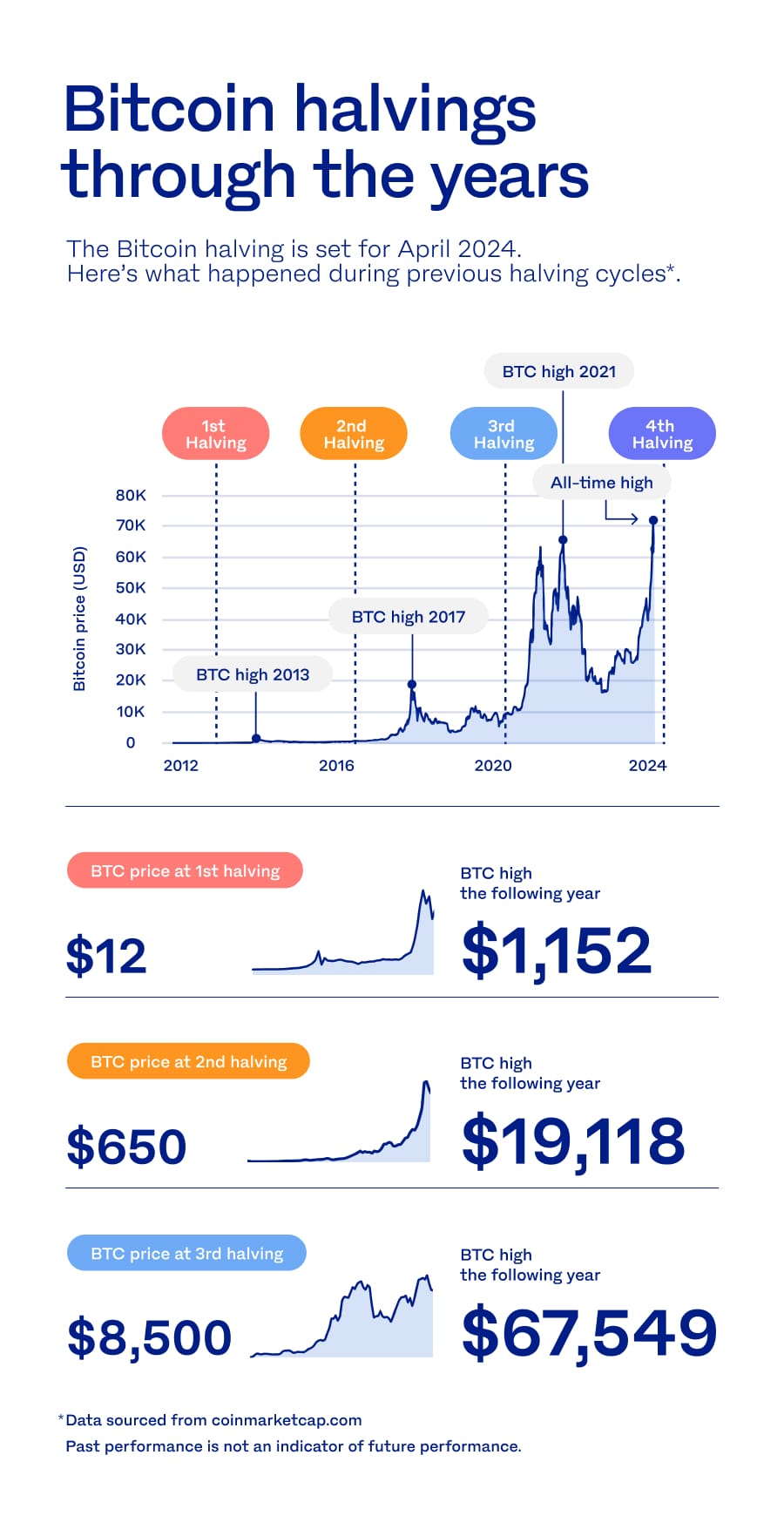

With the fourth Bitcoin Halving looming on the horizon, cryptocurrency enthusiasts and investors are closely examining historical patterns to gauge its potential impact on the price of Bitcoin.

Scheduled to occur every four years, this event slashes the rate of new Bitcoin issuance by half, a mechanism designed to curb inflationary pressures as the total supply of Bitcoin approaches its capped limit of 21 million coins by 2140.

As the upcoming halving approaches, miners face a reduction in their Bitcoin rewards from 6.25 to 3.125 Bitcoins per block, effectively decreasing the supply of newly minted Bitcoin into circulation.

Scarlett Chai, Luno’s country manager for Malaysia, elucidates, “The halving is ingrained in Bitcoin’s algorithm as a deflationary measure, historically leading to post-halving price rallies. However, this cycle presents unique dynamics, notably driven by institutional interest and the recent approval of Bitcoin ETFs in the US.”

Indeed, recent market trends diverge from historical patterns, with Bitcoin achieving all-time highs prior to the halving—a departure from previous cycles. Chai said, “The influx of institutional investors and liquidity from ETFs has reshaped the Bitcoin market, complicating predictions of its future trajectory.”

Leading up to the halving, the cryptocurrency landscape has witnessed significant milestones, including the approval of spot Bitcoin ETFs in the United States, accumulating over RM237 billion (USD50 billion) in assets under management.

March marked another milestone with Bitcoin soaring to a new all-time high of over RM347,400 (USD73,650) on Luno.

Reflecting on the evolution of Bitcoin, Chai added, “Bitcoin has evolved from its early days, with over 46 million addresses holding Bitcoin today, compared to just 43,000 during the first halving in 2012.

Despite market fluctuations, the halving serves as a mechanism to regulate supply, reinforcing Bitcoin’s scarcity.”

Looking back at previous halving events, Bitcoin’s price surged exponentially post-halving, from USD12 in 2012 to approximately USD62,000 within a year after the third halving in 2020.

However, Chai emphasised that while the halving influences miners’ rewards, it does not alter the fundamental nature of Bitcoin ownership for holders.

In essence, the fourth Bitcoin Halving represents a pivotal moment for the cryptocurrency market, characterised by a confluence of institutional adoption, regulatory developments, and evolving investor sentiment.

As the countdown to the halving continues, stakeholders remain vigilant, poised to navigate the evolving landscape of digital assets.