Sunway REIT Management the Manager of Sunway Real Estate Investment Trust (Sunway REIT), has released its financial results for its fifth quarter ended 30 September 2021 showing in profits despite a very uncertain climate. Overall rentals generated gross revenue was RM106.9 million compared to RM107.4 million which was a slight dip but these were mitigated due to the higher gross revenue from the Office and Services segments.

Net Property Income however increased 3.6% year-on-year from RM68.1 million to RM70.5 million in 5Q FP2021 on the back of lower property operating expenses.

Gross revenue for the Retail segment eased 16.5% y-o-y to RM64.9 million, from RM77.7 million in the same period last year, largely attributed to lower rental and carpark income owing to movement restrictions imposed during EMCO and NRP. Correspondingly, NPI decreased 17.1% in the quarter under review to RM36.6 million, from RM44.2 million in the same period last year. Gross revenue for the Hotel segment improved to RM6.2 million, from RM2.8 million in the corresponding period last year, mainly attributed to guaranteed rent from Sunway Putra Hotel and quarantine business at Sunway Clio Hotel. NPI for the Hotel segment more than tripled to RM4.2 million in 5Q FP2021, from RM1.2 million in the same period last year.

Meanwhile, gross revenue for the Office segment surged 80.8% to RM18.9 million, from RM10.5 million in the corresponding period in the preceding year. NPI more than doubled to RM12.8 million, from RM6.3 million in the same period last year. The improved performance was boosted by new income contribution from The Pinnacle Sunway and largely stable average occupancy rate across all office properties in Sunway REIT’s asset portfolio.

As for the services segment revenue edged up 2.8% to RM15.3 million, attributed to annual rental reversion of Sunway Medical Centre and Sunway university & college campus.

- Sunway REIT reported gross revenue of RM517.8 million and NPI of RM334.0 million for 15M FP2021. The overall performance for Sunway REIT during the period was impacted by the various phases of movement control orders. The Retail segment recorded encouraging recovery in 1Q FP2021 following the easing of movement restrictions before the momentum retracted subsequently with the resurgence of COVID-19 cases in September 2020 which has led to the re-introduction of targeted restrictive movement measures. For 15M FP2021, the Retail segment recorded gross revenue of RM311.6 million and NPI of RM164.1 million. The average occupancy rate for the Retail segment remained stable at above 90%.

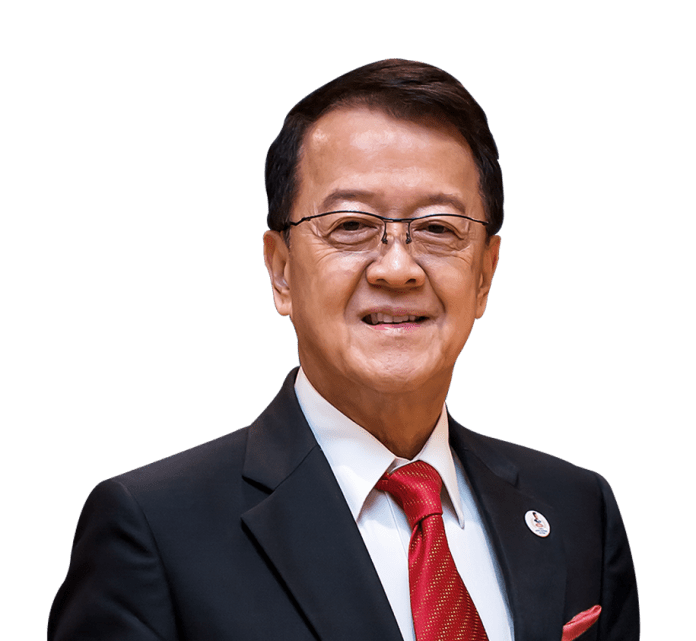

Dato’ Jeffrey Ng, Chief Executive Officer of the Manager, commented, “Undoubtedly, the pandemic had adversely impacted many businesses, not to mention that it had severely impacted our tenants’ operations. Looking back, we are heartened that the asset managers proactively worked hand-in-hand to establish the rental and marketing assistance programme as well as a third-party financing programme for affected tenants.”

On the outlook, Dato’ Jeffrey added, “Sunway REIT is actively exploring acquisition opportunities presented following the fallout of the pandemic. Sunway REIT is in a favourable position to capitalise on yield accretive acquisition opportunities given its healthy balance sheet and debt headroom.”