CPO prices should stay relatively rangebound in 2023F, as RHB Research stated in its sector update on plantation. CPO supply improvements will be relatively balanced with a rise in demand. With that the research house maintains the forecast CPO prices (2023-2024F) at MYR3,900 per tonne and MYR3,500 per tonne. The research house expects CPO supply to improve further in 2024, while pent-up demand in 2023 may moderate, leading to lower prices.

CPO prices are trading within the MYR3,500-4,500 per tonne range, while average 2022 prices should come in close to our MYR5,100 assumption. Going forward, CPO prices should remain in a similar price range for 2023. While upside risks have moderated of late, there are still supportive factors that should keep prices relatively stable.

These include weather uncertainties, the availability of fertiliser from Russia and growing demand due to discounted CPO prices versus that of soybean oil (SBO), as well as from potential increases in Indonesia’s biodiesel mandate.

Nevertheless, on the negative front, the palm oil-gas oil (POGO) spread has reversed and discretionary biodiesel is no longer feasible – while the new deforestation-free supply chain law in the EU could impact demand from the EU ahead.

Although La Nina conditions is expected to linger, with climate models expecting it to end by early 2023, this has not affected South American soybean planting as much as initially expected. Brazil’s planting progress is on track, at 91% as at 5 Dec (as compared to 95% last year). However, Argentina’s planting progress is slower, being 29% completed (as compared to 46% last year).

Should La Nina last longer than expected, Argentina’s soybean planting could be further at risk, while Brazilian soybean quality could be affected.

Indonesia’s biodiesel mandate. The POGO spread has reversed to negative, with gas oil now USD22.45/bbl (USD165/tonne) cheaper than CPO – making it no longer financially feasible to produce biodiesel without subsidies. As such, the research house does not expect any discretionary biodiesel demand to come back. However, Indonesia is still expected to raise its mandate to B35 in 2023, which could add 1.5-2 million tonnes of CPO demand per year.

Overall, stock/usage ratio trends for 2023 are mixed – but are above historical averages. While stock/usage ratios are expected to rise for SBO and the 10 oilseeds composite, they are expected to decline slightly for palm oil, the 8 vegetable oil and 17 oils and fats composites. However, it is noted that all the stock/usage ratios are comfortably above historical averages in 2023 – meaning stock levels are no longer in a tight position for 2023.

Malaysia’s palm oil output fell 7.3% MoM in November, while exports rose 0.9% MoM, leading to stocks declining to 2.29 million tonnes (-5% MoM). Peak output season is over, and output is likely to fall MoM until end-1Q23.

Malaysia seems to have lost out on the usual festive season demand this year due to competition, although it may still see one month of demand improvement in December, as Indonesia’s tax levy has been reinstated. The research house expects stock levels to fall again this month, but stay above the 2 million-tonne mark.

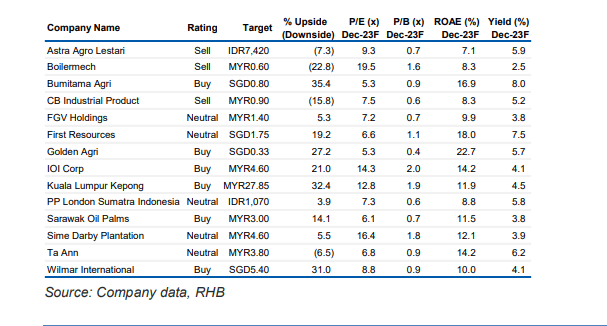

RHB Reseach has six BUY, five NEUTRAL, and three SELL calls on the planters under coverage. Meanwile, Top Picks of plantation sector are integrated players Kuala Lumpur Kepong (KLK), IOI Corp (IOI) and Wilmar.