Below is a Standard Chartered Global Research team’s report on the recently announced Budget 2020.

Step by step

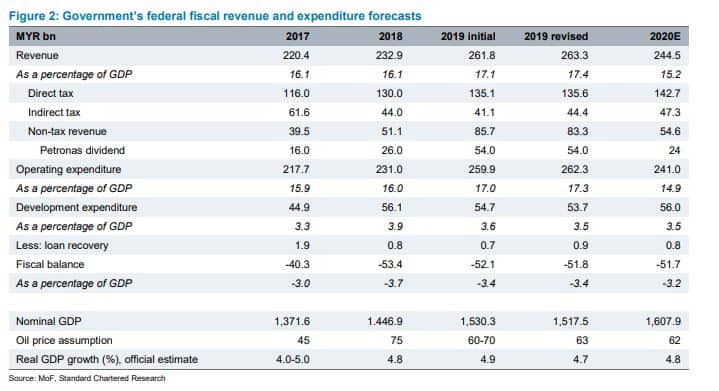

Finance Minister Lim Guan Eng presented his second budget on 11 October. As expected, the 2020 fiscal deficit target was reduced to 3.2 p% of GDP, slightly higher than what was projected in the 2019 budget for 2020. The finance minister had earlier alluded to a more gradual pace of fiscal consolidation, which is justified by the challenging growth environment. Notably, the government is sticking to its medium-term consolidation objective.

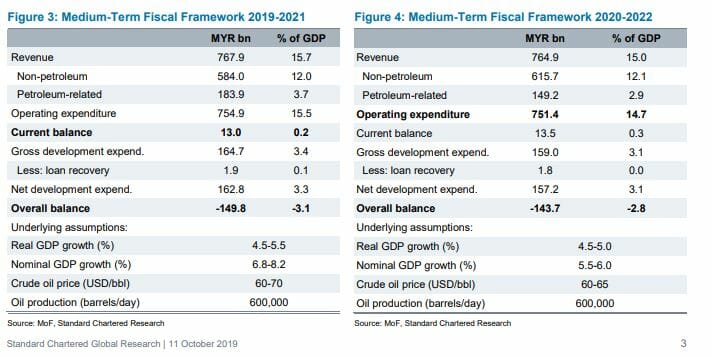

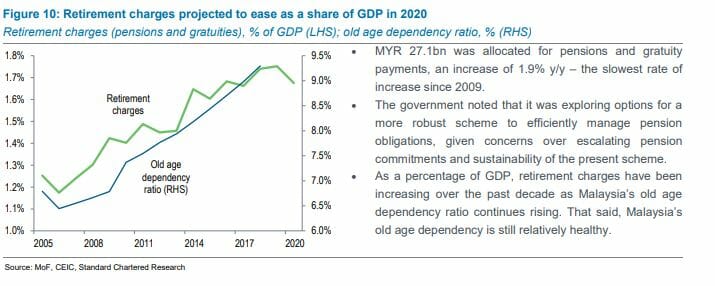

According to the Medium-Term Fiscal Framework (MTFF), the government is targeting an average fiscal deficit of 2.8% of GDP for 2020-22. This may be a challenging target, and implies an average fiscal deficit target of 2.6% of GDP during 2021-22. The means to reaching the deficit target appears to be expenditure rationalisation over the medium term.

The government is projecting a steady growth rate of 4.7% in 2019 and 4.8% in 2020. Malaysia’s growth so far has proven to be relatively resilient. Strong private consumption and the resumption of mega-infrastructure projects should help. That said, downside risks to growth remains amid external challenges.

We maintain a Neutral near-term duration outlook on MYR debt. The budget announcement is in line with market expectations and supply pressure is manageable. Based on the 2020 fiscal deficit target of 3.2% of GDP, we estimate a similar supply outlook to 2019. In 2020, we expect gross borrowing in MGS and GII to be RM121billion – new funding needs of RM50 billion, and MGS and GII redemptions of

RM71 billion.

