A new line of sustainable financing in Malaysia has been provided for Ikano Centres by HSBC Amanah – the green facility will help Ikano Centres sustainably develop its regional retail hub in Johor comprising Toppen Shopping Centre and IKEA Tebrau.

Being part of Ikano Retail, Ikano Centres operates IKEA stores in five countries as well as shopping centres that are anchored by IKEA. The proceeds from the refinancing facility will contribute to ongoing projects that will support Ikano Centres as it accelerates its sustainability progress.

The company is focused on enabling healthy and sustainable living by tackling its climate footprint together with tenants and customers, while creating a positive impact for people in its communities.

In Malaysia, Ikano Centres is currently operating and managing 3.76 million sq ft in gross leasable area in its four centres.

While in Toppen, which commenced in Johor in 2019, is an open-concept meeting place that attracts people from across South Malaysia and Singapore to four levels of retail and a one-of-a-kind rooftop with gardens, sports courts, a splash park and cinemas. Later this year, Toppen will extend its ‘retailtainment’ concept with an additional multi-storey carpark featuring a rooftop with 50,000 sq ft of new retail space.

The green facility from HSBC will support Toppen’s ongoing development plans to create great customer experiences and secure its position as the heart and hub of the Johor Bahru community.

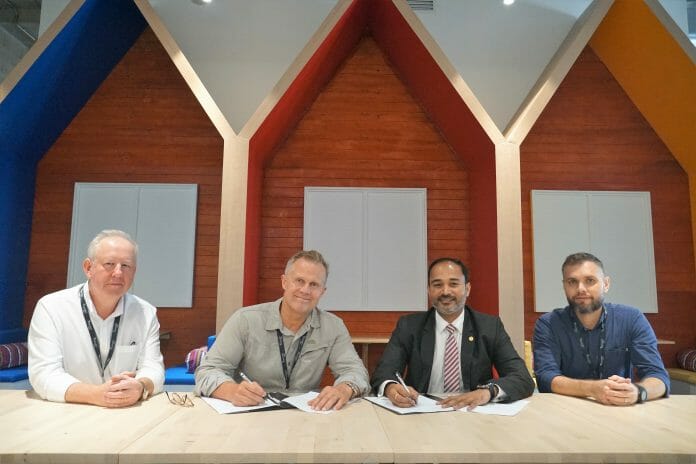

“HSBC’s partnership with Ikano Centres on this new green financing facility in Malaysia, is continued demonstration of the bank’s commitment to support the transition to a low carbon economy. Our clients are increasingly prioritising sustainability to achieve their transition and growth ambitions, and we expect it to remain a crucial factor when making business decisions, particularly as the country accelerates its focus on becoming carbon neutral by 2050. Through the adoption of a sustainable business approach, we believe that Ikano will create long-term value for itself and in society at large,” Christina Cheah, Head of Global Banking, HSBC Malaysia said.

“The retail industry is increasingly embracing green practices to minimise its environmental impact. In Malaysia, HSBC has been partnering with Ikano Centres from 2017 when we first provided financial support to construct its shopping centre in Johor. The move towards a new line of green financing is a natural extension of our relationship and reinforces how we can support clients in the retail sector to thrive during their transition. Through our continued collaboration with Ikano Centres in Malaysia, we are focused on supporting their path to a green future,” Shreyas Krishna, Head of Multinationals, Global Banking, HSBC Malaysia said.

“We need to learn fast and develop new ways to reduce our carbon footprint. By 2030, we aim to power our properties entirely with renewable energy. We are working hard to tackle waste, and we want to inspire and enable our tenants and customers to reduce their impact on the planet as well,” Adrian Mirea, Ikano Centres’ Shopping Centre & Mixed-Use Director, Malaysia said.

Buildings represent 39% of global greenhouse gas emissions – reducing carbon emissions in buildings will be critical to achieving the Paris climate goals and achieving net zero emissions by 2050.Financial institutions have a crucial role to play in encouraging the change required to reduce this type of impact. This includes changing the nature of capital

and increasingly directing it in more sustainable ways.

Globally, HSBC is intensifying its support for customers in their transition to net zero. To help its customers get there, HSBC’s target by 2030 is to provide between USD750 billion and USD1 trillion of finance and investment towards the transition.

In 2022, HSBC Malaysia (comprising both HSBC Bank Malaysia Berhad and HSBC Amanah Malaysia Berhad) itself has earmarked RM2.8 billion towards green and sustainable financing to enable businesses to embark on their sustainability journey and switch to more sustainable ways of doing business – this transaction exhibits some of the work that is being done in tandem with this capital allocation.