The Third-quarter earnings of 2021 (3Q2021) were tough for corporate earnings on account of the lockdowns and semi-lockdowns, but one sector appears to have bucked the trend.

Hong Leong Investment Bank Bhd in its 3Q21 report card said that it was pleasantly surprised the banking sector did a better-than-expected 3Q21 reporting season where sector earnings rose 25% YoY (lower loan loss allowances) but fell 6% QoQ (negative Jaws).

The research house said that it continues to see recovery in CY21-23 with earnings growing at a 2-year CAGR of 11.0% adding that in its the sector’s risk-reward profile remains skewed favourably to the upside as we believe most negatives have been priced in by the market.

HLIB said that the sector’s risk-reward profile continues to skew favourably to the upside as most negatives have been considered by the market.

It said that in its opinion, Covid-19 woes will likely fizzle out in 2022 while the state of the economy and banking sector will only get better in time, furthermore, valuations are undemanding and there is ample market liquidity.

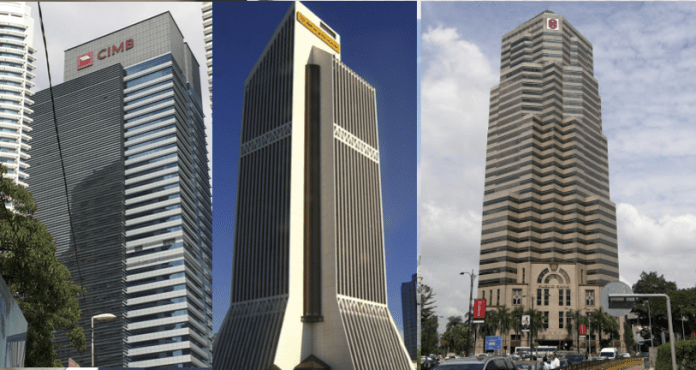

On various stocks in the sector, it has maintained “Overweight” in Maybank, RHB, Alliance and Affin. HLIb says it likes Maybank (TP: RM9.40) for its strong yield and Public Bank (TP: RM4.50) for its resilient asset quality.

For mid-sized banks, RHB (TP: RM7.00) is favoured for its high CET1 ratio and attractive price-tag. For small-sized banks, all 3 under our coverage are Buy calls for different reasons; (i) BIMB (TP: RM3.45) for its positive structural growth drivers, Alliance (TP: RM3.30) for its quicker-than-expected upward normalization in dividend payout and high CET1 ratio and Affin (TP: RM2.25) for its potential value unlocking exercise for AHAM.