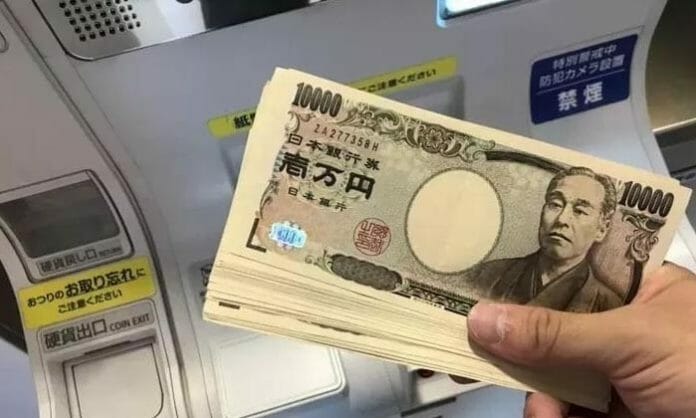

On Monday, April 29th, at 11 a.m. Sydney (Australia) time, the USDJPY was trading at the price of 160.246 levels that had not been seen in a long time. This showcased how weak the Japanese Yen was and how strong the USD was, just after a rally of 5.93% for the month of April on USDJPY.

However, the Bank of Japan was watching it closely, and players around the world were watching it as well, because every time the Japanese yen gets that weak, all the players already know that the BoJ would intervene in this situation.

As expected, but not expected by the market, the Bank of Japan intervened in the market. Right at the beginning, USDJPY dropped 3.17% in the first couple of hours of intervention, leading the USD dollar index as well to fall from 106.020 to 105.461. In percentage, this is a drop of 0.5%. Not only did USDJPY and USD Index drop, but also any other currency with JPY in the quote.

Now some questions come up after this bloody Monday: how can we confirm that the MoF has intervened and how much did they dump on JGBs? A report from the Bank of America Securities said there are some speculations that Japan’s Ministry of Finance (MoF) will disclose the composition of its official reserves for the end of April sometime next week (around May 9th or even earlier).

It will show the size of the total reserve assets and the balance of deposits, securities, and other assets. Assuming the MoF financed intervention by deposits ($155bn as of end-Mar) and securities ($995bn), the updated balances could tell the rough size of FX interventions. BofA estimates that the valuation changes and carry on the deposits and securities would add up to a decline of $14-16b (due to higher rates) for the month of April.

Now, what are the implications? As this is speculation, we can’t forget that there may be more rounds of interventions and could potentially see more downside on the USDJPY to levels such as 151-153. They can’t print infinite money generating more depreciation for their own currency; therefore, there is a limit which BofA estimates to be around $300bn in 2024 but can be subject to arbitrary changes.

This carries a risk that a further delay in the US Fed rate cut or increased possibility of the USD getting stronger could make USDJPY rally again as it is still a good carry trade to have in the portfolio. Additionally, as I just mentioned above, bigger, and bigger numbers of the intervention will be seen as negative, putting fire on the money reserves of the MoF and this would weaken the JPY even more, making it easier to continue to rally.

Market commentary and analysis from Luca Santos, currency analyst ACY Securities