Top Glove Corporation Berhad posted a core net loss of RM57.1m in 2QFY24, marginally narrower than that of the preceding quarter.

Revenue was up 12% qoq, on the back of an 18% qoq growth in sales volume, but this was negated by a 5% qoq decline in ASP, and further exacerbated by higher raw material costs, with average natural rubber and nitrile butadiene rubber (NBR) latex prices up 15% qoq and 3% qoq, respectively.

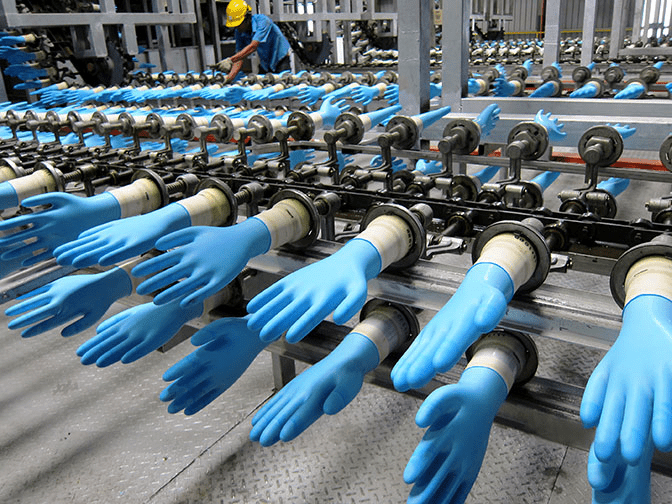

CGS International (CGS) said today (Mar 21) that Top Glove’s utilisation rate in 2QFY24 rose to c.50% (from c.43% in the preceding quarter), based on a total operating capacity of 60bn pieces p.a.

For the 1HFY24 period, core net loss narrowed to RM116.9m (1HFY23: -RM321.0m), making up 58% of our projected net loss of RM201.5m for FY24F.

CGS deems the 1H results as in line as we expect gradual earnings improvement in 2HFY24F, on the back of higher sales volumes.

Sales volume recovery evident, but ability to hike ASP unclear

Management said that there has been a growing number of Chinese glovemakers added to the FDA import alert since the beginning of this year. This could channel some orders from US customers back to Malaysian manufacturers, management said, which could drive volume recovery further.

Management expects latex prices to peak in May-Jun 2024F, and natural gas tariffs to rise in Apr 2024F, both of which could mitigate the positive impact of rising sales volumes.

That said, management believes the narrowing price gap with regional players could provide an avenue for Top Glove to hike its ASPs in the coming months to mitigate the impact of rising raw material prices.

CGS, however, thinks this is a tall order for Top Glove without sacrificing sales volumes growth, given the industry’s lingering excess capacity. As such, we maintain our FY24-26F estimates that imply a gradual recovery going forward.

Reiterate Reduce

CGS maintains their Reduce call, with an unchanged TP of RM0.70 (1.0x CY25F P/BV). CGS thinks the market has priced in a faster earnings recovery for Top Glove than they expect, with the stock trading at 31.9x FY26F P/E vs. regional peer average of 12x.

Upside risks are stronger-than-expected restocking activities by end-customers due to emergence of another health crisis, and regional players facing eroding pricing power, resulting in stronger-than-expected profitability for local players, including Top Glove.

De-rating catalysts include sustained weakness in pricing power among the local players, aggressive capacity expansion of the regional players, as well as strengthening of the ringgit against the US dollar.