The U.S. economy shrank in first quarter of 2022 but consumers and businesses kept spending in a sign of underlying resilience.

The shrinking marks the first time since the pandemic recession struck two years ago, contracting at a 1.4 percent annual rate. However, the weak showing does not mean a recession is likely in the coming months. The first quarter’s growth was hampered mainly by a slower restocking of goods in stores and warehouses and by a sharp drop in exports.

Most economists expect a rebound in the second quarter as solid hiring and wage gains sustain growth.

The Commerce Department’s estimate Thursday of the first quarter’s gross domestic product — the nation’s total output of goods and services — fell far below the 6.9 percent annual growth in the fourth quarter of 2021. And for 2021 as a whole, the economy grew 5.7 percent, the highest calendar-year expansion since 1984.

To some extent, the first quarter’s weak showing also reflected a slowdown from last year’s robust rebound from the pandemic, which was fueled in part by vast government aid and ultra-low interest rates. With stimulus checks and other government supports having ended, consumer spending has slowed from its blistering pace in the first half of last year.

Meanwhile, the U.S. job market remains robust. The number of people receiving unemployment benefits, a proxy for layoffs, fell to the lowest level since 1970. In the first quarter, businesses and consumers increased their spending at a 3.7 percent annual rate after adjusting for inflation.

1Q2022 slowdown followed vigorous growth in the 4Q2021, driven by a surge in inventories as companies restocked in anticipation of holiday season spending.

Imports surged nearly 20 percent in the first quarter as businesses and consumers bought more goods from abroad while U.S. exports fell nearly 6 percent. That disparity widened the trade deficit and subtracted 3.2 percentage points from the quarter’s growth.

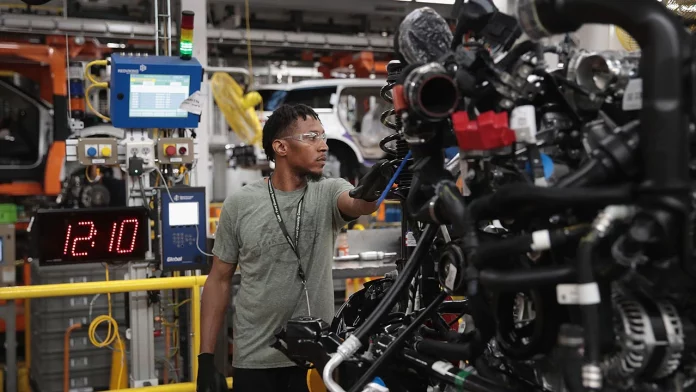

The weakness of the economy’s overall growth rate contrasts with the vitality of the job market. At 3.6 percent, the unemployment rate is nearly back to the half-century low it reached just before the pandemic. Layoffs have reached historically low levels as employers, plagued by labor shortages, have held tightly onto their workers.

Wages are rising steadily as companies compete to attract and retain workers, a trend that has helped maintain consumers’ ability to spend. At the same time, though, that spending has helped fuel inflation, which reached 8.5 percent in March compared with 12 months earlier.

The economy is facing a range of pressures that have heightened worries about its fundamental health and raised concerns about a possible recession next year. Inflation is squeezing households as gas and food prices spike, borrowing costs mount and the global economy is rattled by Russia’s invasion of Ukraine and China’s Covid-19 lockdowns.