With bullish setup still intact, RHB Retail Research has continued its stance on HSI futures: long positions.

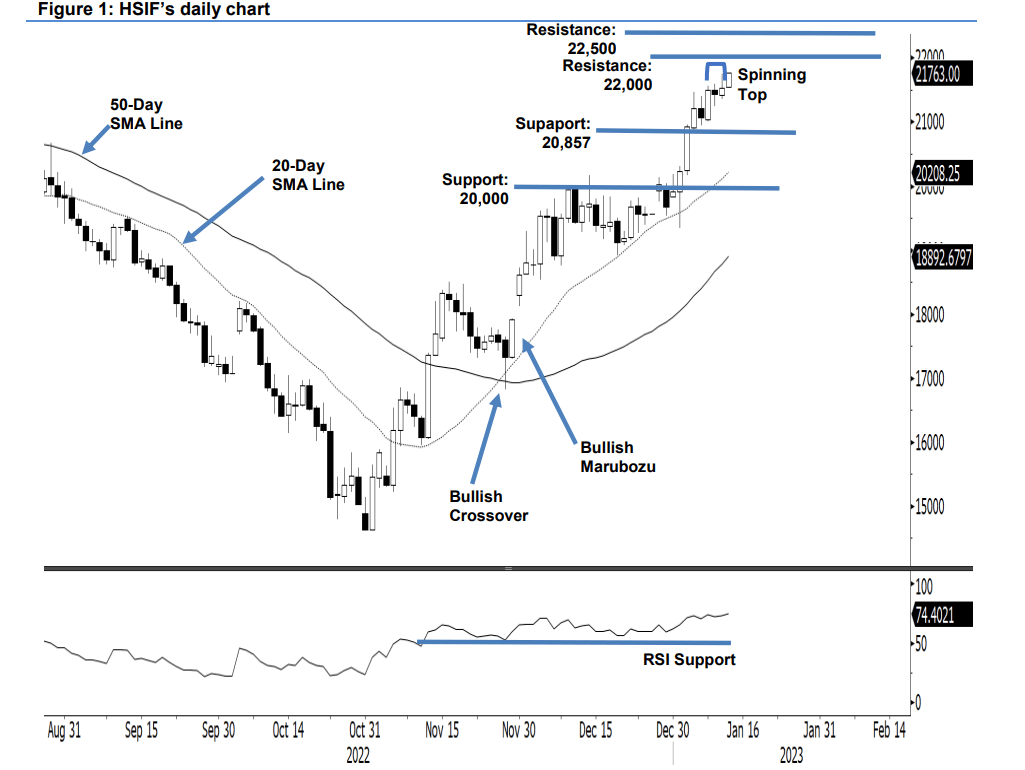

Although the HSIF trended upwards yesterday, sentiment turned cautious as profit-taking activities led to the formation of a Spinning Top. The index opened at 21,420 points, rose to test the day’s high of 21,756 points before pulling back in the afternoon to close at 21,538 points – printing a long upper shadow. In the evening session, the index rose 225 points and last traded at 21,763 points. The day session’s candlestick pattern suggests that the index

could be rounding lower in the coming sessions.

In the event that bearish pressure is extended, the HSIF may retrace towards the 20,857-point support. Breaching the immediate support would confirm the reversal signal of Spinning Top.

For the immediate term, the index should be moving sideways for a consolidation. For now, the research house is still holding on a positive trading bias until immediate support is breached.

Traders should stick to the long positions initiated at 18,617 points (30 Nov’s close). To minimise the trading risks, the stop-loss has been revised upwards to 20,857 points, from 20,000 points.

The immediate support remains at 20,857 points (5 Jan’s low), followed by 20,000 points. Meanwhile, the immediate resistance is still pegged at 22,000 points, followed by 22,500 points.