When the local bourse opened, The FBM KLCI inched higher at 1,484.56 as compared to last Friday’s close of 1,480.55.

At press time, the main index was traded in the range of 1,483.93 – 1,485.67.

At 9:11am, the KLCI gained 4.90 points or 0.34% at 1,485.54.

According to analysts, investors may remain in a cautious mood attributed to increasing market volatility. The KLCI is likely to trade in range bound. The upcoming Chinese New Year might influence the market with a slightly upward bias.

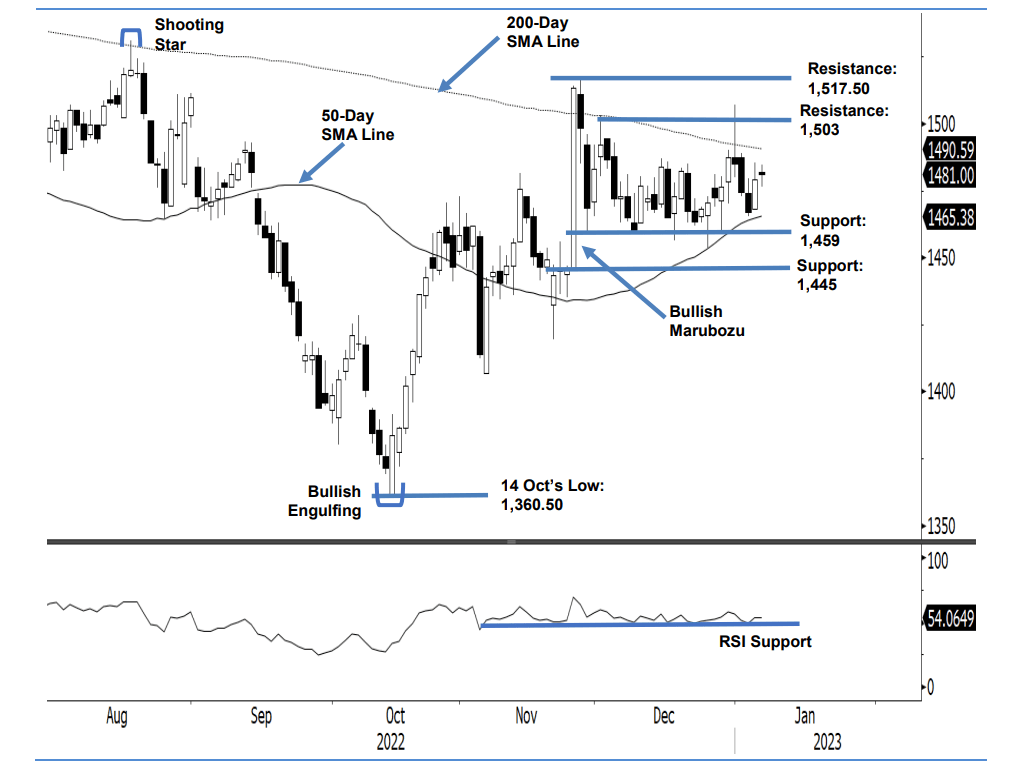

Technical Analysis on KLCI Futures (FKLI)

RHB Retail Research has retained its long positions on FKLI.

The FKLI managed to inch higher last Friday, climbing 2 points to close at 1,481 points – eyeing to climb above the 200-day SMA line. The index started off at 1,482 points and climbed towards the 1,484.50-point day high but pulled back towards 1,476.50 points before the close. Although the closing price is lower than the opening price, the index still charted a “higher low” candlestick, thus, the bulls still have an upper hand. If the bullish momentum follows through,

the index should climb and test the 200-day SMA line.

Crossing above the long-term moving average line will strengthen the bullish setup and attract strong buying interest. Towards the downside, the 1,459-point level is acting as the support now. As long as the immediate support remains intact, the bulls will attempt to charge higher. At this stage, we think the bulls are still in control, hence, we keep to our positive trading bias.

We advise traders to hold on to the long positions initiated at 1,475.50 points, which was the closing level of 11 Nov. To minimise the downside risks, the stop-loss is set at 1,459 points.

The immediate support stays at 1,459 points – 29 Nov 2022’s low – followed by 1,445 points. Conversely, the immediate resistance is pegged at 1,503 points – 1 Dec 2022’s high – followed by the higher resistance pegged at 1,517.50 points ie 25 Nov 2022’s high.