The ACE-market bound, electronics manufacturing services (EMS) provider expects to raise RM33.8 million under its listing exercise on the Bursa Securities.

On the proceeds from the floating of its shares, the Company plans to use RM7.0 million (20.7%) to fund the research and development (R&D) activities for new product development and RM6.5 million (19.3%) to further expand its R&D office space, raw material storage and ancillary facilities to cater for its future growth, as well as for future R&D activities; whilst RM3.0 million (8.9%) will be used to acquire machinery and equipment for its existing factory in Rawang to enhance its manufacturing efficiency and capabilities; RM10 million (29.6%) will be used for the repayment of bank borrowings; RM3.9 million (11.4%) for general working capital; the remaining RM3.4 million (10.1%) to defray the estimated listing expenses.

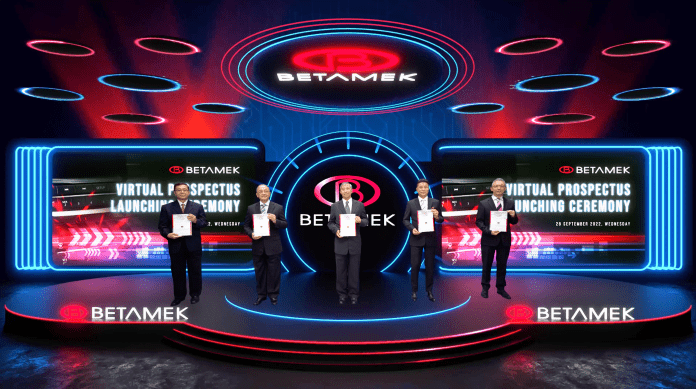

“The Company is in discussion with its technology partners to develop and introduce more innovative technologies and new product solutions that have market potential,” Encik Mirzan Mahathir, Managing Director of Betamek said.

“Over the years, we have been expanding our product portfolio by including new automotive electronic solutions and technologies required to complement the features of our products,” he added.

“As hybrid, electric and autonomous vehicles gain global market share, Betamek is in a unique position to leverage this growing market trend and expand and diversify our product offerings with competitive solutions that incorporate the innovative Malaysian DNA,” he remarked.

“Today’s vehicle infotainment system entails evolution of the vehicle-stereo technology alongside elements of audio and video, Internet of Things (IoT), GPS and navigation capabilities as well as vehicle safety and security. We consider that there are still many untapped opportunities for product segments in relation to advanced driver assistance systems, entertainment and connectivity, IoT and accessories of vehicles,” he added.

Under the listing exercise, Betamek is issuing 67.5 million new shares in Betamek, representing 15.0% of the enlarged share capital at an issue price of RM0.50 per share.

Of the 67.5 million new shares, 22.5 million new shares will be made available to the Malaysian public via balloting; 13.5 million new shares for its eligible Directors, employees and persons who have contributed to the success of Betamek Group under Pink Form Allocations while the remaining 31.5 million new shares are earmarked for private placement to selected investors.

As part of its listing exercise, the existing shareholders of the Company, Iskandar Holdings Sdn Bhd will also make an offer for sale of 45.0 million existing shares to selected investors by way of private placement.

Based on the enlarged share capital of 450.0 million shares, Betamek is expected to have a market capitalisation of RM225.0 million.

The IPO is open for subscription from today until 7 October 2022. The listing is tentatively scheduled on 26 October 2022.

M & A Securities is appointed as the Adviser, Sponsor, Underwriter and Placement Agent for the IPO exercise.