Johor Plantations Group Berhad formerly known as Johor Plantations Berhad announced that it had obtained approval from the Securities Commission Malaysia to list on the Main Market of Bursa Malaysia Securities Berhad.

The group aims to offer of up to 875 million shares will comprise a public issue of 464 million new shares and an offer for sale of up to 411 million existing shares. Of these 875 million shares, up to 485 million will be made available to Malaysians and foreign institutions, 312.5 million will be allocated to Bumiputera investors approved by the Ministry of Investment, Trade and Industry, 50 million shares will be made available for application by the Malaysian public by way of balloting while the remaining 27.5 million shares will be earmarked for eligible persons who have contributed to the success of the JPG group.

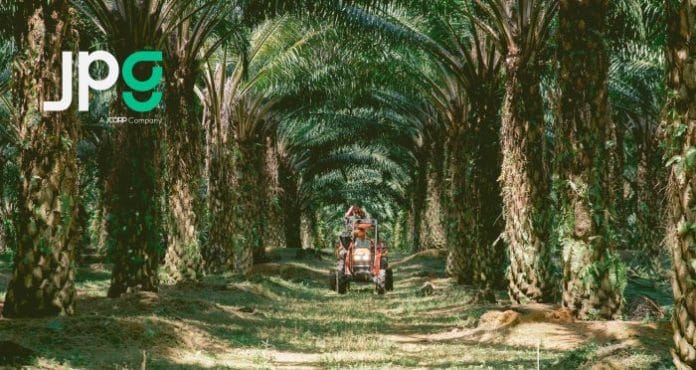

JPG’s Managing Director, Mohd Faris Adli Shukery, said “ This strategic move will enhance our position as a fully integrated oil palm producer and generate additional revenue across the entire value chain. It is also expected to generate positive shareholder value, reflecting our commitment to long-term wealth creation for our investors. With this in mind, we will strategically utilise part of our IPO proceeds to construct an integrated sustainable palm oil complex while ensuring business continuity through disciplined replanting strategies.”

RHB Investment Bank Berhad is the Principal Adviser, Joint Global Coordinator, Joint Bookrunner, Managing Underwriter and Joint Underwriter for this IPO exercise. AmInvestment Bank Berhad and CIMB Investment Bank Berhad are the Joint Global Coordinators, Joint Bookrunners and Joint Underwriters. CLSA Singapore Pte Ltd and CLSA Securities Malaysia Sdn Bhd are the Joint Global Coordinators and Joint Bookrunners while Affin Hwang Investment Bank Berhad is the Joint Bookrunner and Joint Underwriter.