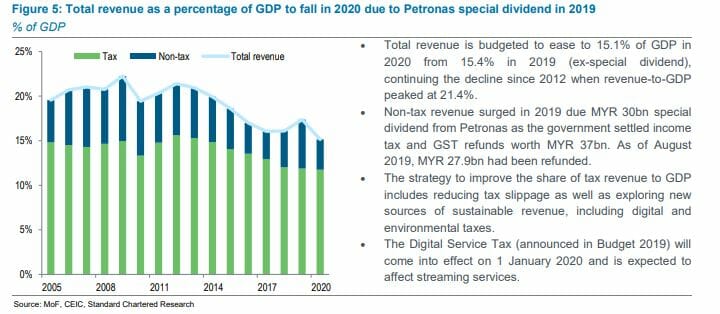

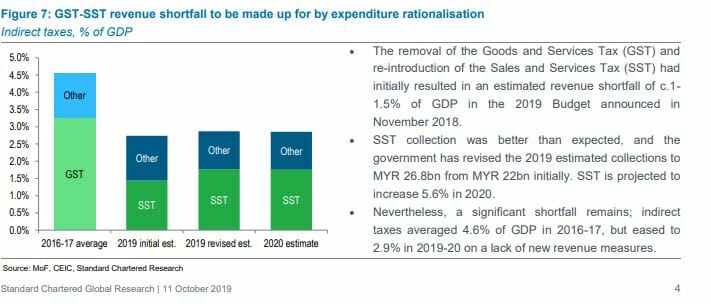

Revenue outlook remains constrained

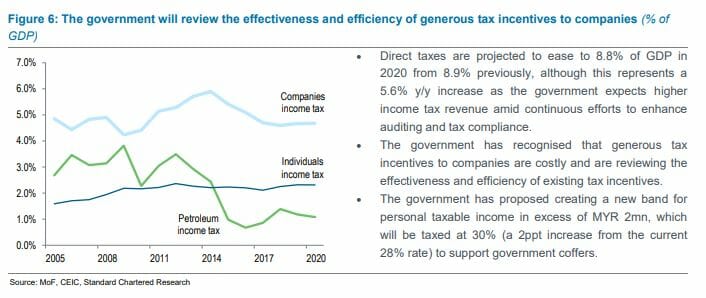

Excluding special dividends from Petronas, total revenue is budgeted to increase by 4.8% in 2020. Corporate income taxes are projected to rise 6.7%, while individual income taxes are expected to increase 6.1%, supported by a proposed new tax band for top income earners. Indirect taxes are expected to rise 6.5%, with the sales and

services tax (SST) projected to bring in MYR 28.3bn.

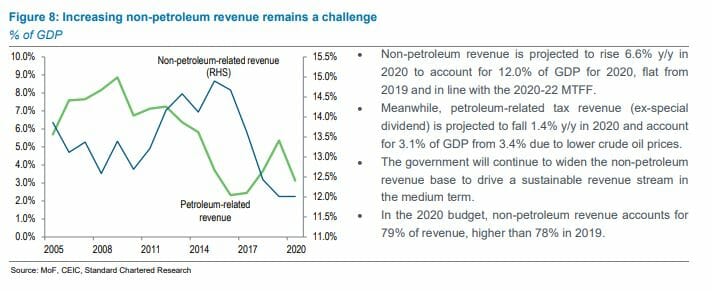

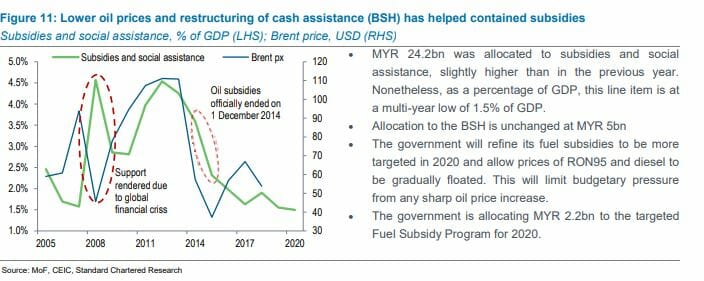

Previously introduced measures such as air departure levies and digital service taxes (effective in 2020) should support revenue. However, even though tax revenue is expected to grow 5.5%, it will likely ease to 15.1% of GDP, continuing a steady decline since 2012. In particular, non-petroleum-related revenue as a percentage of GDP remains low. Any downside risks to growth projections may also affect near-term revenue projections.

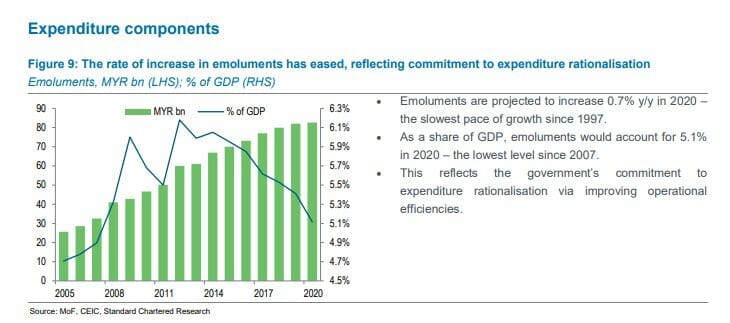

Operating expenditure is budgeted to increase 7% (excluding the effects of RM37 billion of tax refunds in 2019). The bulk of the increase is due to a 28% rise in supplies and services as the government allocates more funds for repair and maintenance of

public assets. Development expenditure was allocated more funds in 2020 to accelerate programme implementation.

As a share of GDP, development expenditure was maintained at 3.5% in 2020.

