RHB Retail Research has reiterated its long positions on HSI futures.

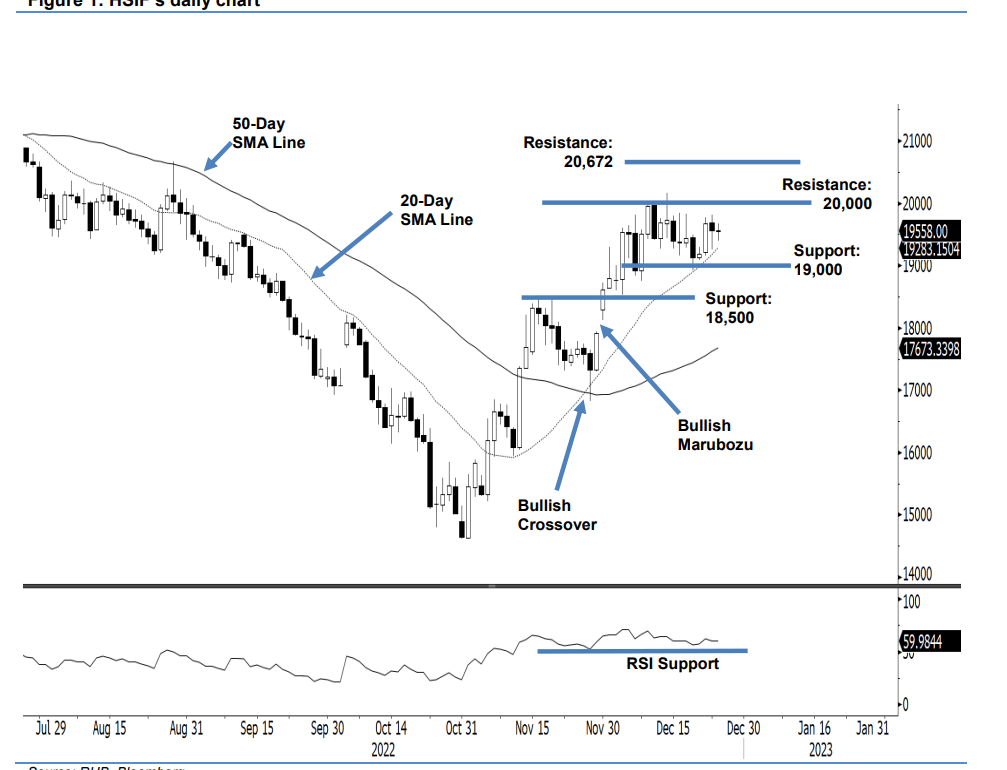

The HSIF refused to rebound further last Friday, closing 122 points lower at 19,558 points – still above the 20-day average line of 19,283 points. The index opened at 19,684 points and whipsawed between the 19,817-point high and 19,256-point low, which saw it closing slightly below the opening level. In the evening, the HSIF moved in a neutral tone, as the last trade was unchanged at 19,558 pts. The mild pullback above the 20-day average line suggests the positive rebound printed last Wednesday remains valid, as the bullish momentum has yet to be negated.

As the RSI has steadied at the 59% level, we will likely see the index bouncing off the 20-day average line to inch towards 20,000 points in the coming sessions. The medium-term outlook remains bullish, with the upside bias beyond the 20,000-point mark. As such, the research house is keeping to its bullish bias – unless the trailing-stop level is triggered.

Traders should remain in the long positions initiated at 18,617 points or 30 Nov’s close. To minimise trading risks, the trailing-stop threshold is set at 19,000 points.

The immediate support is set at 19,000 points and followed by 18,500 points. The first resistance stays at 20,000 points. This is followed by 20,672 points, which was the high of 29 Aug.