By Wellian Wiranto, OCBC Bank economist

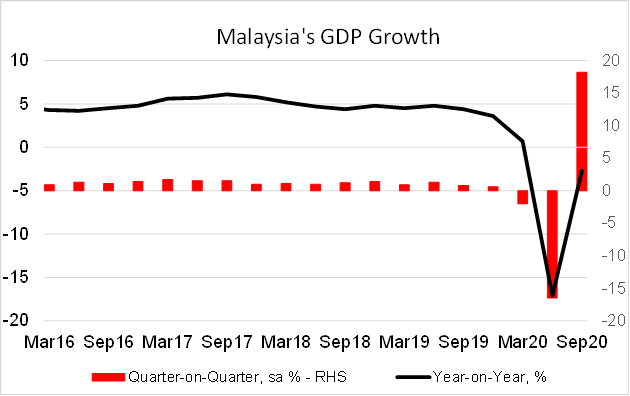

• After what was a brutal economic slump in Q2, Malaysia saw a rapid recovery in Q3, as signalled by a sharp sequential uptick of 18.2 percent on a seasonally adjusted basis. In year-on-year terms, it came in at -2.7 percent, better than the -4.0 percent that we and market consensus had in mind.

• Looking at the key components, private consumption staged a valiant recovery. Even as it remains wounded by the pandemic attacks, consumption has nonetheless shown signs of recovering. External demand, however, was the leading hero. Powered by exports demand on electrical and electronic products in particular, manufacturing posted 3.3 percent yoy growth.

• While heartening, the strong Q3 numbers would naturally invite questions about Q4’s outturn, in light of the virus resurgence. We still do see continued recovery, but the pace of uptick is likely to be hurt. In terms of policy, the good Q3 GDP print has offered space for BNM to observe Q4 more cautiously and the chances of Jan 2021 rate cut would now be reduced.

Not so negative = positive

To be sure, at a negative growth rate of 2.7 percent yoy, the Malaysia’s Q3 GDP data bear the imprint of an economy that is still suffering considerably from the pandemic effects. However, it did come better than the -4.0 percent rate that we and the market had expected. Moreover, the Q3 headline number marked a strong sequential uptick of 18.2 percent on a seasonally adjusted basis, a sharp U-turn from the 16.5 percent contraction suffered in Q2.

Looking at the some of the key subcomponents, the substantial recovery in Q3 would not have been possible without a requisite uptick in private consumption, which has been playing an increasingly important role in the Malaysian economy in recent years.

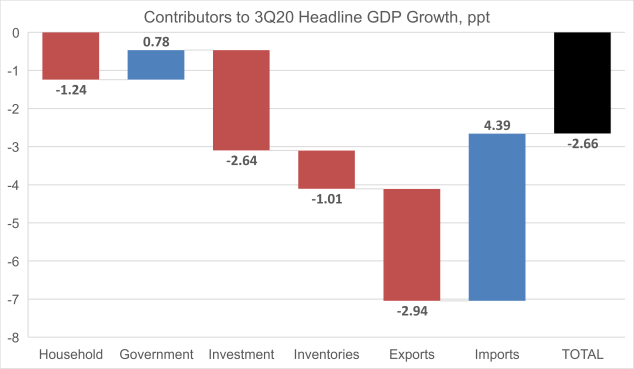

To that end, after dropping by a hefty 18.5 percent yoy in Q2, private consumption rebounded considerably in Q3, with a growth rate of -2.7 percent yoy. Rather than pulling down the overall headline growth substantially, by nearly 11 percentage points in Q2, the category now subtracts just 1.2ppt in Q3. The relatively robust recovery in consumption tallies with the relative improvement in employment picture that we have seen for Malaysia in Q3.

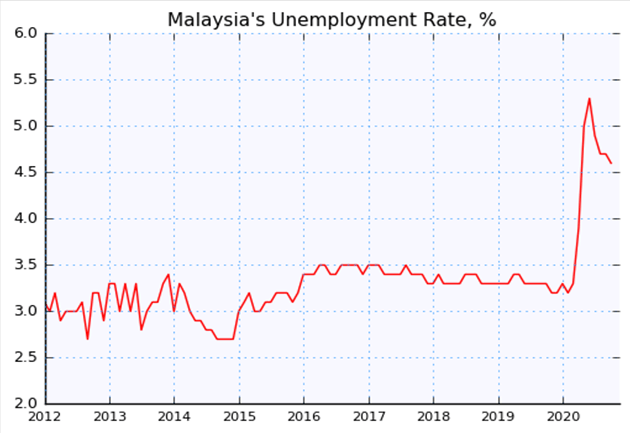

While the latest unemployment rate of 4.6 percent as of September is still high compared to 3.2 percent at the start of the year, it has nonetheless shown an encouraging improvement when compared to the high 5.3 percent of May this year at the height of the crisis.

Encouraging signs of recovery can be seen in investment activities, as well. In normal times, that sentence would have easily been a careless typo if we judge from the fact that the category is still contracting by as much as 11.6 percent yoy and contributing a net -2.64ppt to headline growth. However, in the current extraordinary climate, any relative positive movement itself is laudable.

The same category saw deep slump of nearly 29 percent yoy and pushing headline growth by over 7ppt in Q2, for one. A similar set of dynamics can be seen in exports. It is undeniable that its performance still bears damage from the blows of the pandemic – pushing down headline growth by nearly 3ppt for instance – but, again, on a relative basis compared to Q2 (whereby it dragged down growth by nearly 14ppt), the outturn for exports in Q3 have improved massively. Indeed, on a sectoral basis, the exports-dependent manufacturing sector has even started to grow in yoy terms, by 3.3 percent in Q3 compared to -18.3 percent in Q2.

As Bank Negara emphasised in its press release accompanying the GDP data today, “Improvements in growth were seen across most economic sectors, particularly in the manufacturing sector, which turned positive following strong E&E production activity.” In short, so far so good from the Q3 prints.

What does it entail for the economy in Q4 and into next year, however? At the broad level, the momentum bodes well for the recovery. In particular, the uptick in export-oriented manufacturing activities should help to reinforce the improvement in employment outlook, which would in turn allow the private consumption to continue rebounding. That’s the good news. The less-rosy reality, however, is that the resurgence of pandemic on the ground would dent the pace of recovery in Q4.

While the restriction orders are a lot less stringent than in Q2, the psychological factor at play remains there and would curtail private consumption recovery. The silver lining is that the bulk of economic activities – including manufacturing facilities – have stayed largely untouched. Our baseline expectation is thus for growth to come in at -1.5 percent yoy in Q4, marking some improvement from Q3 but at a less robust pace of recovery than before.

Hence, for the year as a whole, growth would likely come in at around -5.1 percent yoy. In terms of policy reaction, Bank Negara could have been as positively surprised as the market with the Q3 data. In its last MPC meeting on November 3 rd , even as it struck a relatively sanguine tone on growth outlook, it has nonetheless appeared to leave the door open for rate cut by pointing towards downside risks.

While those risks remain, the better-than-expected outturn in Q3 GDP would have nonetheless given the central bank more room to wait and see how the Q4 economic recovery pans out. Hence, it does not look like BNM will be in a hurry to cut rate just yet in its upcoming meeting on 19-20 January