Relying on expenditure rationalisation

Despite a more gradual pace of fiscal consolidation for 2020, the government remains committed to fiscal prudence over the next few years. According to its MTFF (Figure 4), the government is projecting an average fiscal deficit of 2.6% of GDP over 2021-22. This assumes nominal GDP growth of 6% over 2021-22, which appears reasonable, in our view. The fiscal deficit target appears challenging. Assuming a

uniform reduction in the fiscal deficit, the government may have to target a deficit of 2.8% and 2.6% of GDP for 2021 and 2022, respectively.

Raising revenue remains a key challenge. According to the MTFF, total revenue to GDP is targeted at 15% of GDP. Our estimate for 2020 revenue is 15.2% of GDP.

From a growth perspective, the MTFF implies revenue growth of 4.2% per annum in 2021 and 2022, higher than the average 2.3% growth during 2016-20. That said, any upside surprise, such as more efficient tax collection or new taxes over the new few years, should relieve pressure on expenditure rationalisation.

Given the lack of revenue space (the government did not introduce any major revenue measures for 2020), the focus may remain on expenditure rationalisation. Total expenditure is 18.4% of GDP. According to the MTFF, the government projects average total expenditure of 17.8% of GDP for 2020-22. Based on our estimates, this may imply an average 3.9% per annum growth in operating expenditure in 2021 and 2022 and a -5.5% per annum fall in gross development expenditure in 2021 and 2022.

Revenue components

Expenditure components

Rates strategy

• Gross supply of MGS and GII remains stable at RM121 billion in 2020

• 2020 net MGS supply has increased to RM22 billion vs RM14 billion in 2019

• Supply risk is manageable due to light GG supply and flush liquidity

Fiscal consolidation and light GG supply support local demand

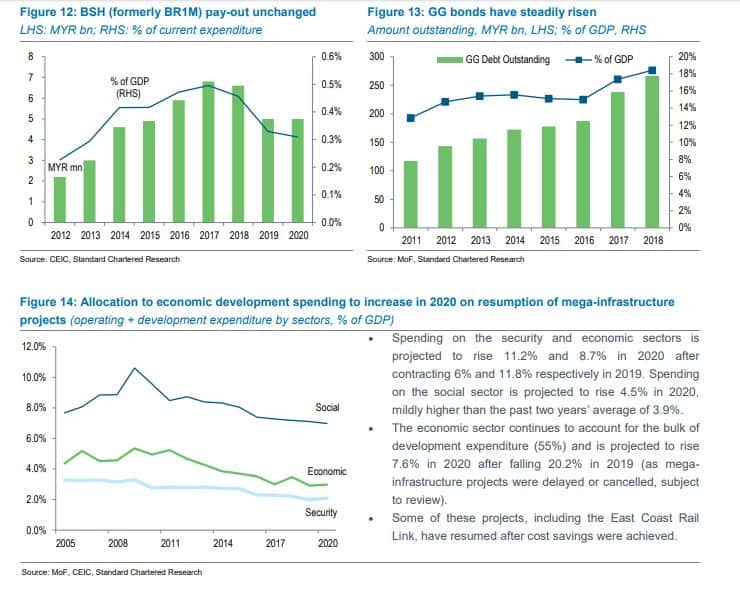

We maintain a Neutral near-term duration outlook on Ringgit debt. The budget announcement is in line with market expectations and supply pressure is manageable. Based on the 2020 fiscal deficit target of 3.2% of GDP, we estimate a similar supply outlook to 2019. In 2020, we expect gross borrowing in MGS and GII to be RM121 billion – new funding needs of RM50 billion, and MGS and GII redemptions of RM71 billion.

We expect a 44:56 ratio between gross issuance of MGS and GIIs in 2020. Total planned 2020 gross issuance increases to RM121 billion from RM115 billion in 2019, with slightly higher redemptions. However, redemption is skewed more toward GII (RM40 billion) and less toward MGS (RM31bilion). As a result, net supply in MGS for 2020 is set to increase to RM22 billion from only RM14 billion in 2019. The redemption profile for MGS and GII suggests light reinvestment demand for MYR debt in January and February, but this is likely to increase significantly as most redemptions will be in Q2.

We believe flush onshore liquidity and a lower supply of government-guaranteed (GGs) bonds are likely to support local demand for MGS. As of end-June 2019, total GGs was around RM273bn which is around 18% of GDP. This is a significant amount, but net GG supply in 2019 YTD has declined to RM9.3 billion from RM18 billion

in 2018 and RM30 billion in 2017. We do not expect any significant expansion of GG supply as the government has been cautious about any off-balance-sheet liabilities.

We expect slightly higher net GG supply RM15 billion in 2020. The addition GGs bonds are likely to be well-received by onshore investors. Onshore demand on MGS is likely to exceed supply, in our view. Local pension fund’s (EPF’s) allocation to MGS and equivalent bonds increased by RM30 billion to RM 269 billion in H1-2019, compared with RM32 billion in 2018.