MARC Ratings has revised the outlook on Top Glove Corporation Bhd’s corporate credit rating to negative from stable on concerns that the impact of the continued tough global market conditions for glove manufacturers will weigh on the group’s performance.

Concurrently, the rating outlook on the RM3.0 billion Perpetual Sukuk Wakalah Programme of Top Glove’s wholly-owned funding vehicle TG Excellence Berhad has also been revised to negative. Top Glove has provided an irrevocable and unconditional guarantee on the perpetual sukuk. MARC Ratings has maintained the Top Glove and TG Excellence ratings at AA+ and AA-IS(cg), with the rating differential reflecting the subordination of the perpetual sukuk to the parent’s senior unsecured obligations. The outstanding perpetual sukuk currently stands at RM1.18 billion.

Top Glove’s group performance was expected to normalise as factors that had prompted the significant run-up in demand and consequently, glove prices during the height of the COVID-19 pandemic eased as the crisis abated. However, the lingering imbalance in global supply-demand of gloves due to overcapacity and excess stockholding, as well as increased competition from China has substantially reduced glove prices. Average price declined by around 60% compared to at the height of the crisis.

The rating agency also notes that in addition to the weakened selling prices of gloves, Top Glove had to contend with the recent substantial hike in natural gas prices, as well as increased labour costs. These factors have contributed to an erosion in profit margin. For the first quarter of the financial year ending August 31, 2023 (1QFY2023), earnings before interest, tax, depreciation and amortisation (EBITDA) was negative of about RM66 million on lower revenue of RM632.5 million (1QFY2022: about RM335 million; RM1.6 billion). MARC Ratings expects financial performance for full-year FY2023 to remain subdued.

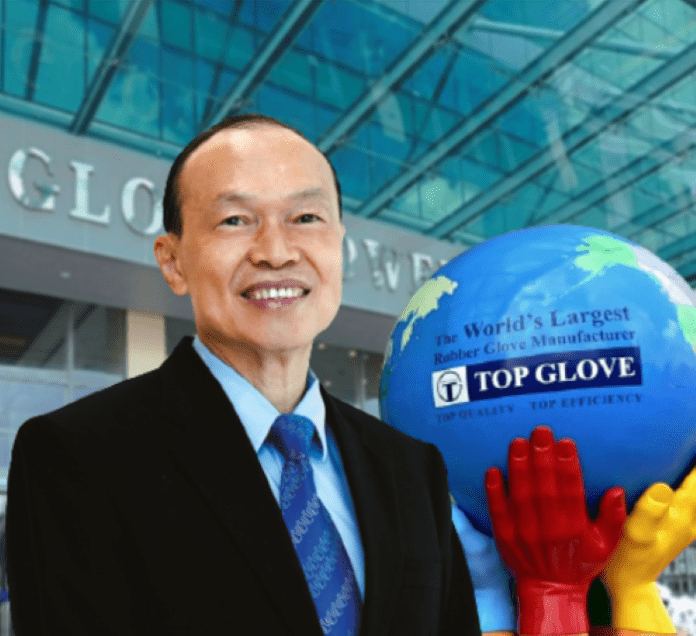

The world’s largest rubber glove maker retains a healthy liquidity position of RM742.5 million relative to its financial obligations as of end-November 2022. The group has no notable maturities over FY2023-FY2024, and with adjusted debt-to-equity (DE) and net DE ratios of 0.22x and 0.09x, it has the wherewithal to weather the challenging period. It has also undertaken measures to shore up its liquidity position including by deferring expansion of production capacity, initiating temporary shut down, and decommissioning older production lines. It will also not declare dividends for FY2023.

MARC Ratings said it will undertake a review on Top Glove’s rating within the next six months. The rating could be lowered if the challenges the group currently faces continue to hamper any meaningful improvement in financial performance, particularly its cash flow metrics. The rating differential on the perpetual sukuk would remain at two notches. Conversely, notable and sustainable improvements in the group’s credit profile could lead to the ratings outlook being revised back to stable.