Speaking at the Boost’s Life Hacks for Beating the Pandemic virtual event, Director of Merchants at Boost, Eric Chong said the digital wallet app will continue to boost small and medium-sized enterprises (SMEs) into adopting digital strategies.

Two key barriers for SMEs to tap into digitalisation is their [SMEs] deep rooted trust in cash payments especially for very small merchants like sellers in the night markets and the lack of knowledge in terms of who to approach and the cost of going into digitalisation.

To counter the stated issues, Boost has partnered up with Boost’s sister company, Aspirasi to assist SMEs in financial management and loan programmes with up to RM20,000 with no interest for the next six months.

“To further increase SMEs digital adoption, Boost has also partnered up with the government to support SMEs in the country as to help them qualify for the digitisation grant,” Eric said.

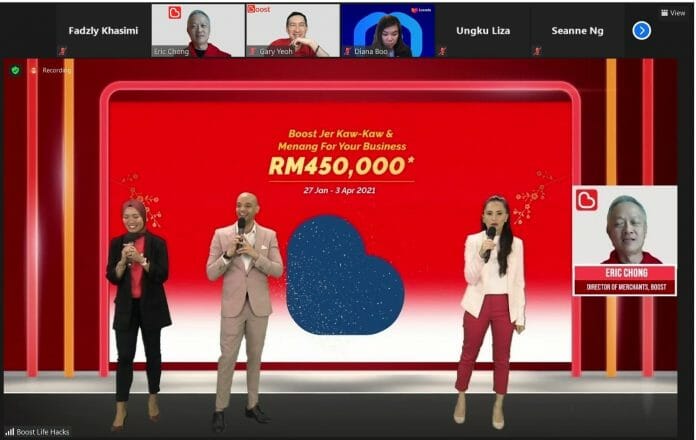

Boost has also initiated the “Boost Jer Kaw Kaw and Menang Your Business” campaign, starting from January 27 to April 21 to encourage SMEs to move into the Boost app. This is to stimulate SMEs in advertising their [SMEs] customers to pay using the Boost app.

“The e-wallet platform will be aiming to strengthen Boost’s digital ecosystem with payment play, exploring new ventures and producing new landing products for the consumers. For the SMEs, Boost will strengthen their [SMEs] power by giving easy access to Boost’s payment link and by linking the SMEs to Aspirasi for any assistance in financial management,” Boost’s Marketing Director, Ungku Liza said.