance / takaful activities.

The Netherlands, Indonesia and Singapore were the main destinations of DIA flows in 2022.

Overall, the accumulated investment abroad surged to RM607.5 billion mostly in Services sector, followed by Mining & quarrying and Manufacturing sectors. Singapore, Indonesia and the Netherlands ranked as the top destinations of DIA position in 2022.

In terms of income, DIA registered a value of RM49.3 billion mainly driven by Services and Mining & quarrying sectors with a combine share 80.8 per cent of the total income.

DIA Malaysia continues to show a sustainable trend, with local companies fervently exploring opportunities in the international market. This trend involves not only specific sectors, but also diversification into sectors related to high technology, financial services, and natural resources, providing clarity on the existence of various Malaysian investment portfolios around the world.

In the aftermath of the COVID-19 pandemic crisis that hit the world in 2020, Malaysia’s direct investment abroad trend experienced dynamics that reflected the resilience and adaptation of local companies to the affected economic landscape.

Notably, the grand opening of Battersea Power Station on October 14th, 2022, in the United Kingdom, stands as a testament to Malaysia’s post-pandemic investment success. Developed by a Malaysian consortium that acquired the Power Station’s commercial assets for RM8.197 billion, the opening ceremony symbolising the success of Malaysian investment abroad post-pandemic.

Amidst the various economic challenges posed by the pandemic, there are intriguing indicators that illustrate the diversification in how Malaysian companies respond to global uncertainty. According to a study by Bank Negara Malaysia titled “Malaysia’s Trade Resilience,” following the easing of COVID-19 restrictions, the Malaysian economy underwent a robust recovery, characterised by significant export growth across various sectors.

This cross-product recovery exhibited stability and diversification in economic performance, with exceptional performance noted in certain sectors, notably the Electrical and Electronics (E&E) sector, which represented over a third of exports and played a pivotal role in the recovery process. Additionally, the uptick in commodity prices provided further support to commodity-related exports, while the positive correlation with regional economic recovery highlighted Malaysia’s significance in the increasingly stable and expanding international trade landscape.

Overall, DIA observed Malaysian companies adapting their investment strategies to navigate current challenges and unearth new opportunities. The current performance of DIA not only underscores the agility of Malaysian companies in responding to the evolving global economic scenario but also contributes positively to the nation’s economic resurgence and bolsters the objectives of sustainable economic growth.

Return On Investment (ROI)

After the COVID-19 pandemic subsided and the global economy slowly recovered from its impact, further analysis of the income gained on investments in 2022 revealed that both FDI and DIA investors continued to experience high returns on their investments.

On average, the return on investment for FDI companies in 2022 slightly decreased to 12 cent from 13 cent in 2021 for every RM1 of investment and conversely, Malaysian companies received eight cent for every RM1 of investment made abroad.

The Services sector attained the highest income from FDI, while the Manufacturing sector secured the highest income from DIA. The rate of return on FDI is higher than investing abroad (DIA), primarily due to the higher profitability of FDI companies in Malaysia.

These companies are predominantly engaged in the electrical & electronic, financial, health, metal, and petrochemical industries, which yield greater profits.

Challenges And Opportunities

Investing directly abroad presents Malaysian companies with challenges that require prudent management. Political and economic uncertainties in foreign countries can lead to significant risks, particularly amid frequent changes in the political landscape.

Moreover, alterations in policies and regulations within these countries can profoundly impact profits and business operations. Currency exchange risk poses another challenge, necessitating the implementation of an effective risk management strategy to mitigate fluctuations in currency values. Additionally, market diversity, encompassing cultural differences and unique market characteristics, underscores the importance of thorough research to formulate successful international business strategies.

Nevertheless, direct investment abroad also offers various opportunities to enhance the global presence of Malaysian companies. This includes access to broader markets, enabling companies to explore and expand their market share.

Furthermore, venturing into foreign markets provides opportunities to acquire the latest technology and innovation, thereby strengthening overall competitiveness and operational agility.

In this context, direct investment abroad enables companies to achieve a necessary balance in their investment portfolio amidst market instability in Malaysia and capitalise on opportunities for sustainable growth.

The future of DIA in Malaysia holds various challenges and opportunities. In this context, Malaysia’s strategy to navigate the uncertain global market requires adaptability and resilience. Different investment sectors, such as technology and international cooperation, may witness new growth. The future outlook also emphasises the importance of diversifying investment portfolios to address the ever-changing market risks.

It is crucial to ensure that foreign investments support sustainability and generate benefits not only economically but also socially and environmentally.

According to a news excerpt from The Star (January 2024), the Prime Minister of Malaysia has urged government-linked investment companies (GLICs) and government-linked companies (GLCs) to reduce their overseas investments and increase their domestic investments. Nevertheless, the Government prepared to give flexibility to GLCs and GLICs to make investments abroad if there is a need.

The Prime Minister has also asked the Finance Ministry and Pantau MADANI to coordinate efforts so that GLICs and GLCs implement strategic investments in line with the New Industrial Master Plan and the National Energy Transition Roadmap.

In summary, direct investment abroad has emerged as a substantial catalyst for the nation’s economic advancement and international impact. Malaysian enterprises, overcoming hurdles and capitalising on opportunities, persist in making a lasting impression on the global arena, buoyed by strategic governmental backing.

The article was published in the Department of Statistics Malaysia (DOSM) Malaysian Economic Statistics Review – Vol. 2/2024, written by Diyana Amalina Mat Zelan and Siti Sarah Che Dan. The views expressed are those of the authors and do not necessarily represent the views of the DOSM.